- Apple Cinemas and IMAX Corporation recently announced an agreement to install five IMAX with Laser systems across the United States, doubling IMAX's presence within Apple Cinemas venues and marking the company's return to Philadelphia for the first time since 2020.

- This partnership not only boosts IMAX's footprint in key urban centers but also showcases the industry demand for advanced cinema technology and immersive viewing experiences.

- We'll explore how doubling IMAX’s installations with Apple Cinemas could support recurring revenue and margin expansion for the business.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

IMAX Investment Narrative Recap

IMAX investors are ultimately betting that premium out-of-home entertainment remains a destination of choice, and that demand for immersive cinema technology will drive recurring installs and margin expansion. The Apple Cinemas partnership meaningfully grows IMAX’s footprint in urban markets and supports the company’s network-driven revenue model, but it does not fundamentally ease the risk of volatility tied to the Hollywood content pipeline, a factor that remains the most critical short-term catalyst and headwind for the stock.

Among recent announcements, IMAX expanded its partnership with TOHO Cinemas in Japan, targeting six new system installations. Like the Apple Cinemas deal, this highlights momentum in premium large format adoption, but recurring demand for tentpole releases will likely remain the single largest driver, and risk, to near-term performance. But even strong new partnerships do little to offset...

Read the full narrative on IMAX (it's free!)

IMAX is projected to reach $465.5 million in revenue and $73.0 million in earnings by 2028. This is based on an anticipated annual revenue growth rate of 8.7% and an increase in earnings of $40.2 million from the current $32.8 million.

Uncover how IMAX's forecasts yield a $32.82 fair value, a 28% upside to its current price.

Exploring Other Perspectives

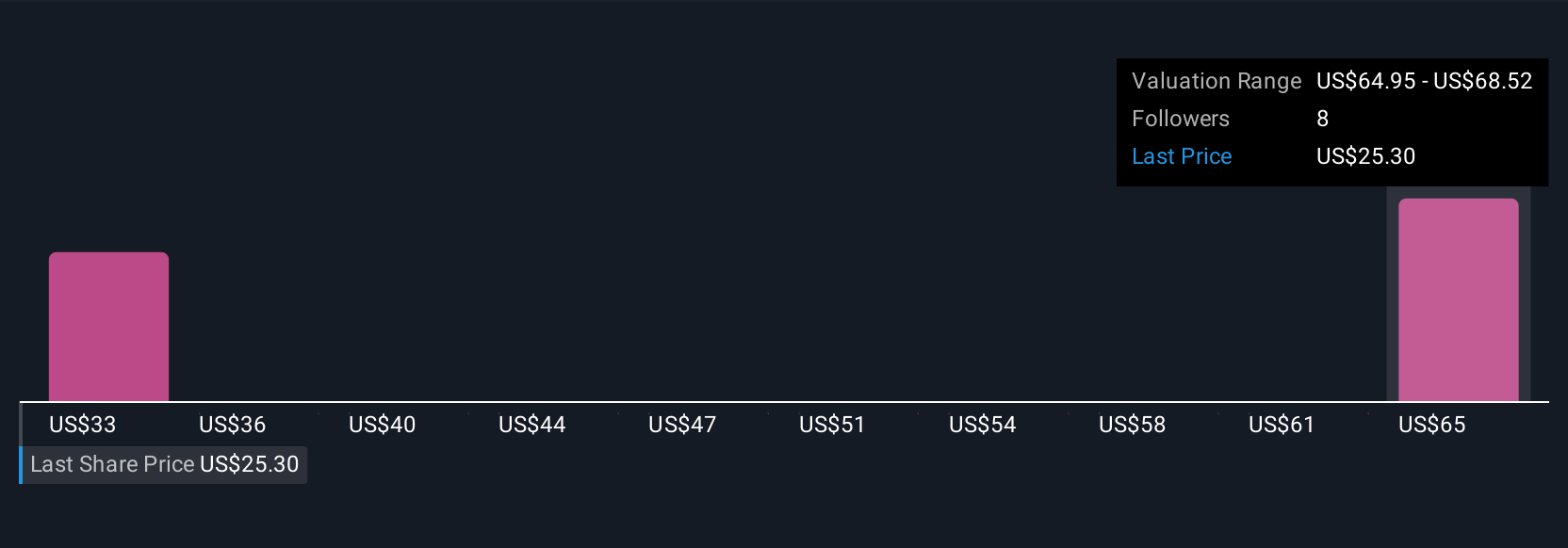

Simply Wall St Community fair value estimates for IMAX range widely from US$32.82 to US$68.39, drawn from two separate analyses. With install growth a key catalyst driving bullish forecasts, you can explore why market participants disagree so sharply about future performance.

Explore 2 other fair value estimates on IMAX - why the stock might be worth over 2x more than the current price!

Build Your Own IMAX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IMAX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMAX's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com