- In the past week, Essent Group reported second quarter 2025 results that saw earnings per share and revenue exceed analyst expectations, declared a quarterly cash dividend of US$0.31 per share, and completed a share repurchase program totaling almost 4.18 million shares for US$240.21 million.

- Additionally, Moody's upgraded Essent Group's insurance financial strength and debt ratings, signaling a strengthened credit profile and confidence in the company’s business fundamentals.

- We'll now consider how these stronger-than-expected earnings and Moody's rating upgrade may influence Essent Group's investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Essent Group Investment Narrative Recap

To own shares in Essent Group, you need confidence in its ability to balance steady premium income and disciplined capital return against risks from slow mortgage origination and sensitivity to interest rates. The company’s upbeat earnings and recent credit rating upgrade do help address short-term concerns about financial strength, but they do not immediately solve the core risk of subdued mortgage activity. For investors, the biggest near-term catalyst remains Essent’s elevated persistency rates, while the persistence of high interest rates is a key risk that could limit further gains.

Among recent announcements, Essent’s completion of its US$240.21 million share buyback program stands out. This reduces the number of shares outstanding, enhancing future earnings per share and shareholder returns, and it comes at a time when balancing capital efficiency with consistent premium income remains central to the company’s investment story. In contrast, investors should also be aware that persistently high interest rates continue to weigh on mortgage demand and could eventually pressure revenue...

Read the full narrative on Essent Group (it's free!)

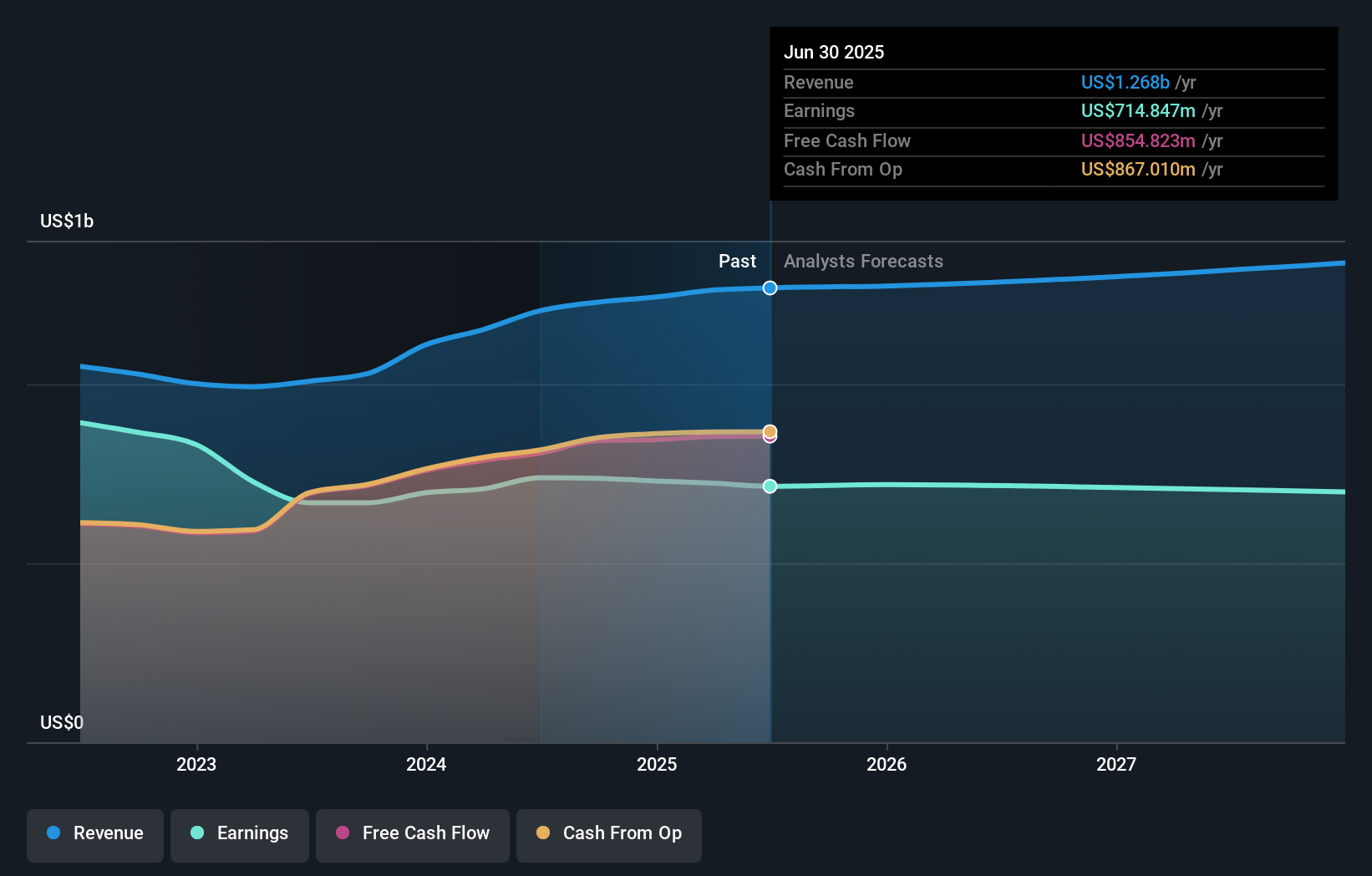

Essent Group's narrative projects $1.4 billion in revenue and $711.3 million in earnings by 2028. This requires 3.2% yearly revenue growth and a $11.8 million decrease in earnings from the current $723.1 million.

Uncover how Essent Group's forecasts yield a $65.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Only a single fair value estimate from the Simply Wall St Community was submitted, suggesting Essent Group is worth US$130.50. While some see significant upside, the risk from continued weak mortgage origination could influence future performance. Explore more community viewpoints to see how opinions on Essent Group can differ.

Explore another fair value estimate on Essent Group - why the stock might be worth over 2x more than the current price!

Build Your Own Essent Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Essent Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Essent Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Essent Group's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com