- Marriott Vacations Worldwide Corporation recently reported its second quarter 2025 earnings, with sales rising to US$160 million and revenue to US$1.25 billion, while net income climbed to US$69 million, all compared to the prior year.

- Despite reaffirming its full-year guidance, the company's significant year-over-year increases in net income and earnings per share point to enhanced profitability and operational execution.

- We'll explore how this strong earnings performance, especially the marked growth in profitability, influences Marriott Vacations Worldwide's broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Marriott Vacations Worldwide Investment Narrative Recap

To be a Marriott Vacations Worldwide shareholder, you need belief in the long-term staying power of vacation ownership and the company’s ability to expand its reach and maintain profitability as consumer preferences evolve. The latest earnings report showed strong year-over-year growth in profits and sales, but the reaffirmed full-year guidance suggests the results do not materially change the near-term catalyst, the ongoing lift from first-time buyer momentum. The main risk remains a potential slowdown in owner sales and declining value per guest, neither of which appear to be immediately impacted by this quarter’s news.

Among recent company announcements, the reiteration of full-year 2025 sales guidance stands out as most relevant. Despite the surge in quarterly net income and positive earnings trends, steady guidance signals that management expects trends to persist but is not willing to raise expectations, underscoring a measured approach as the company targets long-term growth while monitoring changing consumer behaviors.

In contrast to the current upbeat performance, investors should be aware that sustained weakness in owner upgrades could...

Read the full narrative on Marriott Vacations Worldwide (it's free!)

Marriott Vacations Worldwide's narrative projects $6.3 billion in revenue and $346.8 million in earnings by 2028. This requires a 23.2% yearly revenue growth and a $87.8 million earnings increase from $259.0 million today.

Uncover how Marriott Vacations Worldwide's forecasts yield a $91.10 fair value, a 24% upside to its current price.

Exploring Other Perspectives

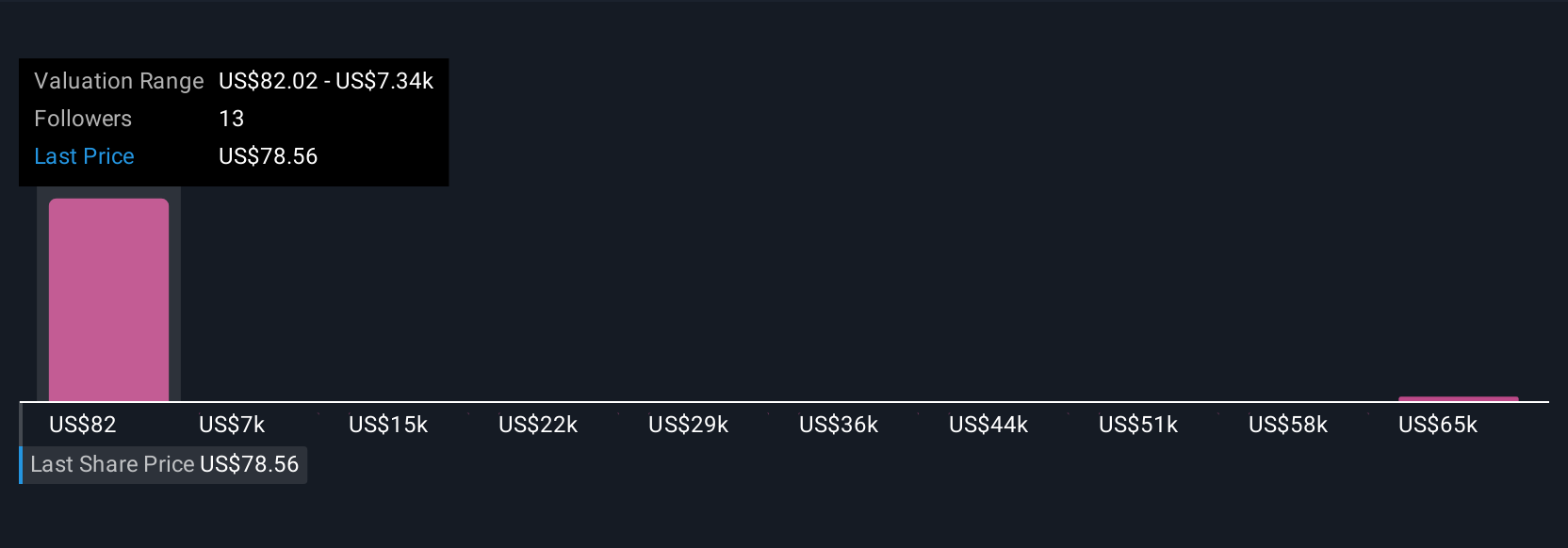

Simply Wall St Community members submitted six fair value estimates, spanning from US$82.02 to an outlier of US$72,680.55. While opinions on future value vary widely, first-time buyer growth continues to act as a pillar for potential revenue gains, highlighting how individual outlooks can diverge when considering Marriott Vacations Worldwide's long-term prospects.

Explore 6 other fair value estimates on Marriott Vacations Worldwide - why the stock might be a potential multi-bagger!

Build Your Own Marriott Vacations Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marriott Vacations Worldwide research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marriott Vacations Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marriott Vacations Worldwide's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com