- Amazon announced that NetApp's FSx for ONTAP® is now a supported external storage option for Amazon Elastic VMware Service (EVS) on AWS, enabling organizations to migrate VMware workloads directly to the cloud with advanced data management, disaster recovery, and ransomware protection features.

- This integration makes NetApp the only enterprise storage solution provider with a first-party data storage service natively built on AWS, offering customers a unique edge for secure and efficient cloud migrations.

- We'll now explore how NetApp's expanded support for Amazon EVS could further reinforce its position in enterprise cloud data services.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

NetApp Investment Narrative Recap

To be a NetApp shareholder, you need to believe in the company’s ability to drive revenue and earnings growth through cloud partnerships, innovative storage technology, and improved sales execution. The recent integration with AWS for VMware supports NetApp’s strength in enterprise cloud data solutions, but it does not materially shift the most important short-term catalyst, flash storage and public cloud revenue acceleration, nor offset the primary risk surrounding sales execution and demand softness, especially in Europe and the US public sector.

Among recent announcements, the July 31 expansion of NetApp’s BlueXP with VMware disaster recovery support directly reinforces the latest news, enhancing NetApp’s value proposition within the AWS ecosystem and strengthening capabilities in data protection for migrating enterprise workloads, a critical driver as more organizations transition to hybrid clouds.

Yet, in contrast to these advancements, investors should be aware of unresolved concerns around inconsistent execution and how this could still limit...

Read the full narrative on NetApp (it's free!)

NetApp's outlook points to $7.5 billion in revenue and $1.4 billion in earnings by 2028. This implies a 4.3% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.2 billion.

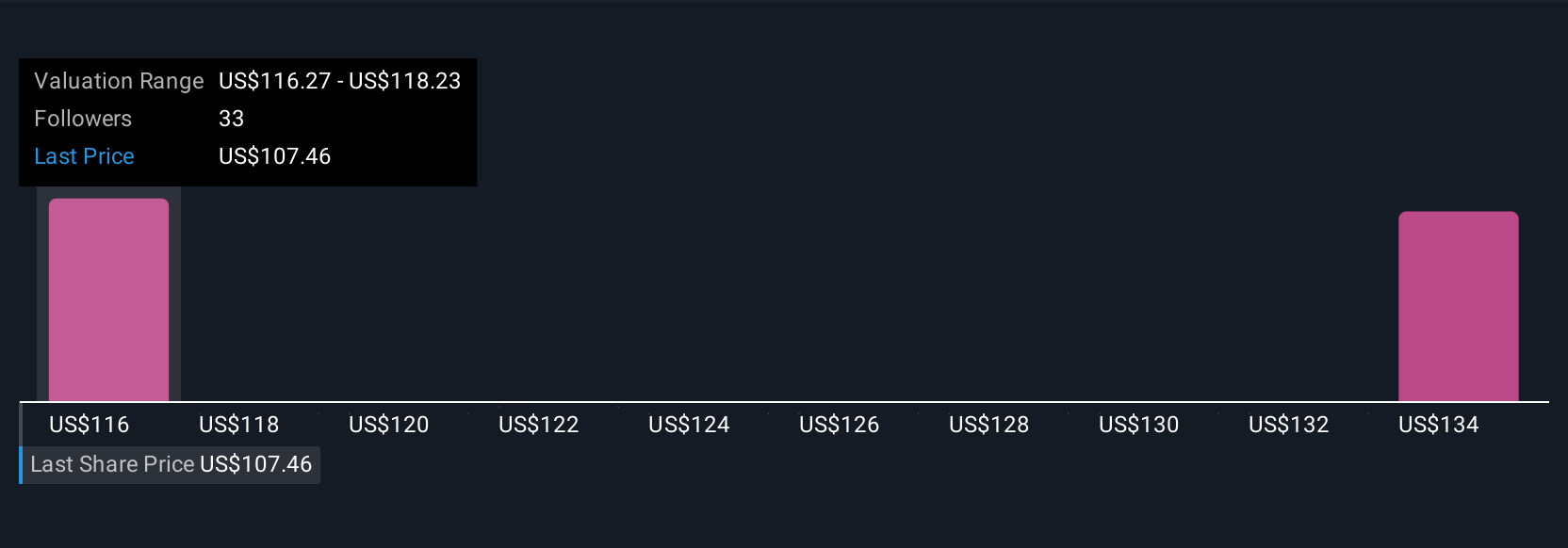

Uncover how NetApp's forecasts yield a $115.07 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span from US$115.07 to US$171.70, highlighting a wide range of retail investor perspectives. With opinions splitting sharply, broader execution risks remain top of mind for many market participants considering NetApp’s next phase, see how others view these uncertainties and opportunities.

Explore 4 other fair value estimates on NetApp - why the stock might be worth as much as 59% more than the current price!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com