- PPL Corporation announced past second quarter results, reporting US$2.03 billion in sales and US$183 million in net income, along with reaffirmed guidance for 2025, projecting 6% to 8% annual EPS and dividend growth through at least 2028.

- An interesting insight is that the company expects to achieve EPS growth near the upper end of its guidance range, highlighting continued momentum in both earnings and dividends.

- With management reiterating its EPS and dividend growth outlook, we'll examine how this optimism shapes PPL's long-term investment narrative.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

PPL Investment Narrative Recap

To be a PPL shareholder today, you need to believe the company will deliver sustained regulated earnings and dividend growth by executing on its massive grid and generation upgrade plans, while effectively managing regulatory and policy risks. The reaffirmed 2025 guidance and upbeat long-term growth outlook does not materially alter the most important near-term catalyst, securing timely rate approvals for multibillion-dollar capital investments. However, exposure to regulatory delay remains the biggest short-term risk for PPL’s earnings trajectory.

Among recent company announcements, the new joint venture with Blackstone Infrastructure to develop gas-fired generation for data centers in Pennsylvania stands out. This move directly targets one of PPL's most critical catalysts: capturing rising power demand from hyperscale customers, which supports the company’s confidence around rate base and earnings growth.

Yet, in contrast to growth headlines, investors should also be aware of lingering regulatory risks, including how shifts in state-level oversight could impact...

Read the full narrative on PPL (it's free!)

PPL's narrative projects $9.6 billion revenue and $1.7 billion earnings by 2028. This requires 3.1% yearly revenue growth and a $714 million earnings increase from $986 million currently.

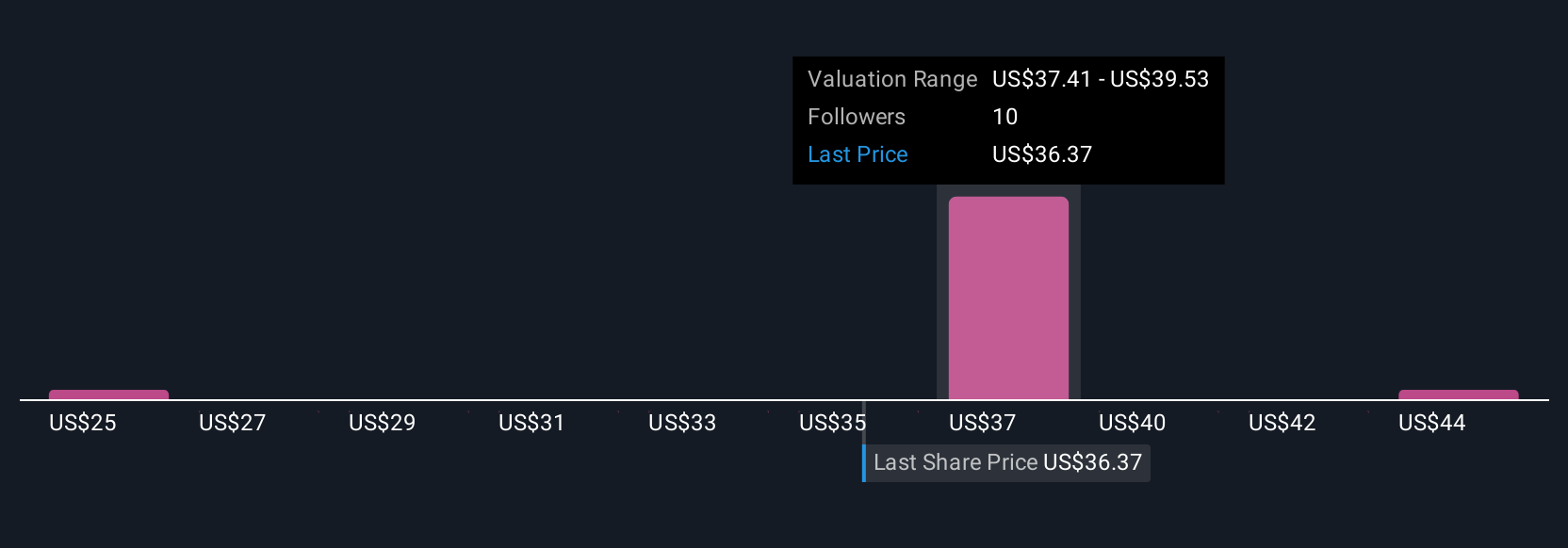

Uncover how PPL's forecasts yield a $38.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$24.73 to US$45.87, reflecting wide differences in outlook. While opinions vary, the company’s dependence on rate approval outcomes highlights how broad regulatory risks can directly influence future results and investor confidence.

Explore 3 other fair value estimates on PPL - why the stock might be worth as much as 24% more than the current price!

Build Your Own PPL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPL research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PPL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPL's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com