- Earlier this month, Teledyne HiRel Semiconductors released a new industrial-grade embedded MultiMediaCard (eMMC) module featuring 128GB of eMMC 5.1-compliant storage designed for high-speed, long-term reliability in challenging environments such as aerospace, defense, and edge computing.

- This launch highlights Teledyne’s commitment to product innovation tailored for critical sectors, adding further support to its presence in rugged and mission-critical applications.

- We'll now consider how the eMMC module release may bolster Teledyne's investment narrative, especially in aerospace and defense markets.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Teledyne Technologies Investment Narrative Recap

For investors interested in Teledyne Technologies, the core thesis centers on believing in its sustained leadership in mission-critical electronics for aerospace and defense, where long product life cycles and technical differentiation can support resilient demand. The newly launched eMMC module reinforces Teledyne’s product innovation but, by itself, does not materially shift the near-term earnings catalysts, which remain tied to defense order growth. The key risk to watch is ongoing margin compression within recently acquired and legacy business lines.

Among recent developments, Teledyne’s announcement of a new US$2 billion share repurchase program stands out as particularly relevant, especially as management signals confidence in cash generation. This initiative directly relates to potential catalysts such as operational execution in end markets and improved shareholder returns, though its benefit will depend on maintaining robust earnings and free cash flow.

However, investors should also be aware that, despite strong order pipelines, persistent cost pressures and integration hurdles could challenge margin improvement if...

Read the full narrative on Teledyne Technologies (it's free!)

Teledyne Technologies' narrative projects $6.9 billion revenue and $1.1 billion earnings by 2028. This requires 5.2% yearly revenue growth and a $241 million earnings increase from $859 million.

Uncover how Teledyne Technologies' forecasts yield a $609.41 fair value, a 10% upside to its current price.

Exploring Other Perspectives

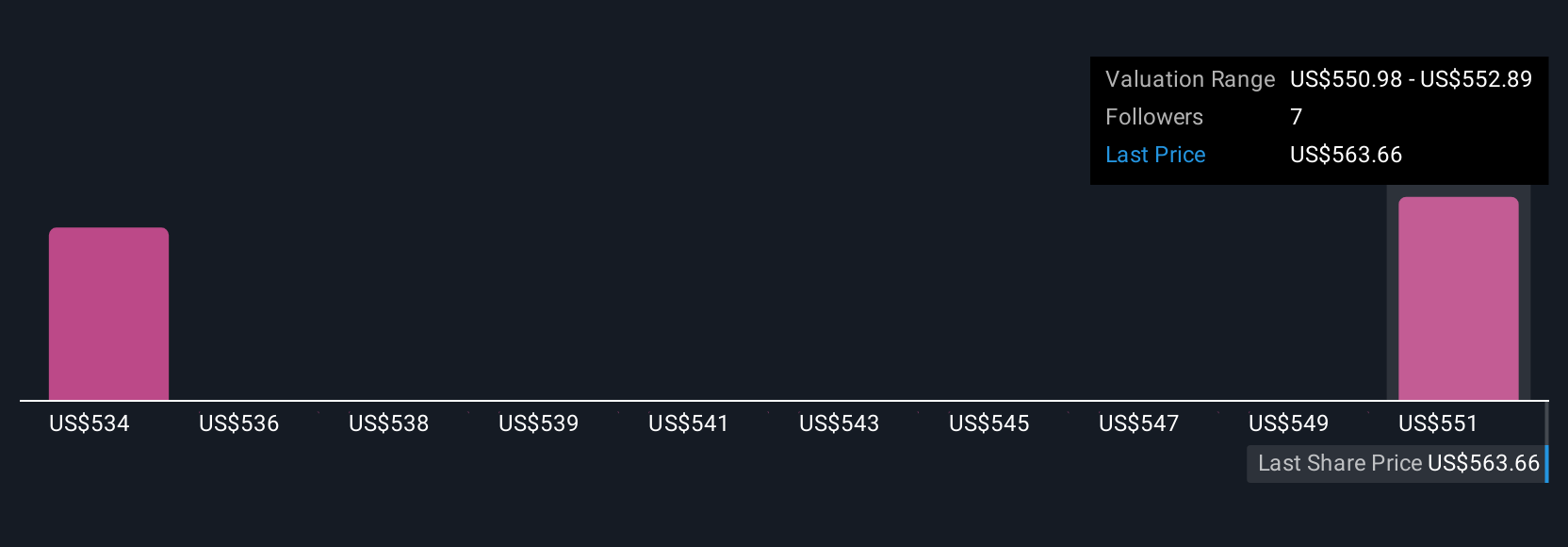

Two community fair value estimates for Teledyne range from US$558.73 to US$609.41, revealing a spread of private valuations among Simply Wall St Community users. With margin pressure still a concern, you are encouraged to compare these perspectives and consider how differing views may affect your assessment of the company’s resilience.

Explore 2 other fair value estimates on Teledyne Technologies - why the stock might be worth as much as 10% more than the current price!

Build Your Own Teledyne Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teledyne Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teledyne Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teledyne Technologies' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com