- On August 12, 2025, Visteon Corporation presented at the J.P. Morgan Auto Conference in New York, attracting investor attention amid heightened options market activity and positive analyst sentiment.

- An unusually high implied volatility in Visteon's September $45 put options, combined with upward earnings estimate revisions and a strong return on equity, highlighted increased expectations ahead of the conference.

- Given the surge in options activity, we'll examine how rising investor anticipation influences Visteon's investment narrative and sector outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Visteon Investment Narrative Recap

To be a shareholder in Visteon, you need confidence in the company’s ability to drive growth from its leadership in automotive display and cockpit technology, while managing industry headwinds like tariffs and international market shifts. The recent J.P. Morgan Auto Conference spotlight brought increased investor focus, but the surge in options activity does not substantially change the most important short term catalyst: winning new business with global OEMs. Meanwhile, risks from volatile industry volumes and tariffs remain key concerns, unaffected by this event.

Among recent announcements, Visteon’s decision to initiate a quarterly dividend stands out. This move, coming just weeks before the conference, signals a shift toward returning capital to shareholders and may influence how investors factor in both current profitability and expectations for future cash flow growth amid ongoing sector pressures. In the context of industry catalysts, consistent dividend payments could support shareholder confidence as the company pursues expansion in high-growth markets.

However, in contrast to the excitement around growth prospects, ongoing uncertainty about new and proposed tariffs could impact revenue forecasts and is information investors should be aware of...

Read the full narrative on Visteon (it's free!)

Visteon's outlook anticipates $4.3 billion in revenue and $260.2 million in earnings by 2028. This scenario is based on a 3.8% annual revenue growth rate but implies a decrease in earnings of $30.8 million from the current $291.0 million.

Uncover how Visteon's forecasts yield a $122.14 fair value, a 3% upside to its current price.

Exploring Other Perspectives

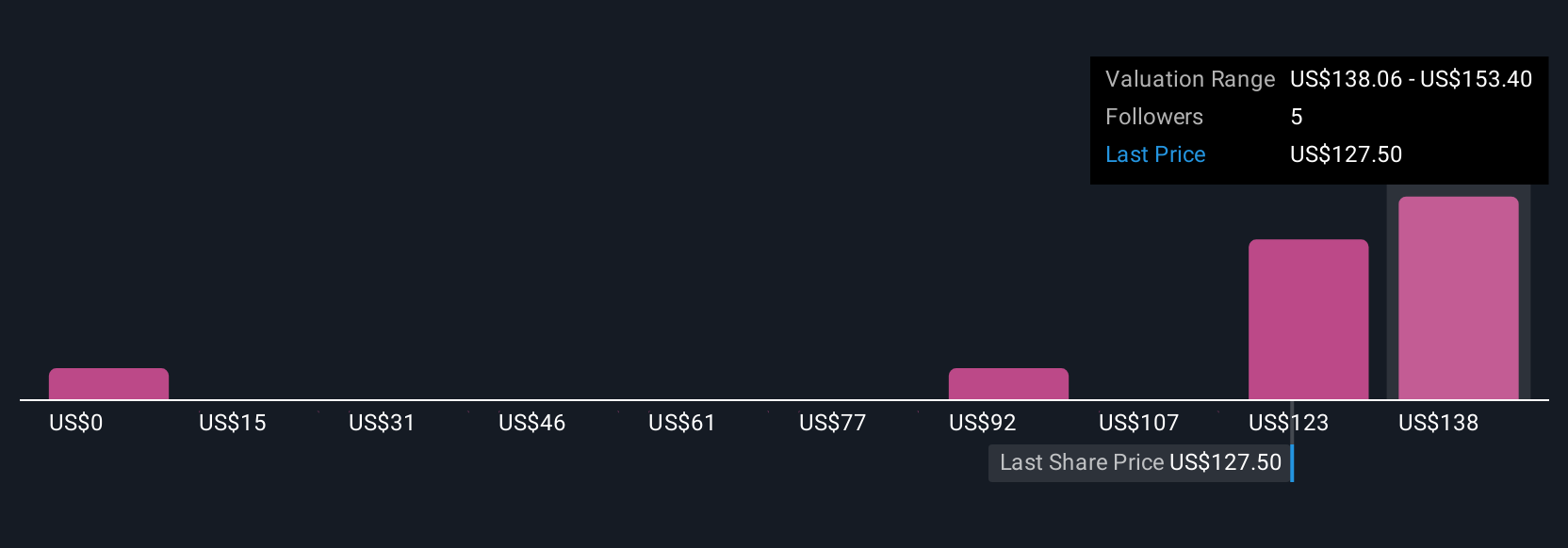

Five members of the Simply Wall St Community have shared fair value estimates for Visteon ranging from US$15 to US$155 per share. While some anticipate upside tied to the company’s expansion into new markets, others highlight risks like industry production declines as critical to watch. Investor opinions vary widely and you are invited to compare these views alongside your own outlook.

Explore 5 other fair value estimates on Visteon - why the stock might be worth as much as 30% more than the current price!

Build Your Own Visteon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Visteon research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Visteon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Visteon's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com