- Interparfums, Inc. recently reported its second quarter 2025 results, showing sales of US$333.94 million and net income of US$31.99 million, both lower than the previous year, while also confirming a regular quarterly cash dividend and maintaining annual earnings guidance.

- Despite softer quarterly figures, the company’s reaffirmed full-year outlook highlights management’s confidence in overcoming recent international revenue challenges and ongoing economic uncertainty.

- With management reiterating its annual sales and earnings targets, we now assess how this confidence shapes the longer-term investment case for Interparfums.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Interparfums Investment Narrative Recap

If you are considering Interparfums as a long-term holding, you need to believe in the company’s ability to grow premium fragrance brands internationally and defend profitability despite near-term profit softness and unpredictable international sales. The latest quarterly results showed only modest declines, with management reaffirming full-year guidance, a signal that recent revenue setbacks are not yet material enough to shift the biggest near-term catalyst (brand launches and geographic expansion) or the primary risk (currency swings and overseas market volatility). Among recent developments, Interparfums’ confirmation of a regular US$0.80 per share quarterly dividend stands out, reinforcing management’s continued commitment to shareholder returns during a period of revenue adjustment. This announcement is consistent with the company’s confidence in its ongoing cash generation, even as external headwinds could influence timing and magnitude of sales recoveries. Yet, despite this reassurance, investors should still be aware that international exposure brings inherent risks, especially considering...

Read the full narrative on Interparfums (it's free!)

Interparfums' outlook anticipates $1.7 billion in revenue and $205.0 million in earnings by 2028. This is based on a projected 4.9% annual revenue growth rate and a $44.0 million increase in earnings from the current level of $161.0 million.

Uncover how Interparfums' forecasts yield a $163.33 fair value, a 40% upside to its current price.

Exploring Other Perspectives

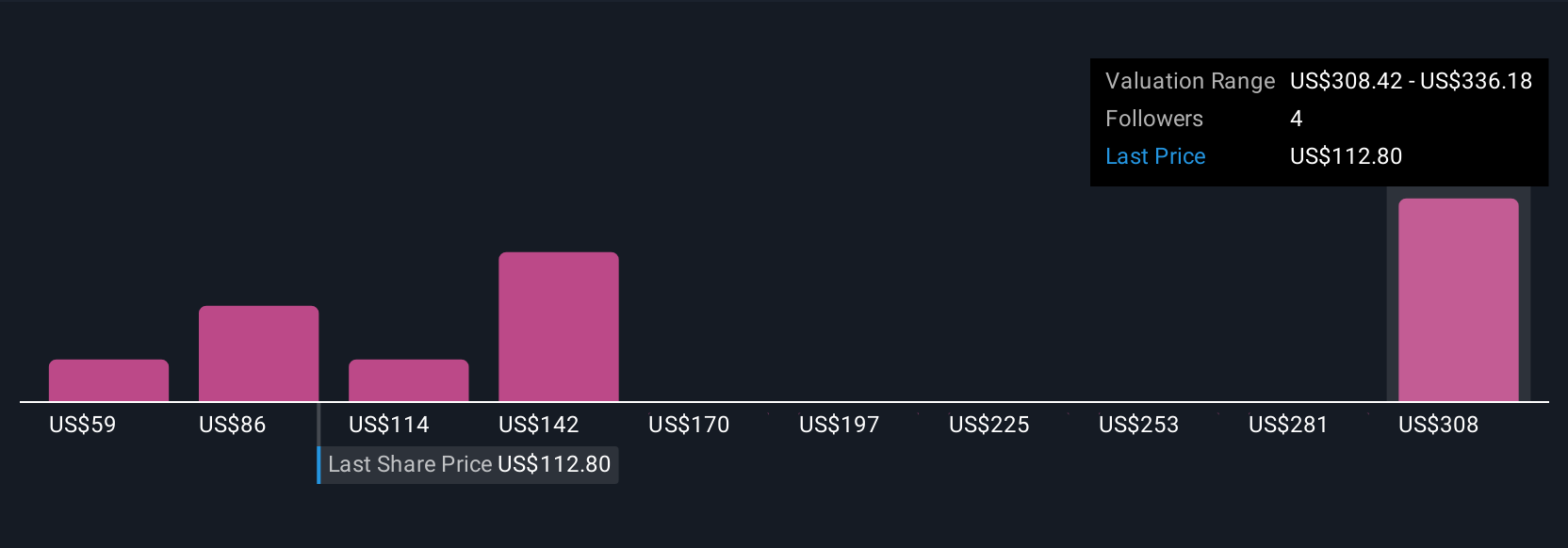

Six private retail investors from the Simply Wall St Community set Interparfums’ fair value between US$58.55 and US$338.16, reflecting wide-ranging views. Consider how currency volatility could influence future performance across such diverse expectations.

Explore 6 other fair value estimates on Interparfums - why the stock might be worth 50% less than the current price!

Build Your Own Interparfums Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interparfums research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Interparfums research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interparfums' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com