- Delek US Holdings recently reported second quarter 2025 results, showing sales of US$2,764.6 million and a net loss of US$106.4 million, reflecting both lower revenue and higher net loss compared to the previous year.

- Despite these challenging results, the company advanced its Enterprise Optimization Plan, delivered cash flow improvements, continued share repurchases, and affirmed its quarterly dividend, underscoring ongoing investment in operational efficiency and shareholder returns.

- Given this focus on operational improvements and capital return, we'll consider how Delek's ongoing cost efficiency efforts shape its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Delek US Holdings Investment Narrative Recap

To be a shareholder in Delek US Holdings right now, you need to believe in the company’s ability to drive meaningful cash flow and profitability gains through operational efficiency, particularly as the Enterprise Optimization Plan progresses. The recent report of larger net losses and lower revenues does not materially change the primary catalyst: unlocking sustained cash flow improvement. However, the biggest risk remains deteriorating refining margins, which, as seen in recent results, can pressure both earnings and overall financial resilience.

Among the latest developments, Delek’s continued share repurchases, buying back 1.8% of shares for US$20.5 million in recent months, stand out. This action is particularly relevant given the company’s focus on capital returns, despite operating headwinds, and supports the narrative around short-term catalysts such as improved operational performance and cash flow enhancements. But while sharing capital with investors signals confidence, it does not shield against the underlying...

Read the full narrative on Delek US Holdings (it's free!)

Delek US Holdings is projected to reach $10.1 billion in revenue and $1.4 billion in earnings by 2028. This outlook is based on an annual revenue decline of 3.8% and a $2.2 billion increase in earnings from the current level of -$802.9 million.

Uncover how Delek US Holdings' forecasts yield a $21.46 fair value, in line with its current price.

Exploring Other Perspectives

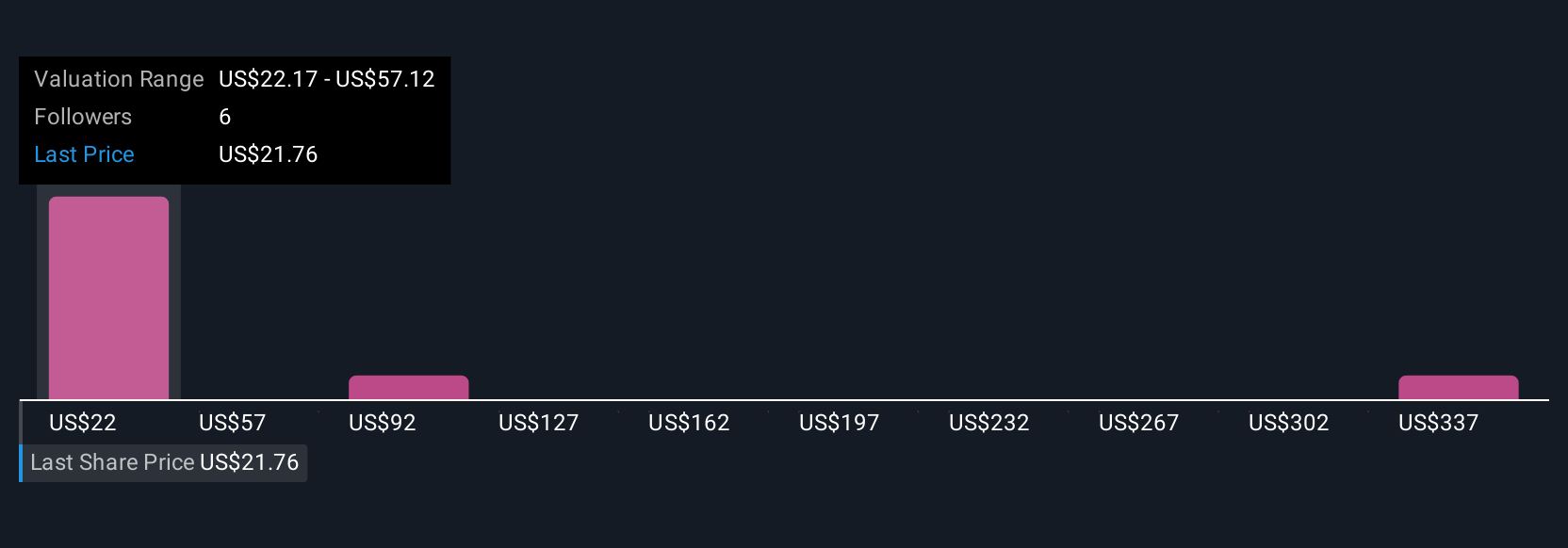

Simply Wall St Community members have submitted four fair value estimates, ranging widely from US$21.46 to US$371.71 per share. As you consider your own view, remember that ongoing pressure from refining margins may continue to shape Delek’s future earnings and shareholder value.

Explore 4 other fair value estimates on Delek US Holdings - why the stock might be worth just $21.46!

Build Your Own Delek US Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delek US Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Delek US Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delek US Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com