- Earlier this month, Barrett Business Services, Inc. reported second quarter results showing revenue of US$307.66 million and net income of US$18.45 million, both higher than the same period last year, and also announced a new US$100 million share repurchase program alongside an upcoming quarterly dividend payment.

- In addition to reporting higher earnings, BBSI expanded into the Chicago market, signaling continued intent to diversify its geographic footprint and service offerings for small- and mid-sized businesses.

- We'll examine how the combination of robust earnings and a significant share repurchase initiative influences Barrett Business Services' investment outlook.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Barrett Business Services Investment Narrative Recap

To feel comfortable owning shares of Barrett Business Services, an investor should have confidence in the ongoing adoption of outsourced HR and payroll solutions, and believe that geographic expansion will offset regional and industry-specific volatility. The latest earnings report and Chicago expansion provide support for short-term growth catalysts, but do not fundamentally change the most important near-term risk, client hiring levels remain below historical norms, putting pressure on future worksite employee growth. The news, while positive, does not materially resolve this underlying risk.

Among the recent announcements, the launch of a new US$100 million share repurchase program stands out as the most relevant. This move builds on an already substantial volume of buybacks, potentially enhancing shareholder returns and signaling management's continued commitment to shareholder value, which aligns with catalysts around earnings momentum and geographic diversification.

By contrast, the possibility of continued sluggish client hiring, especially amid demographic shifts or wider remote work adoption, is a factor investors should be acutely aware of...

Read the full narrative on Barrett Business Services (it's free!)

Barrett Business Services is forecast to reach $1.4 billion in revenue and $71.7 million in earnings by 2028. This scenario assumes a 7.0% annual revenue growth rate and a $19.6 million increase in earnings from the current level of $52.1 million.

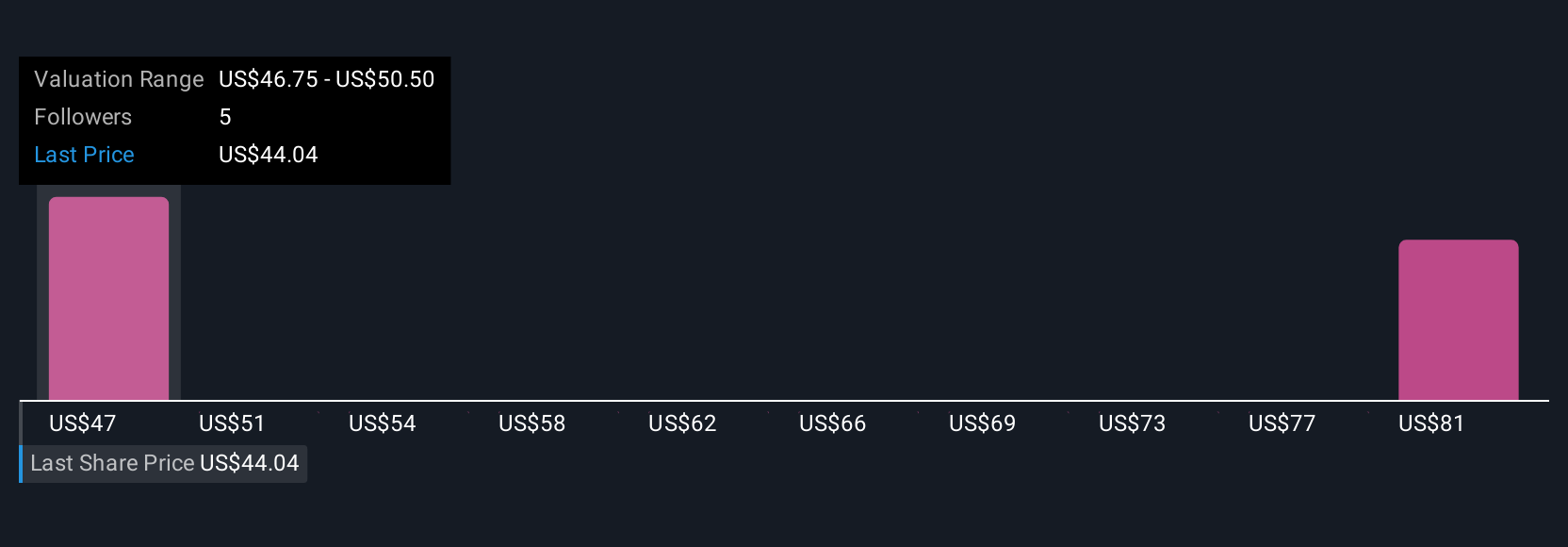

Uncover how Barrett Business Services' forecasts yield a $51.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members' fair value estimates for BBSI range from US$51.50 to US$135.00, with just 2 distinct perspectives captured. Expansion into new markets like Chicago continues to be highlighted as an important driver of future performance, but opinions can differ widely and you can explore several alternative viewpoints.

Explore 2 other fair value estimates on Barrett Business Services - why the stock might be worth just $51.50!

Build Your Own Barrett Business Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Barrett Business Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Barrett Business Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Barrett Business Services' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com