- Choice Hotels International recently lowered its full-year 2025 earnings guidance and reported mixed second-quarter results, with revenue and net income both declining year over year despite increased sales.

- This news comes as the company also continued its long-running share buyback program, bringing total repurchases under its 2004 authorization to over 32 million shares for more than US$2 billion.

- We’ll look at how the updated earnings guidance raises questions for Choice Hotels’ future growth expectations in the evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Choice Hotels International Investment Narrative Recap

To be a shareholder in Choice Hotels International, you need confidence in its ability to deliver earnings growth through international expansion, digital investment, and efficient franchising, even as recent results and lowered earnings guidance point to softer near-term momentum. While the updated 2025 earnings outlook signals continued pressure from weak government and international travel, the impact on the company’s core investment thesis may not be material in the short term if domestic resilience holds. The biggest risk right now remains ongoing revenue headwinds linked to softer demand and industry uncertainty.

Among recent announcements, the Q2 2025 buyback update stands out as the most relevant to these developments: Choice repurchased over 350,000 shares last quarter, maintaining its commitment to share repurchases even as financial results moderated. This approach could help offset EPS softness and support shareholder value, though it does not directly address the revenue and margin risks now in sharper focus for investors watching near-term catalysts.

However, investors should be aware that pressures on RevPAR and downward earnings guidance could signal more persistent headwinds than expected...

Read the full narrative on Choice Hotels International (it's free!)

Choice Hotels International's outlook indicates revenues of $1.8 billion and earnings of $379.9 million by 2028. This scenario assumes 32.4% annual revenue growth and a $73.6 million increase in earnings from the current $306.3 million.

Uncover how Choice Hotels International's forecasts yield a $134.57 fair value, a 11% upside to its current price.

Exploring Other Perspectives

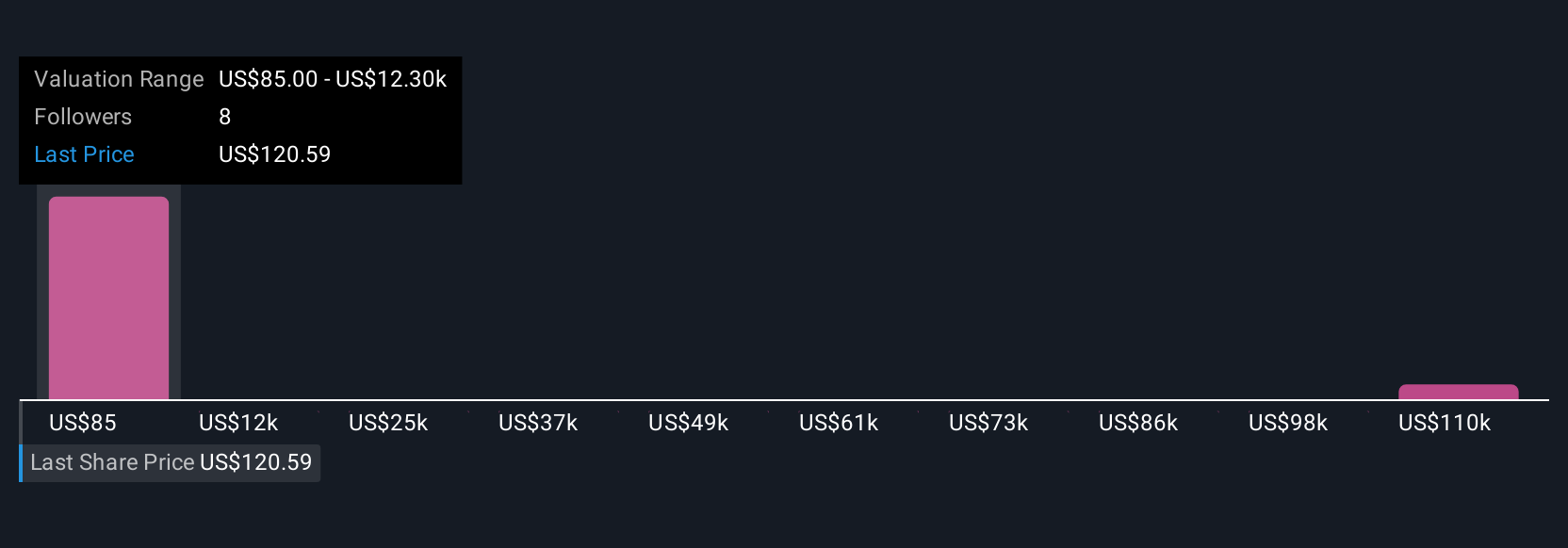

Six individual fair value estimates from the Simply Wall St Community for Choice Hotels International range widely, from US$85 to over US$122,000, reflecting sharply different outlooks. As the company highlights a disciplined share buyback during a period of earnings pressure, you can explore how these divergent perspectives align with ongoing revenue risk in the months ahead.

Explore 6 other fair value estimates on Choice Hotels International - why the stock might be a potential multi-bagger!

Build Your Own Choice Hotels International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Choice Hotels International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Choice Hotels International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Choice Hotels International's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com