United Airlines Holdings (UAL) recently saw a 24.7% increase in its share price over the last quarter. This upward movement coincided with important developments, such as the completion of the DOT review for its collaboration with JetBlue Airways, which opens avenues for enhanced customer benefits and operational synergies. Meanwhile, UAL's buyback program, where over 3.5 million shares were reacquired, may have bolstered investor confidence. Although the company's Q2 earnings revealed a decrease in net income, the revenue still saw a modest increase. These factors likely played a role, although the overall market rally would have been a key influence as well.

Be aware that United Airlines Holdings is showing 2 possible red flags in our investment analysis.

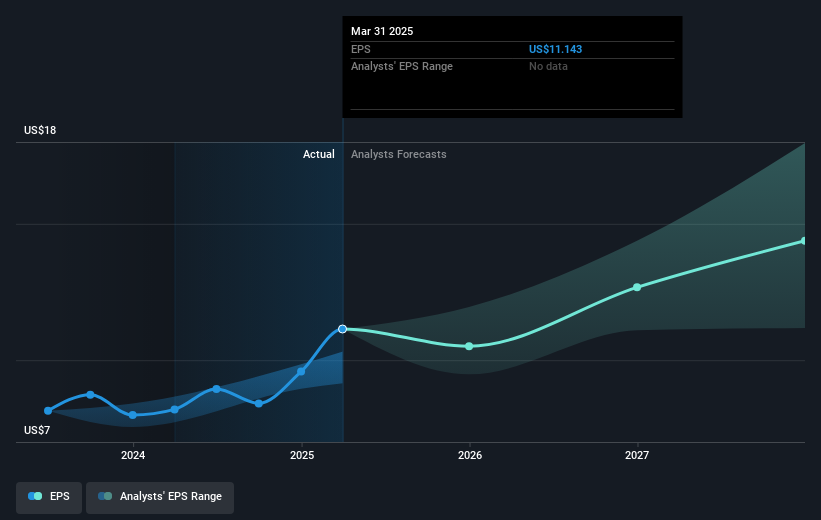

The recent news of United Airlines Holdings' collaboration with JetBlue Airways and its share buyback program could bolster the company's revenue and earnings potential. By completing the DOT review with JetBlue, UAL could enhance customer benefits and operational synergies, potentially leading to increased revenue from fuller or more frequent flights. The buyback program may indicate management's confidence in UAL's growth prospects, providing further reassurance to investors. This confluence of factors could influence analysts' future revenue and earnings estimates, currently forecasted to reach US$67.6 billion and US$4.2 billion respectively by August 2028.

Over the past five years, United Airlines Holdings has delivered a total shareholder return of 189.79%, indicating substantial long-term growth. Within the past year alone, UAL has outperformed the US Airlines industry, which posted a 75.8% one-year return, by a considerable margin. Despite these strong gains, the company's current share price of US$98.47 falls short of the consensus price target of US$107.55. This suggests a potential 9.2% appreciation, assuming the company's earnings growth and profit margin achieve forecasted levels and market conditions remain stable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com