- Eagle Materials Inc. recently declared a quarterly cash dividend of US$0.25 per share, payable on October 16, 2025, with a record date of September 15, and announced the resignation of director Richard R. Stewart following its annual shareholder meeting on August 4, 2025.

- Shareholders approved a proposal to declassify the Board of Directors, marking a governance shift that heightens board accountability and refreshment.

- We'll explore how the board declassification and dividend decision could shape Eagle Materials' longer-term value proposition for investors.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

Eagle Materials Investment Narrative Recap

To be a shareholder in Eagle Materials, you need to see the long-term demand for construction and infrastructure fueling continued cement and wallboard sales, despite current volatility in earnings and sector demand. The recent dividend affirmation and board declassification announcement do not materially shift the immediate catalysts or address short-term risks, such as ongoing margin pressure from cost inflation and uncertain volume growth, facing the business right now.

Of the latest developments, the approval to declassify the Board of Directors is most relevant for investors. This governance change increases board accountability and the frequency of director elections, potentially allowing for more responsive oversight as the company addresses industry headwinds and pursues expanded operational efficiency efforts.

However, even with strong board governance, investors should be aware that rising costs and sluggish residential construction activity might put additional pressure on...

Read the full narrative on Eagle Materials (it's free!)

Eagle Materials' narrative projects $2.6 billion in revenue and $524.5 million in earnings by 2028. This requires 3.8% yearly revenue growth and an earnings increase of $71.6 million from $452.9 million.

Uncover how Eagle Materials' forecasts yield a $246.89 fair value, a 6% upside to its current price.

Exploring Other Perspectives

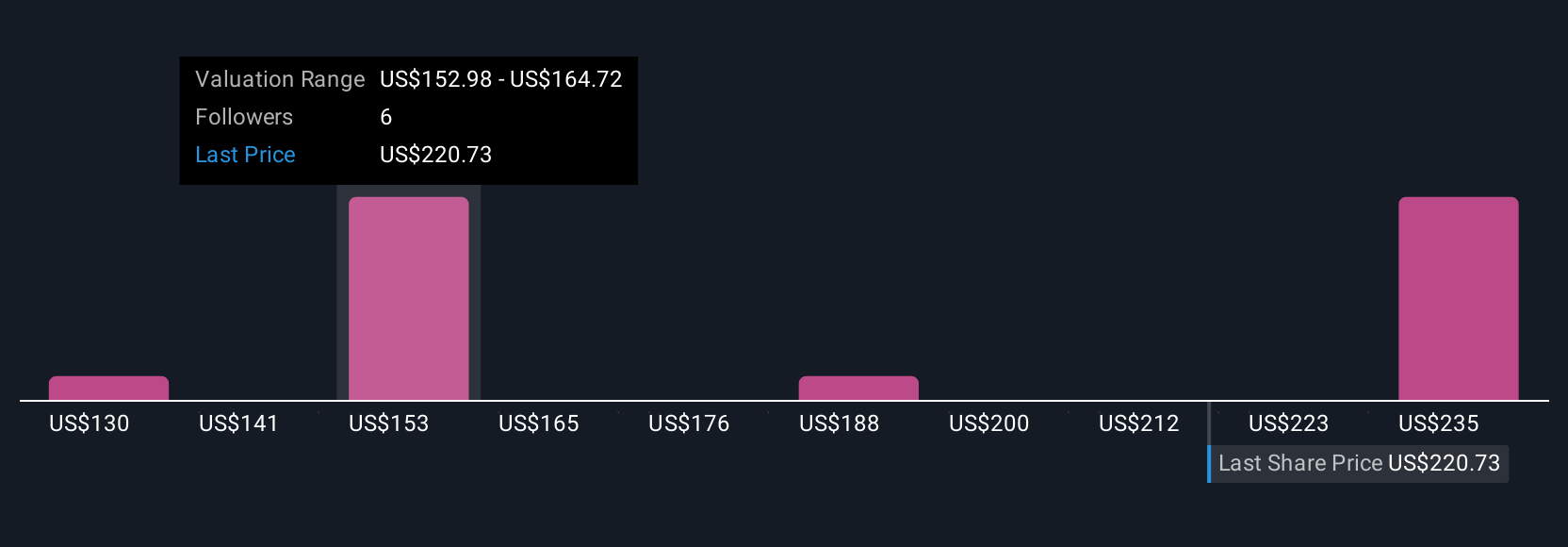

Simply Wall St Community fair value estimates for Eagle Materials range from US$117.66 to US$246.89 across 4 investor views. Amid persistent cost risks, your outlook may differ from others when weighing potential returns and downside factors.

Explore 4 other fair value estimates on Eagle Materials - why the stock might be worth as much as 6% more than the current price!

Build Your Own Eagle Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eagle Materials research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eagle Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eagle Materials' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com