- On August 13, 2025, S&P Global Ratings upgraded ADT Inc. to a ‘BB’ rating, citing improved credit metrics and a significant reduction in ownership by financial sponsor Apollo, whose holding in ADT has fallen to around 14%.

- This governance change is expected to support stronger oversight and more disciplined financial policies as ADT focuses on enhancing its cash flows and capital allocation priorities.

- We'll explore how S&P's increased confidence in ADT's financial health could influence the company's outlook and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

ADT Investment Narrative Recap

To be an ADT shareholder today, you need to trust in management’s ability to drive stable cash flows and defend recurring revenue in a market increasingly challenged by new DIY and smart home competitors. S&P’s upgrade in August 2025 strengthens near-term confidence in ADT’s credit metrics, but it does not immediately resolve concerns over competitive pressures and the company’s high debt load, the two biggest issues shaping short-term momentum and risk.

Among recent announcements, ADT’s July 2025 follow-on equity offering, which raised US$590.01 million, stands out as particularly tied to the rating upgrade, raising new capital and reducing sponsor control both support stronger financial footing. With S&P spotlighting improved cash generation and capital discipline, this share issuance is especially relevant as investors weigh current catalysts against ongoing challenges to organic subscriber growth and margin improvement.

However, investors should also consider that, despite enhanced governance, competitive threats from lower-cost DIY offerings remain a critical variable that could...

Read the full narrative on ADT (it's free!)

ADT's outlook forecasts $5.7 billion in revenue and $857.3 million in earnings by 2028. This implies a 3.8% annual revenue growth rate and a $217.3 million increase in earnings from the current $640.0 million.

Uncover how ADT's forecasts yield a $9.38 fair value, a 10% upside to its current price.

Exploring Other Perspectives

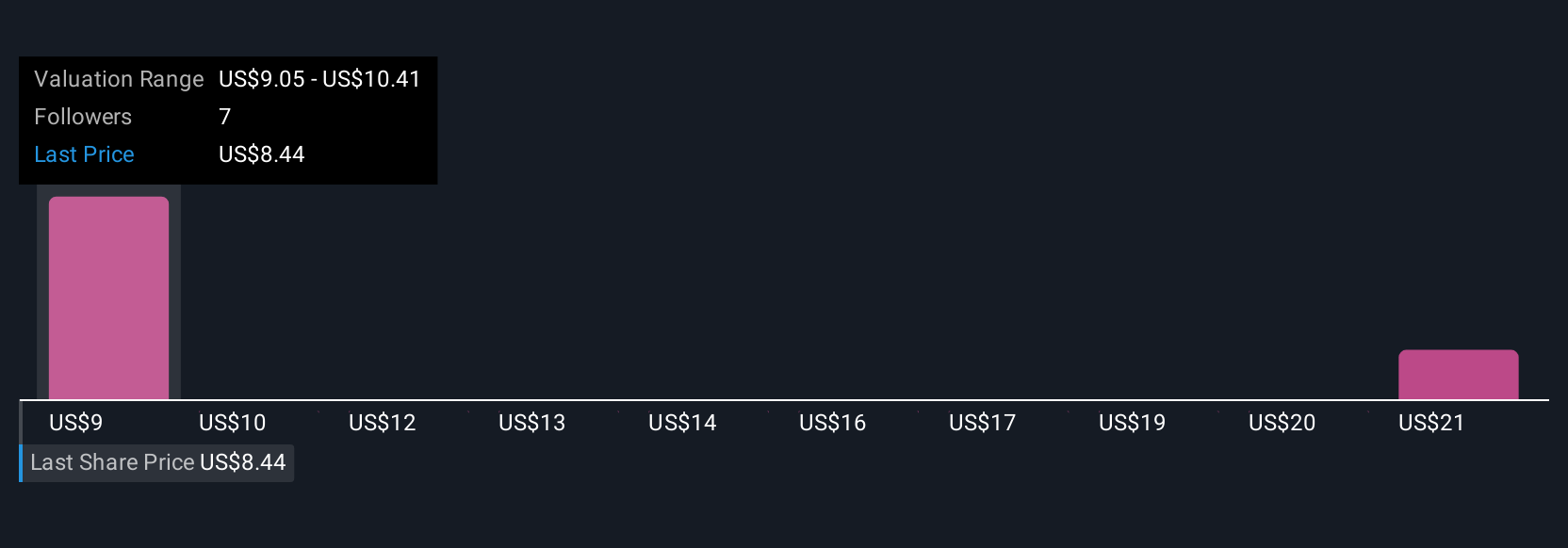

Three Simply Wall St Community member valuations of ADT range widely from US$9.05 to US$20.77 per share. While participants see opportunities in stable earnings growth, many are weighing this against ongoing questions about ADT’s high debt levels and ability to adapt to shifting market trends, explore the full spectrum of viewpoints directly from the Community.

Explore 3 other fair value estimates on ADT - why the stock might be worth just $9.05!

Build Your Own ADT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADT's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com