Shares of Bitcoin Depot Inc. (NASDAQ:BTM) edged higher in Wednesday's pre-market trading after the cryptocurrency ATM operator reported nearly a threefold jump in second-quarter profits.

BTM is showing upward movement. See if it is worth your attention here.

Bitcoin Rally Helps Drive Earnings

The company's net income skyrocketed 183% to $12.3 million year-over-year, while revenue increased 6% to $172.1 million.

The Atlanta-based firm attributed the profit increase in part to the $2.3 million mark-to-market gain on its BTC holdings. The apex cryptocurrency closed the second quarter up nearly 30%, reversing the declines from the first quarter.

Bitcoin Depot bought six more BTC in the quarter, bringing the total held for investment to 100.35 BTC, worth $12.07 million.

See Also: Bitcoin To Hit $150,000, Coin Bureau’s Nic Puckrin Affirms

Stock Crashed After EPS Missed Estimates

However, the earnings per share came in at $0.16, falling short of the consensus analyst projection of $0.17. The EPS miss likely signaled to investors that per-share profitability was not as robust as anticipated, leading to a fall in stock price after the financials.

Price Action: Bitcoin Depot shares rose 2.84% in pre-market trading after closing 12.45% lower at $4.220 in Tuesday’s regular session. Year-to-date, the stock has surged 160%

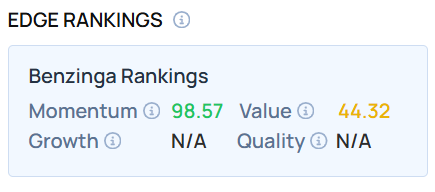

The stock exhibited a high Momentum score as of this writing. Visit Benzinga Edge Stock Rankings to check how it fares against other Bitcoin-linked stocks, such as Strategy Inc. (NASDAQ:MSTR).

Read Next:

Image via Shutterstock