- Moody’s Corporation reported strong Q2 2025 results, with adjusted earnings per share surpassing estimates, resilient Ratings segment performance, and elevated growth in Moody’s Analytics, as detailed during its recent conference presentation.

- The company's raised full-year revenue growth guidance and projected 10% EPS growth midpoint highlight robust demand in private credit ratings and expanding Analytics capabilities.

- We’ll explore how Moody’s raised guidance, driven by strong Analytics growth and private credit demand, influences the company’s investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Moody's Investment Narrative Recap

To own Moody’s shares, you need confidence in the company’s pivotal role in global credit markets and its ability to benefit from automation and the structural rise of private credit, while managing regulatory challenges. The latest Q2 results and increased full-year guidance reinforce the near-term catalyst of strengthening demand in private credit and data-driven Analytics, but do not materially change the pressing risk of regulatory scrutiny in the fast-growing private credit sector, which continues to shadow the outlook. Among recent developments, Moody’s partnership with MSCI on private credit risk solutions stands out as directly relevant, it supports Moody’s momentum in expanding Analytics capabilities, and relates closely to the private credit market growth highlighted in both earnings results and guidance, underscoring the significance of continued innovation for future catalysts. Yet, while demand for private credit ratings is a clear growth driver, investors should remain mindful of emerging regulatory threats and unresolved policy uncertainty that could ...

Read the full narrative on Moody's (it's free!)

Moody's narrative projects $9.0 billion revenue and $3.0 billion earnings by 2028. This requires 7.2% yearly revenue growth and a $0.9 billion earnings increase from $2.1 billion today.

Uncover how Moody's forecasts yield a $538.43 fair value, a 4% upside to its current price.

Exploring Other Perspectives

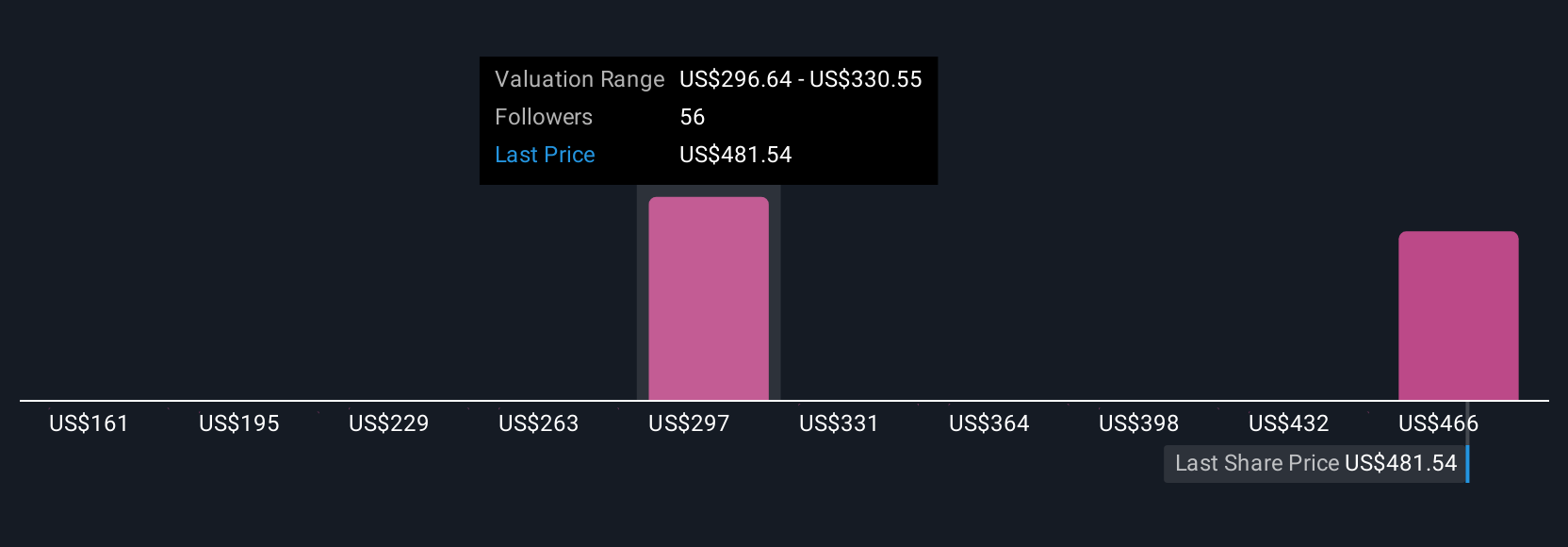

Twelve Simply Wall St Community fair value estimates for Moody’s range from US$251 to US$538 per share. With regulatory scrutiny looming over private credit expansion, diverse investor views reflect uncertainty and reward potential. Explore how your own outlook stacks up against these perspectives.

Explore 12 other fair value estimates on Moody's - why the stock might be worth as much as $538.43!

Build Your Own Moody's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Moody's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moody's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com