Walmart (WMT) experienced a 9.8% price increase over the past month, a period marked by notable collaborations and product launches occurring in its stores. Pure Protein's new partnerships with Post Consumer Brands and Frank's RedHot, alongside fresh product offerings such as protein bars and popped crisps available at Walmart, align with the firm's commitment to innovative, healthier snack alternatives. These developments occurred amidst a broader market rally, as the S&P 500 and Nasdaq reached record highs, highlighting the potential influence of Walmart's expanded product lineup on its stock's performance.

Walmart has 2 possible red flags we think you should know about.

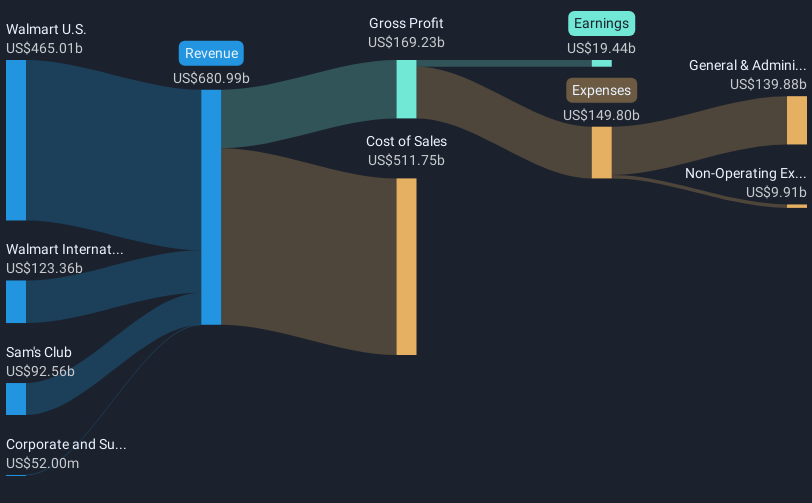

Walmart's recent collaborations and product launches align with its ongoing focus on expanding higher-margin segments such as membership, marketplace, and advertising, which are expected to enhance profitability. These initiatives could contribute to incremental revenue streams and bolster earnings forecasts that currently project an increase to $26.3 billion by 2028. The rollout of healthier snack alternatives broadens Walmart's product offering, potentially driving customer acquisition and retention—key factors in its e-commerce growth strategy. This, along with supply chain and tech investments, aims to improve operational efficiency, crucial for maintaining robust financial health.

Over the past five years, Walmart's total shareholder return, including reinvested dividends, stood at 146.80%. This long-term performance highlights the company's resilience and offers a contrast to its more recent one-year stock performance, which exceeded both the US market's 19.6% return and the US Consumer Retailing industry's 31.6% return over the same period. Such comparative strength underscores Walmart's competitive positioning in the retail sector.

With a current share price of approximately US$103.62, Walmart's stock is trading just below the analyst consensus price target of US$110.27, indicating a potential for appreciation. However, the price target is not significantly higher, suggesting the stock is seen as fairly valued based on projected earnings and revenue growth. Continued execution in higher-margin ventures and expansion into fintech with the impending PhonePe IPO remain critical to achieving these targets and altering market perceptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com