- Analyst sentiment toward SkyWest has grown increasingly positive over the past month, with an improved average brokerage recommendation of 1.20 and a Zacks Rank #1 (Strong Buy) reflecting higher consensus earnings estimates.

- This collective optimism highlights growing confidence in SkyWest's earnings outlook and signals expectations of stronger near-term performance for the company.

- We'll examine how these upgraded analyst outlooks and stronger earnings forecasts may impact the company's investment narrative and future prospects.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

SkyWest Investment Narrative Recap

To be a SkyWest shareholder, an investor should have conviction in the company's ability to harness sustained demand for regional air travel while managing the evolving risks posed by labor costs and contract renegotiations with major carriers. The recent wave of positive analyst sentiment, highlighted by upward earnings estimate revisions and a strong buy consensus, reinforces the near-term catalyst of robust earnings delivery. However, these favorable updates do not materially shift the persistent risks tied to labor shortages or CPA dependencies that remain fundamental to SkyWest's ongoing performance.

SkyWest's most recent earnings announcement on July 24, 2025, revealed significant year-over-year growth in both revenue and net income. This result directly underscores the current optimism from analysts and strengthens the short-term investment case centered on profitable expansion and effective cost management, and it further highlights the company's execution against the backdrop of both fleet modernization and volatile labor markets.

Yet, on the other hand, investors should also be aware that persistent pilot shortages could...

Read the full narrative on SkyWest (it's free!)

SkyWest's outlook projects $4.5 billion in revenue and $456.8 million in earnings by 2028. This implies a 5.7% annual revenue growth rate and a $48.9 million increase in earnings from the current $407.9 million.

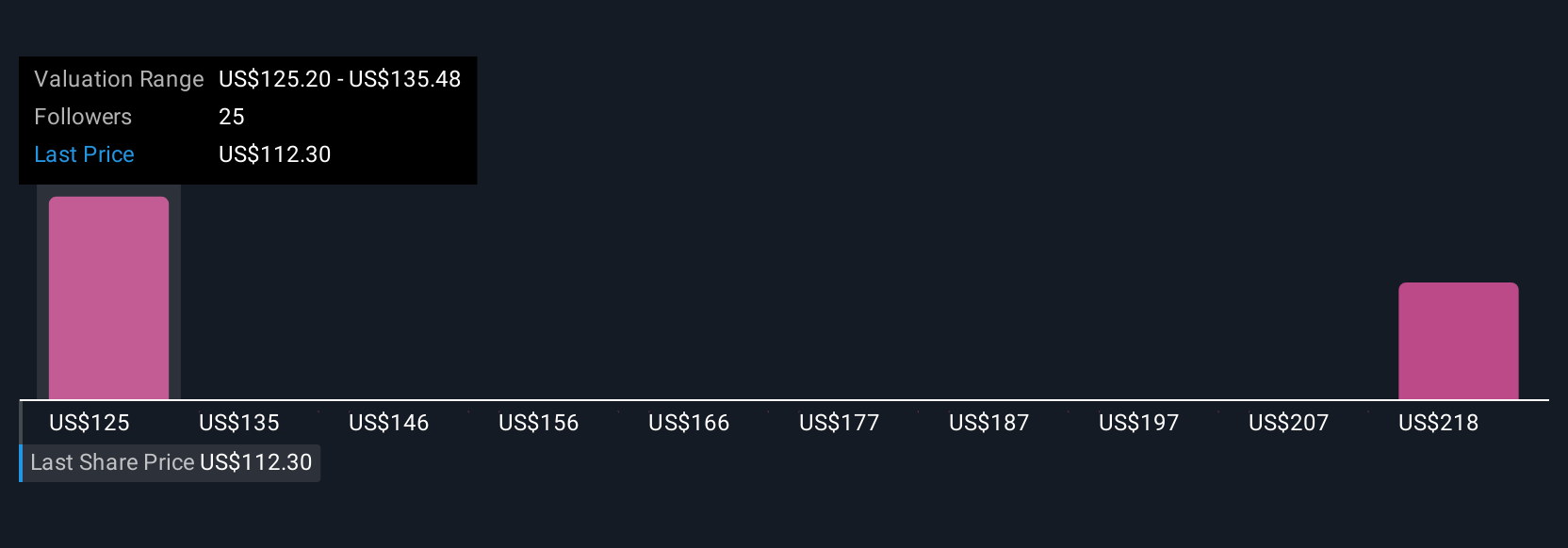

Uncover how SkyWest's forecasts yield a $131.60 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for SkyWest between US$131.60 and US$204.08, reflecting insights from 2 individual perspectives. In contrast, analysts are watching persistent labor risks that could affect SkyWest's ability to fully capitalize on earnings momentum, so explore several viewpoints before making up your mind.

Explore 2 other fair value estimates on SkyWest - why the stock might be worth as much as 74% more than the current price!

Build Your Own SkyWest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SkyWest research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SkyWest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SkyWest's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com