- In July 2025, Terex Corporation announced new earnings guidance for the full year and updated investors on recent share repurchases, while also reporting its second quarter results showing increased sales but a large drop in net income compared to the prior year.

- A key insight from these announcements is that Terex completed a major share buyback program and reduced its loan interest costs, signaling a clear focus on capital structure efficiency and shareholder returns.

- Now, we'll explore how Terex's recently completed share buyback could influence its broader investment narrative and future outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Terex Investment Narrative Recap

To be a Terex shareholder, you need to believe that long-term infrastructure investment and growth in equipment demand will offset cyclical volatility, competitive pressures, and ongoing cost headwinds. The July 2025 news, particularly the combination of stronger sales, a completed share buyback, and reduced interest expenses, does not materially change the most important short-term catalyst: sustained infrastructure spending. However, the biggest current risk remains pressure on operating margins from inflation and customer caution, as recent earnings revealed lower profitability despite higher sales.

Among the July announcements, the completion of Terex's $150.28 million share buyback stands out. Share buybacks directly impact earnings per share and can signal management's confidence in the business, but in this context, they occurred alongside falling net income and continued macroeconomic uncertainty, highlighting the challenges Terex faces turning sales growth into higher earnings.

Yet even as cost headwinds persist, investors should be aware that margin compression in key segments like Aerials could intensify if economic conditions worsen...

Read the full narrative on Terex (it's free!)

Terex's outlook calls for $6.1 billion in revenue and $529.9 million in earnings by 2028. This is based on a 5.7% annual revenue growth rate and an increase in earnings of $350.9 million from the current $179.0 million.

Uncover how Terex's forecasts yield a $54.90 fair value, a 8% upside to its current price.

Exploring Other Perspectives

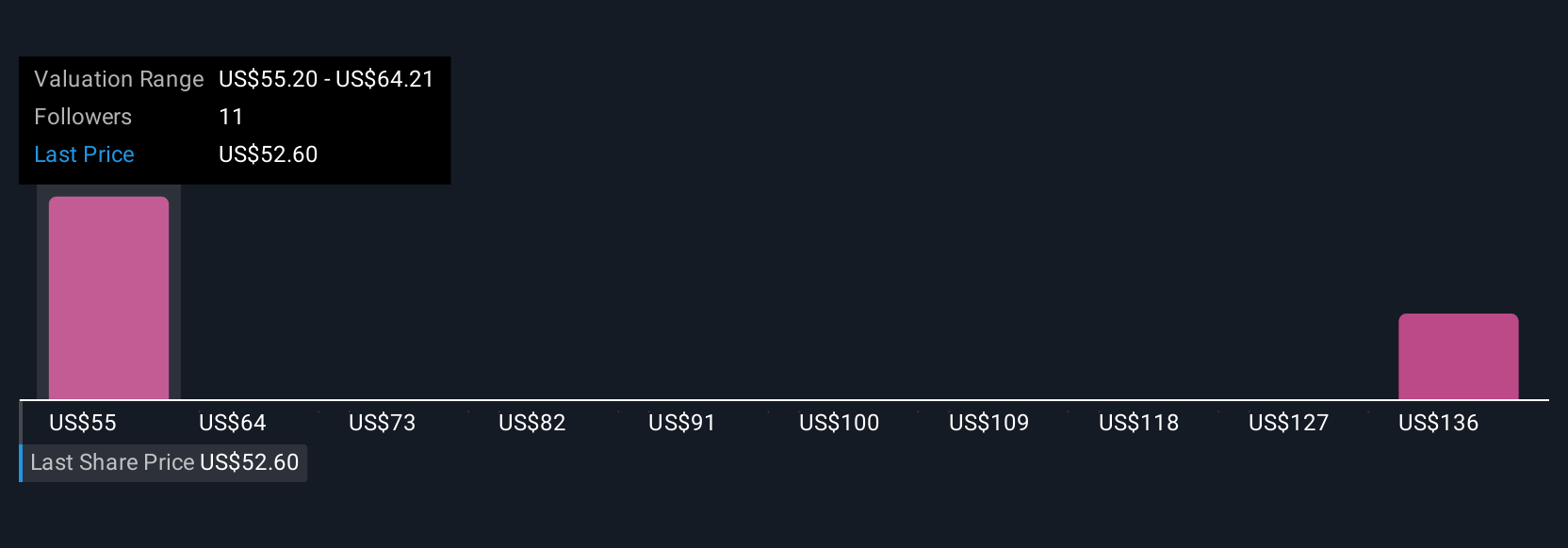

Simply Wall St Community contributors set fair value estimates for Terex between US$54.90 and US$142.71, showing wide variation from three outlooks. These differing opinions reflect how potential operating margin pressures could impact future performance, explore these viewpoints to see the full range of investor expectations.

Explore 3 other fair value estimates on Terex - why the stock might be worth just $54.90!

Build Your Own Terex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Terex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terex's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com