- Federal Agricultural Mortgage Corporation recently reported its second quarter 2025 results, with net income rising to US$54.84 million from US$47.11 million for the prior-year period and diluted earnings per share increasing to US$4.48 from US$3.68.

- This improvement in profitability alongside expanding earnings per share highlights ongoing operational momentum for the company in the latest quarter.

- We'll examine how the quarterly earnings increase may influence the company’s investment narrative and future growth assumptions.

Find companies with promising cash flow potential yet trading below their fair value.

Federal Agricultural Mortgage Investment Narrative Recap

To be a shareholder in Federal Agricultural Mortgage Corporation (Farmer Mac), you need confidence in the company’s ability to expand into rural infrastructure, renewable energy, and agricultural lending while managing credit risk and regulatory pressures. The strong earnings growth seen in the latest quarter reinforces positive operational trends, but does not materially alter the biggest short-term catalyst, which remains demand for new loan products in expanding rural sectors or the main risk, accelerating credit losses in new segments.

Among recent announcements, Farmer Mac’s increase in the quarterly dividend to US$1.50 per share stands out; this reflects capital strength and adds appeal for income-focused shareholders. However, rising expenses or portfolio risks in new business areas could influence the sustainability of such payouts if not matched by continued earnings growth.

Yet, in contrast to the near-term momentum, investors should remain especially aware of potential credit losses as Farmer Mac increases exposure to broadband and infrastructure lending…

Read the full narrative on Federal Agricultural Mortgage (it's free!)

Federal Agricultural Mortgage is projected to reach $514.9 million in revenue and $239.2 million in earnings by 2028. This outlook requires an annual revenue growth rate of 11.8% and a $52.9 million increase in earnings from the current $186.3 million.

Uncover how Federal Agricultural Mortgage's forecasts yield a $226.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

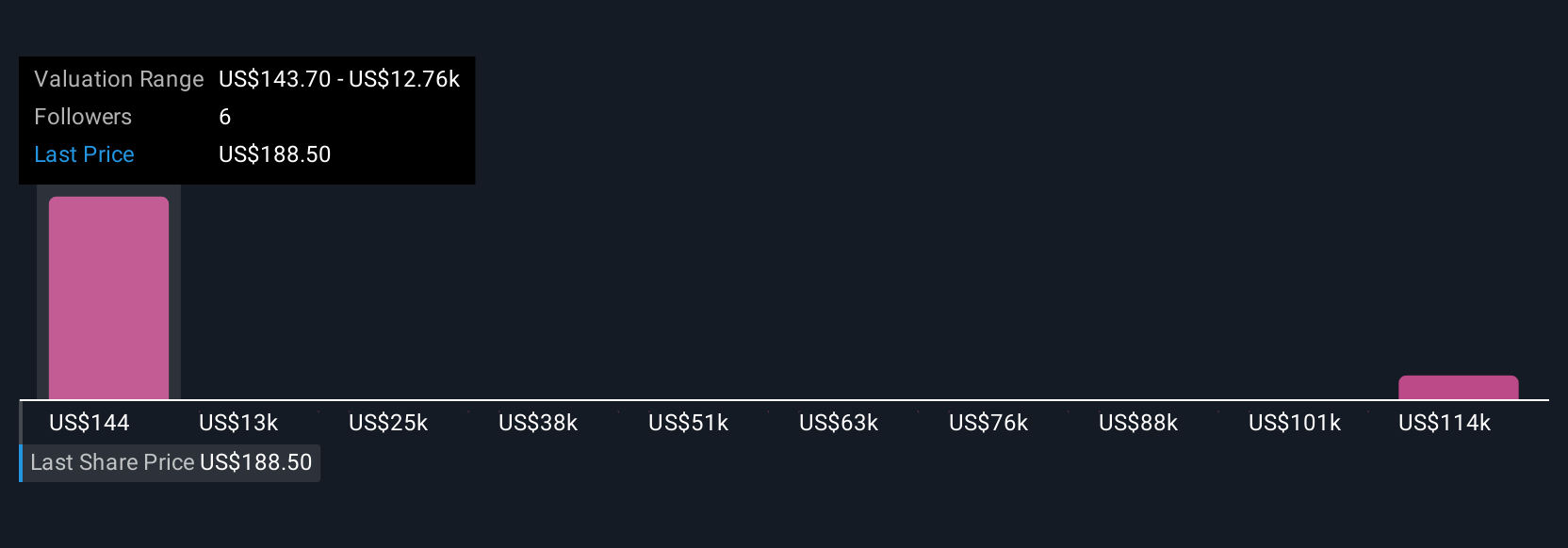

Simply Wall St Community members posted four fair value estimates for Farmer Mac, with figures ranging from US$143 to US$126,259 per share. While these opinions vary widely, the strong recent earnings highlight how operational momentum could shape future valuations in unpredictable ways. Consider comparing these viewpoints to your own assumptions when evaluating the company’s potential.

Explore 4 other fair value estimates on Federal Agricultural Mortgage - why the stock might be a potential multi-bagger!

Build Your Own Federal Agricultural Mortgage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Federal Agricultural Mortgage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal Agricultural Mortgage's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com