- In recent days, Fabrinet received a Zacks Rank of #2, reflecting an improved earnings outlook, alongside positive analyst estimate revisions for full-year profits by 4.9% over the past quarter. This heightened pre-earnings optimism comes just ahead of Fabrinet’s upcoming quarterly results, where analysts anticipate both higher revenue and year-over-year earnings growth.

- Interestingly, Fabrinet’s consistently improving analyst sentiment and its selection as an earnings-beat candidate signal growing confidence in its prospects, particularly amid expectations for robust performance this quarter.

- With analyst sentiment turning more positive and expectations of an earnings beat highlighted, we'll examine the implications for Fabrinet's investment narrative.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fabrinet Investment Narrative Recap

To be a Fabrinet shareholder, you have to believe the company can sustain leadership in specialized optical and electronic manufacturing, steering through near-term sector volatility, especially given recent analyst optimism ahead of earnings. While the Zacks Rank upgrade and estimate revisions set a positive tone, these developments may not fundamentally change the ongoing risk tied to potential revenue instability in datacom as product transitions and customer fluctuations continue to loom large.

Among recent announcements, Fabrinet’s partnership with Innoviz Technologies stands out: being tapped to manufacture LiDAR products boosts the profile of its auto segment at a time when diversification is a key catalyst. This manufacturing deal could buffer against softness in datacom, offering longer-term growth levers as Fabrinet prepares for its next earnings reveal.

In contrast, investors should not overlook the impact of sequential revenue declines tied to datacom product transitions...

Read the full narrative on Fabrinet (it's free!)

Fabrinet's narrative projects $5.0 billion in revenue and $502.5 million in earnings by 2028. This requires 14.9% yearly revenue growth and a $176.1 million earnings increase from the current earnings of $326.4 million.

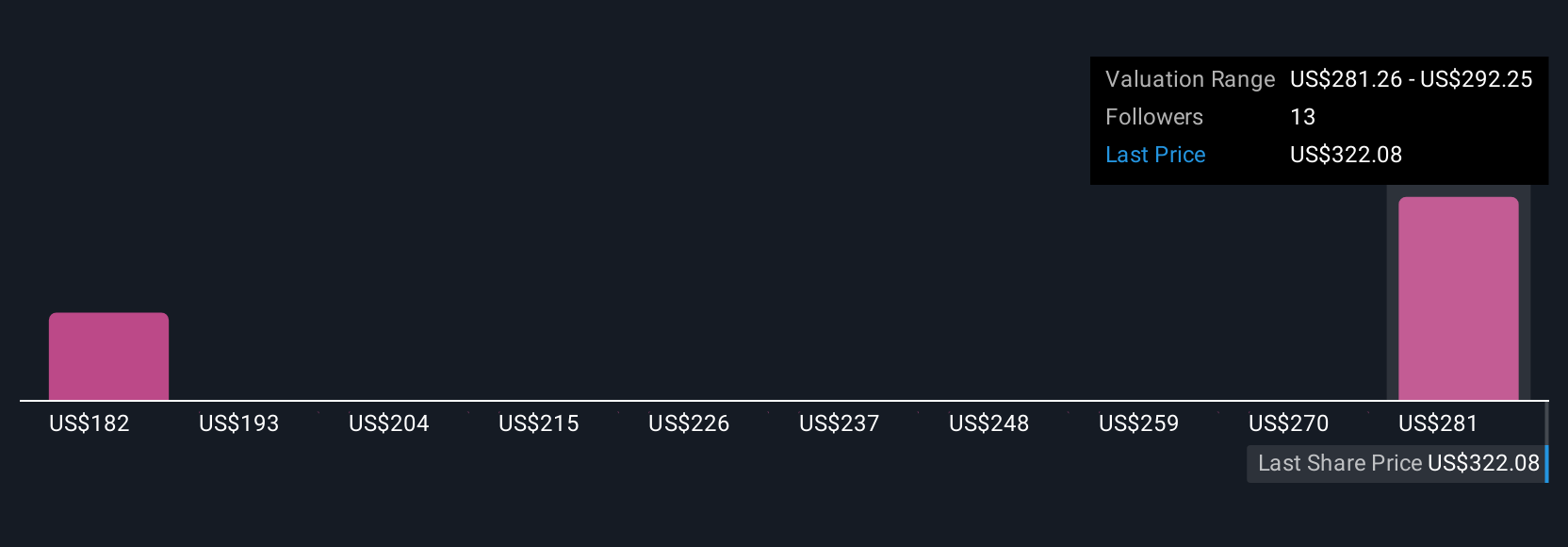

Uncover how Fabrinet's forecasts yield a $292.25 fair value, a 16% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$182.76 to US$292.25, showing how widely investor opinions differ. With ongoing sector shifts affecting Fabrinet’s core revenue streams, it is worth exploring these varied perspectives on the company’s outlook.

Explore 3 other fair value estimates on Fabrinet - why the stock might be worth as much as $292.25!

Build Your Own Fabrinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fabrinet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fabrinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fabrinet's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com