- Herbalife recently reported its second quarter 2025 earnings, revealing net income increased to US$49.3 million from US$4.7 million a year earlier, while quarterly sales dipped slightly to US$1.26 billion.

- In addition to this earnings improvement, Herbalife raised its full-year 2025 net sales guidance and provided positive guidance for the third quarter, highlighting management's more optimistic outlook amid ongoing operational shifts.

- We’ll explore how the strengthened earnings and updated sales outlook may reshape perceptions of Herbalife’s growth trajectory and business model transformation.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Herbalife Investment Narrative Recap

To be a Herbalife shareholder, you need to believe in the company’s continued transformation into a technology-driven wellness brand, alongside its focus on product innovation and digital platforms. The recent earnings beat and raised sales guidance offer some encouragement for near-term operational momentum, though persistent weakness in regional sales trends and ongoing regulatory risk remain the most important catalysts and headwinds. The latest results do not meaningfully shift the balance of near-term risks or substantially change the core narrative.

One announcement worth highlighting is Herbalife’s decision to improve full-year 2025 sales guidance, narrowing expected sales declines and projecting modest growth. This update, while positive in tone, reflects only slight top-line improvement and may not fully resolve questions around the pace or sustainability of Herbalife’s efforts to reignite growth in its core markets.

However, with greater optimism about upcoming quarters, investors should remain aware of ongoing pressure from global regulatory scrutiny and what that could mean for Herbalife’s business model...

Read the full narrative on Herbalife (it's free!)

Herbalife's outlook anticipates $5.6 billion in revenue and $137.6 million in earnings by 2028. This is based on a 4.3% annual revenue growth rate but a significant earnings decrease of $187.4 million from the current $325.0 million.

Uncover how Herbalife's forecasts yield a $9.00 fair value, a 8% downside to its current price.

Exploring Other Perspectives

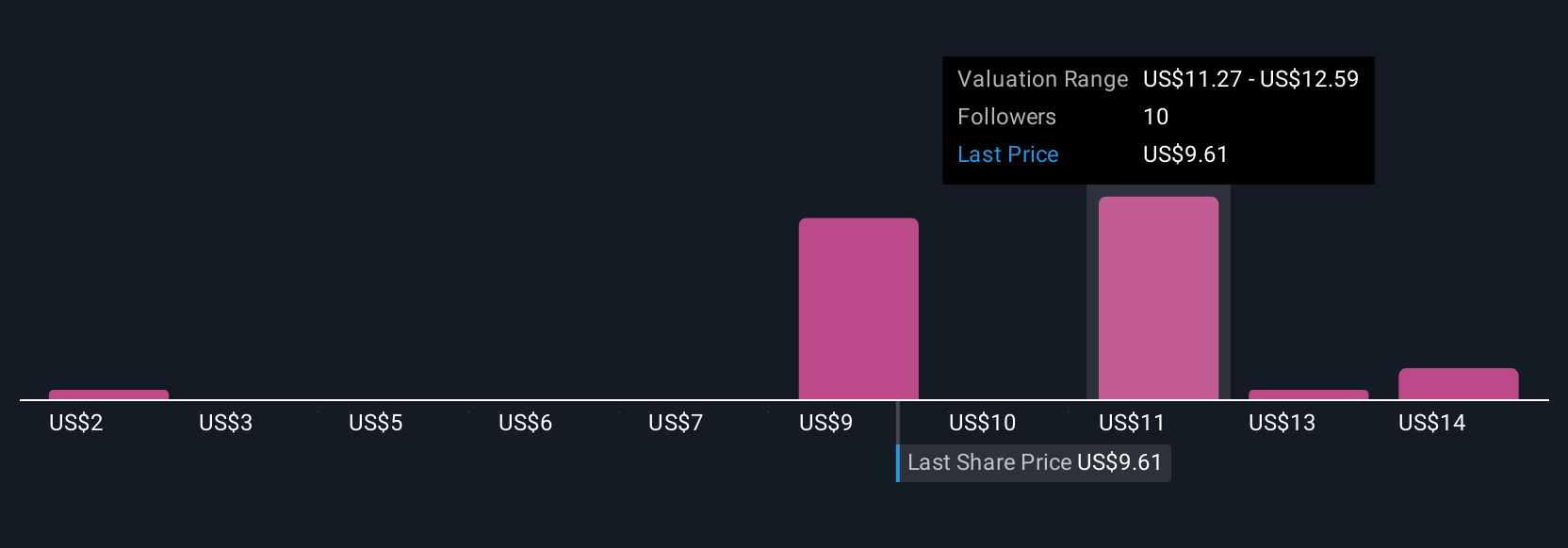

Retail fair value estimates from the Simply Wall St Community range widely from US$2.06 to US$15.22 across 7 perspectives. While some see significant upside, persistent regulatory pressures worldwide continue to shape performance expectations and deserve careful attention.

Explore 7 other fair value estimates on Herbalife - why the stock might be worth less than half the current price!

Build Your Own Herbalife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Herbalife research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Herbalife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Herbalife's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com