- Insperity recently reported second quarter 2025 financial results showing sales growth to US$1,658 million but an unexpected net loss of US$5 million, alongside updated business guidance and the completion of a long-running share repurchase program.

- Alongside weak earnings, Insperity confirmed a refreshed HR solutions portfolio and an upcoming joint product launch with Workday, aiming to address evolving HR needs for small and mid-sized businesses.

- We'll look at how Insperity's recent quarterly loss and cautious guidance may reshape its investment narrative and future growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Insperity Investment Narrative Recap

Insperity’s investment case often centers on its ability to deliver recurring revenue growth and margin expansion by meeting complex HR needs for small and mid-sized businesses. The latest quarterly results, highlighting stronger sales but an unexpected net loss and softer full-year guidance, may dampen optimism around near-term earnings recovery. The biggest catalyst remains execution and adoption of new solutions (especially HRScale with Workday), while the most immediate risk is persistent cost inflation outpacing pricing actions; this risk remains highly material following the recent results.

Among recent announcements, Insperity’s expanded HR solutions portfolio, including HR360, HRCore, and the upcoming HRScale, stands out. These new offerings underscore the company’s ongoing shift toward bundled, technology-integrated services and remain closely tied to the business’s growth ambitions, but their success hinges on effective deployment and improved financial performance.

Conversely, investors should be aware that the main risk, continued escalation in employee healthcare costs and large claims, remains unresolved if pricing power proves insufficient to keep up with cost trends...

Read the full narrative on Insperity (it's free!)

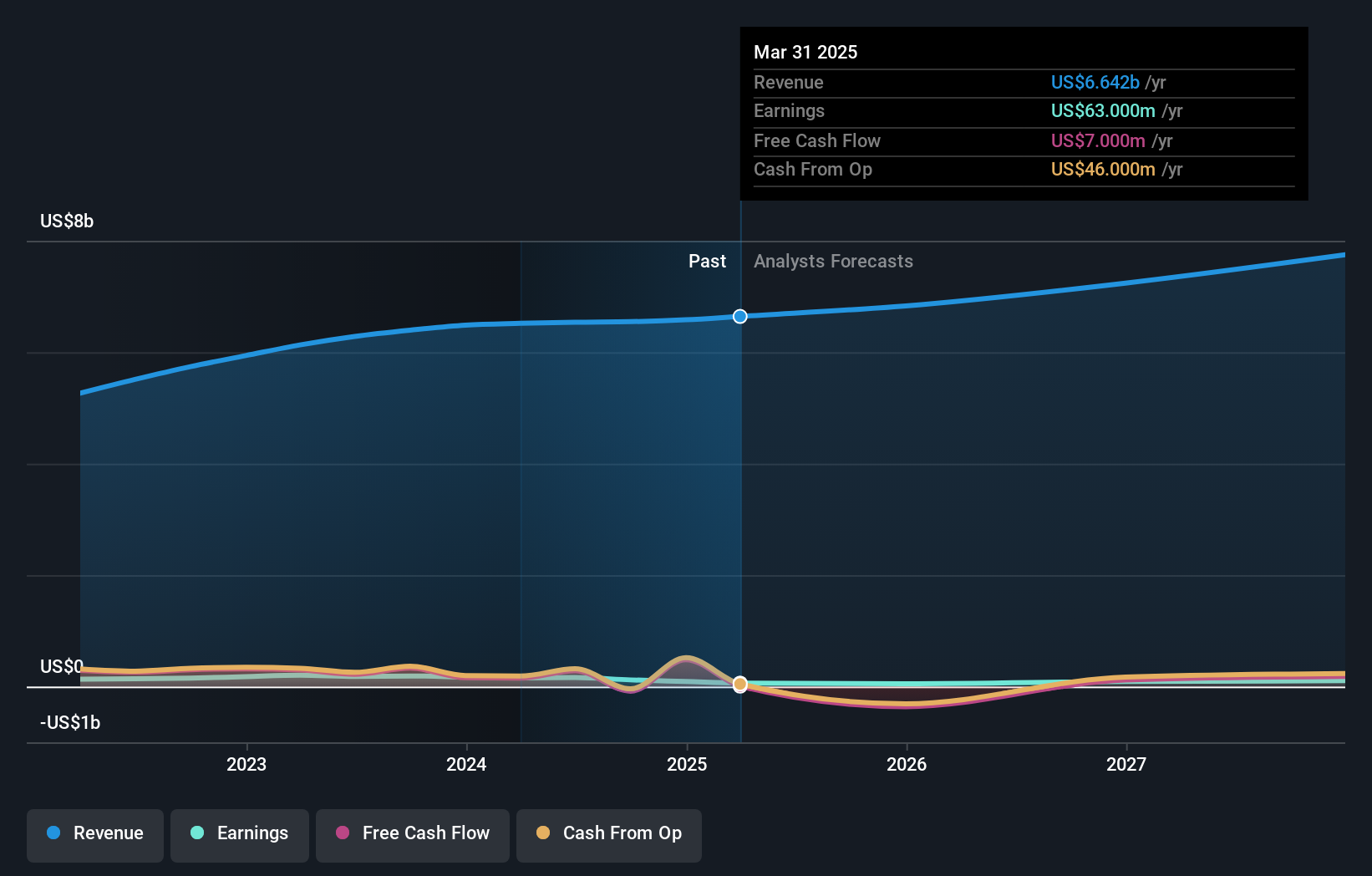

Insperity's outlook anticipates $7.7 billion in revenue and $109.6 million in earnings by 2028. This is based on a 5.0% annual revenue growth rate and a $69.6 million increase in earnings from the current $40.0 million.

Uncover how Insperity's forecasts yield a $57.75 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members supplied two fair value estimates for Insperity, ranging widely from US$57.75 up to US$256.28 per share. With cost inflation still threatening earnings, it’s clear that market views on future prospects can sharply diverge, see how others are analyzing the path forward.

Explore 2 other fair value estimates on Insperity - why the stock might be worth just $57.75!

Build Your Own Insperity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insperity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insperity's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com