- In the past week, Tenet Healthcare received a Zacks Rank #1 (Strong Buy) rating and an A grade for Value, with analyst commentary highlighting its favorable valuation metrics and strong earnings outlook.

- This recognition positioned Tenet Healthcare as an attractive opportunity for value-focused investors, as analysts pointed out it is trading below industry averages by several key valuation measures.

- We'll now examine how the recent analyst endorsement of Tenet Healthcare's undervaluation may influence its overall investment thesis.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Tenet Healthcare Investment Narrative Recap

To be a shareholder in Tenet Healthcare, you need to believe in its ability to harness demographic trends like an aging population, benefit from growing high-acuity service lines and outpatient expansion, and consistently improve operational efficiency for profitable growth. The recent Zacks Rank #1 (Strong Buy) rating and A grade for Value support the near-term narrative that Tenet is undervalued, but do not meaningfully change the primary catalyst of volume growth or offset the persistent risk around future government reimbursement policies.

Among recent company updates, Tenet’s July 2025 announcement of increased share repurchase authorization to US$3,000 million is especially relevant. Ongoing buybacks reinforce management's confidence in the company’s intrinsic value and could amplify returns if earnings outlooks remain stable, though this does not directly address underlying industry reimbursement risks.

However, investors should also be mindful that if legislation changes impact Medicaid supplemental payments, an area contributing over US$1 billion annually, the revenue base could come under pressure ...

Read the full narrative on Tenet Healthcare (it's free!)

Tenet Healthcare's narrative projects $23.3 billion in revenue and $1.4 billion in earnings by 2028. This requires 4.0% yearly revenue growth and a $0.1 billion decrease in earnings from $1.5 billion today.

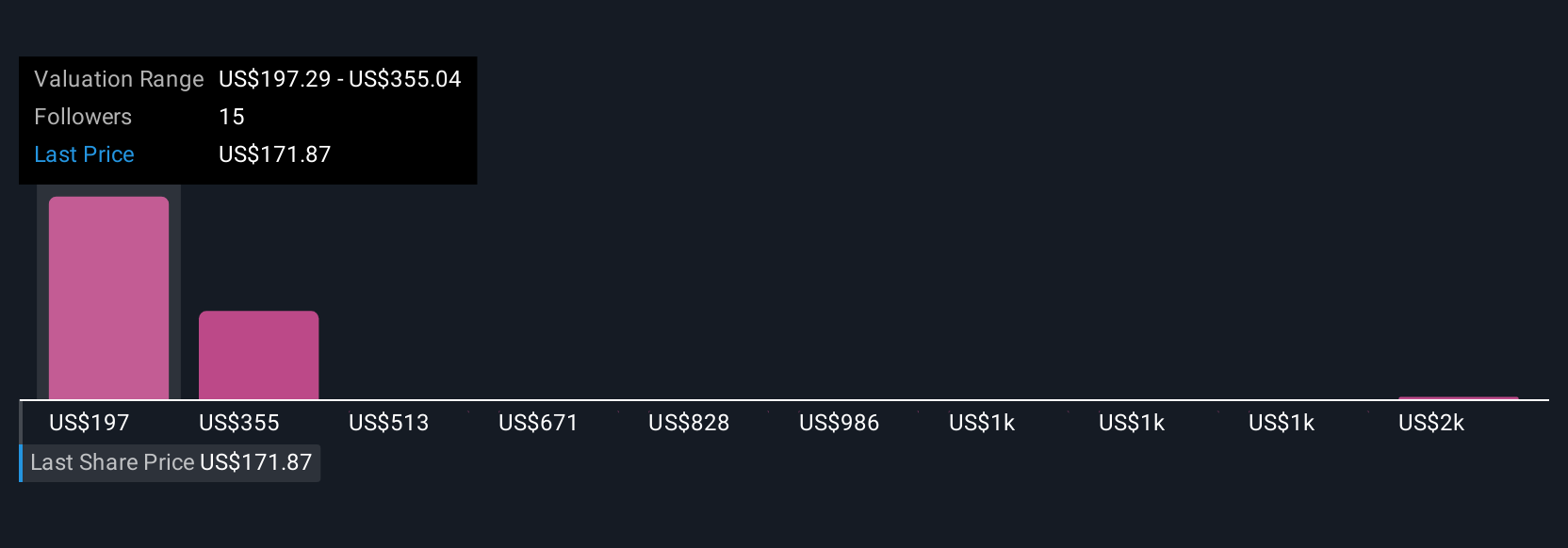

Uncover how Tenet Healthcare's forecasts yield a $197.29 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published three fair value estimates for Tenet Healthcare, ranging from US$197 to US$1,774 per share. While many see strength in Tenet’s high-acuity service line expansion and outpatient growth, opinions differ significantly, making it important to review a variety of perspectives before making a decision.

Explore 3 other fair value estimates on Tenet Healthcare - why the stock might be worth just $197.29!

Build Your Own Tenet Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tenet Healthcare research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Tenet Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tenet Healthcare's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com