- On August 8, 2025, Sobha Realty announced that Otis Worldwide Corporation will provide and install 76 advanced elevators, including Otis Skyrise and Gen2® models, at Dubai’s Riverside Crescent project, which features six residential towers reaching 71 stories.

- This contract highlights Otis’s role in delivering cutting-edge vertical transportation for complex global developments and underscores the company’s capabilities in premium, high-rise urban projects.

- We will examine how this major Dubai project win reinforces Otis’s modernization-driven growth narrative and global premium market positioning.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Otis Worldwide Investment Narrative Recap

To own shares of Otis Worldwide, you need to believe in its ability to drive modernization-led growth, maintain a global premium brand, and leverage recurring service revenues despite headwinds in new equipment sales, especially in China. The recent credit agreement expands Otis’s financial flexibility for operations and working capital, but does not materially shift the immediate catalysts or alter the largest short-term risk, which remains weak order trends and competitive pricing in China. Among recent company actions, Otis’s August 8, 2025, establishment of a new US$1,500 million revolving credit facility stands out. This move secures ample liquidity through 2030, reinforcing Otis’s capacity to execute on premium projects like Dubai’s Riverside Crescent and underpin ongoing modernization initiatives, a key catalyst for future earnings resilience. However, investors should keep in mind that, in contrast, continued weakness in China and margin compression in new equipment sales could …

Read the full narrative on Otis Worldwide (it's free!)

Otis Worldwide's outlook projects $16.4 billion in revenue and $1.9 billion in earnings by 2028. This reflects a 5.0% annual revenue growth rate and a $0.4 billion increase in earnings from $1.5 billion today.

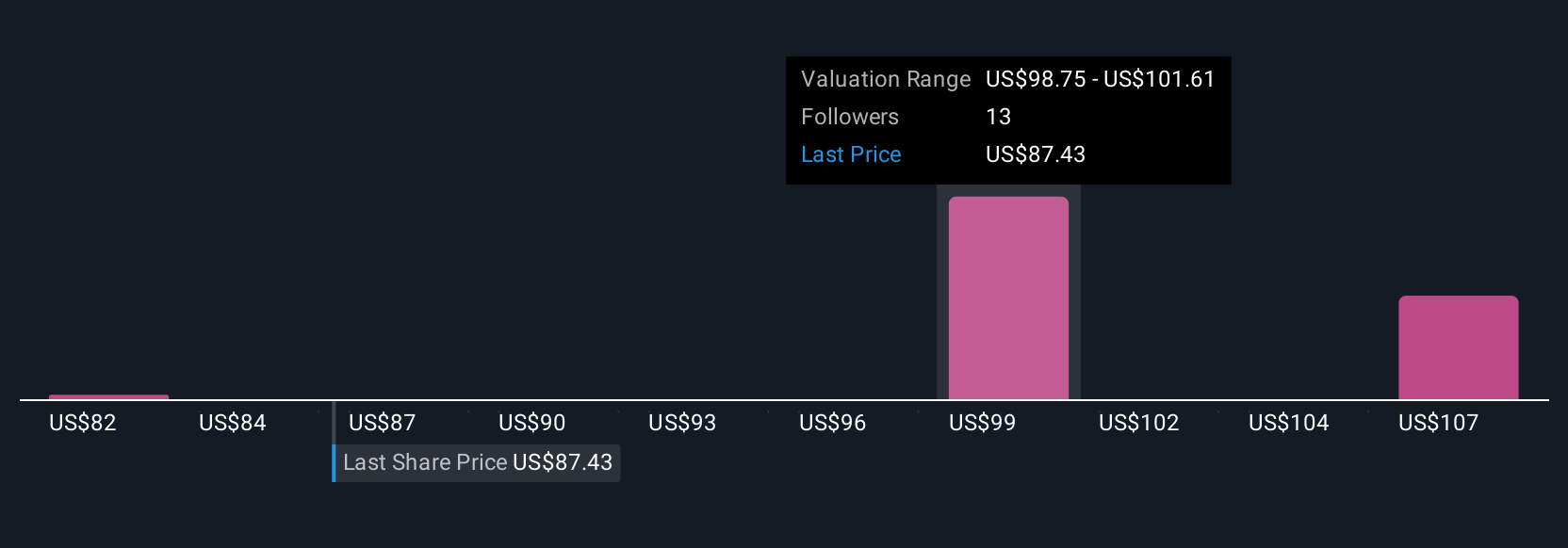

Uncover how Otis Worldwide's forecasts yield a $101.31 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$81.56 to US$110.30 per share. While many see upside from Otis’s modernization momentum, recurring concerns about China’s market pressures remain on the radar for the company’s future performance.

Explore 4 other fair value estimates on Otis Worldwide - why the stock might be worth 7% less than the current price!

Build Your Own Otis Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Otis Worldwide research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Otis Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Otis Worldwide's overall financial health at a glance.

No Opportunity In Otis Worldwide?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com