- CVR Energy, Inc. recently reported a net loss of US$114 million for the second quarter of 2025, alongside declines in sales and throughput compared to the previous year and confirmed the upcoming retirement of its long-serving CEO and President, with succession plans already set in motion.

- Amid these developments, the company's filing of a US$70.68 million shelf registration for an ESOP-related common stock offering and expansion of its board with notable appointments highlight significant structural and leadership changes.

- We'll examine how the executive transition plans and challenging quarterly results may influence CVR Energy's long-term investment outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CVR Energy Investment Narrative Recap

To own shares of CVR Energy, an investor needs confidence in the company's ability to manage through volatile energy market conditions, unlock value via operational upgrades, and benefit from stable U.S. refined product demand. The recent quarterly loss and CEO retirement announcement may put the spotlight on execution risk, but the short-term outlook is still shaped most by refining margins and persistent cost pressures, the impact of these news developments is not material to those immediate drivers.

Among the recent announcements, the filing of a US$70.68 million shelf registration for an ESOP-related common stock offering stands out. This move could affect the company’s capital structure and adds another layer of change for investors to monitor as CVR Energy works through financial challenges and operational upgrades that underpin its profit recovery catalysts.

However, with refining margins still facing pressure and the operational risks associated with older assets, investors should be aware that...

Read the full narrative on CVR Energy (it's free!)

CVR Energy's outlook anticipates $7.7 billion in revenue and $152.7 million in earnings by 2028. This scenario implies a 2.5% annual revenue growth and a $485.7 million earnings increase from the current $-333.0 million.

Uncover how CVR Energy's forecasts yield a $24.00 fair value, a 8% downside to its current price.

Exploring Other Perspectives

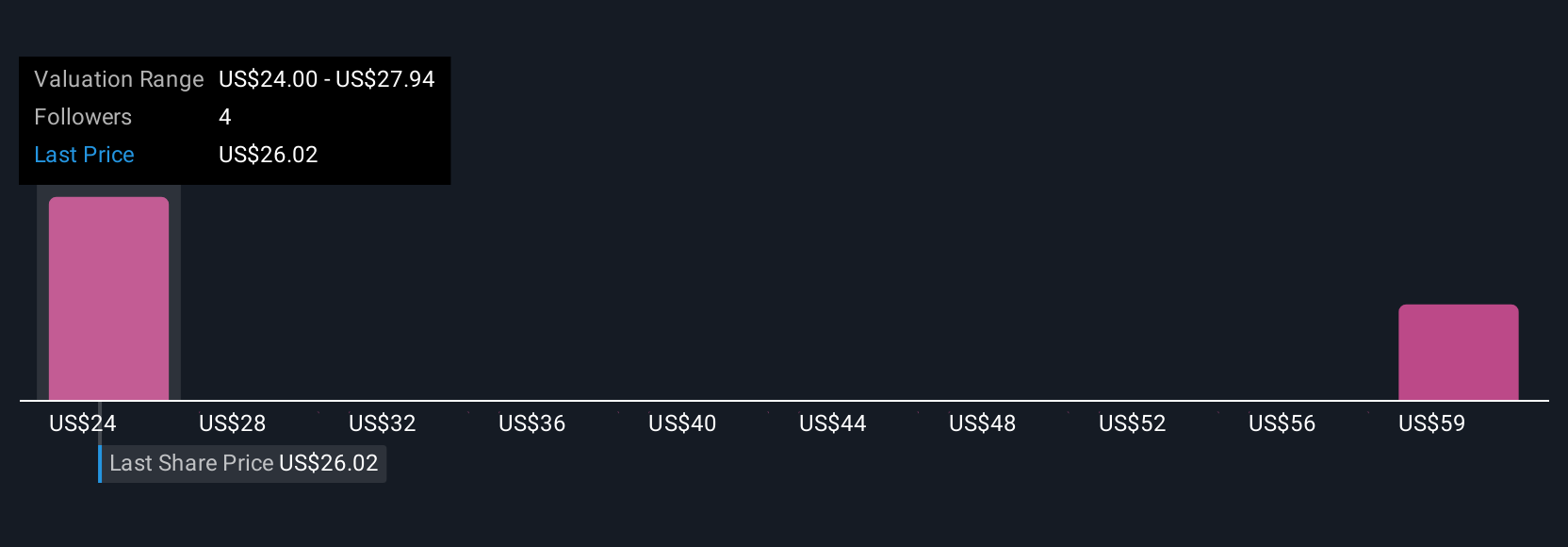

Simply Wall St Community fair value estimates for CVR Energy stock range widely from US$24 to US$59.40, reflecting two very different takes on potential upside. Meanwhile, analysts continue to flag heavy reliance on older refineries as a source of cost and margin risk, reinforcing the need to consider multiple viewpoints on future returns.

Explore 2 other fair value estimates on CVR Energy - why the stock might be worth over 2x more than the current price!

Build Your Own CVR Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CVR Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Energy's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com