- Avnet, Inc. recently reported its fourth quarter and full year 2025 results, posting US$5.62 billion in quarterly sales and net income of US$6.09 million, alongside its earnings guidance for the first quarter of fiscal 2026.

- Despite year-over-year declines, robust sales growth in Asia and leadership changes, including a new Chief Digital Officer and EMEA President, have become focal points for analysts and industry watchers.

- We'll explore how Avnet's continued outperformance in Asia and disciplined inventory management could influence the company's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Avnet Investment Narrative Recap

To be a shareholder in Avnet, you need confidence in its ability to balance strong Asian sales with improving operational discipline, even as earnings and margins face pressure from weak markets elsewhere. The recent fourth-quarter results, which met or exceeded guidance, leave the short-term catalyst focused on inventory management and regional demand. The most significant risk remains ongoing weakness in EMEA and broader economic headwinds, but the new results have not materially changed that backdrop.

Among recent updates, Avnet’s Q1 2026 earnings guidance stands out as most relevant. The company expects sales between US$5.55 billion and US$5.85 billion and GAAP diluted earnings per share of US$0.65, suggesting continued focus on operational execution and disciplined inventory management as primary levers for near-term performance.

In contrast, investors should be aware of the risk that persistent EMEA weakness could outweigh gains from Asian markets if regional trends do not improve...

Read the full narrative on Avnet (it's free!)

Avnet's narrative projects $24.8 billion revenue and $542.9 million earnings by 2028. This requires 3.8% yearly revenue growth and a $226.1 million earnings increase from $316.8 million.

Uncover how Avnet's forecasts yield a $51.25 fair value, a 4% downside to its current price.

Exploring Other Perspectives

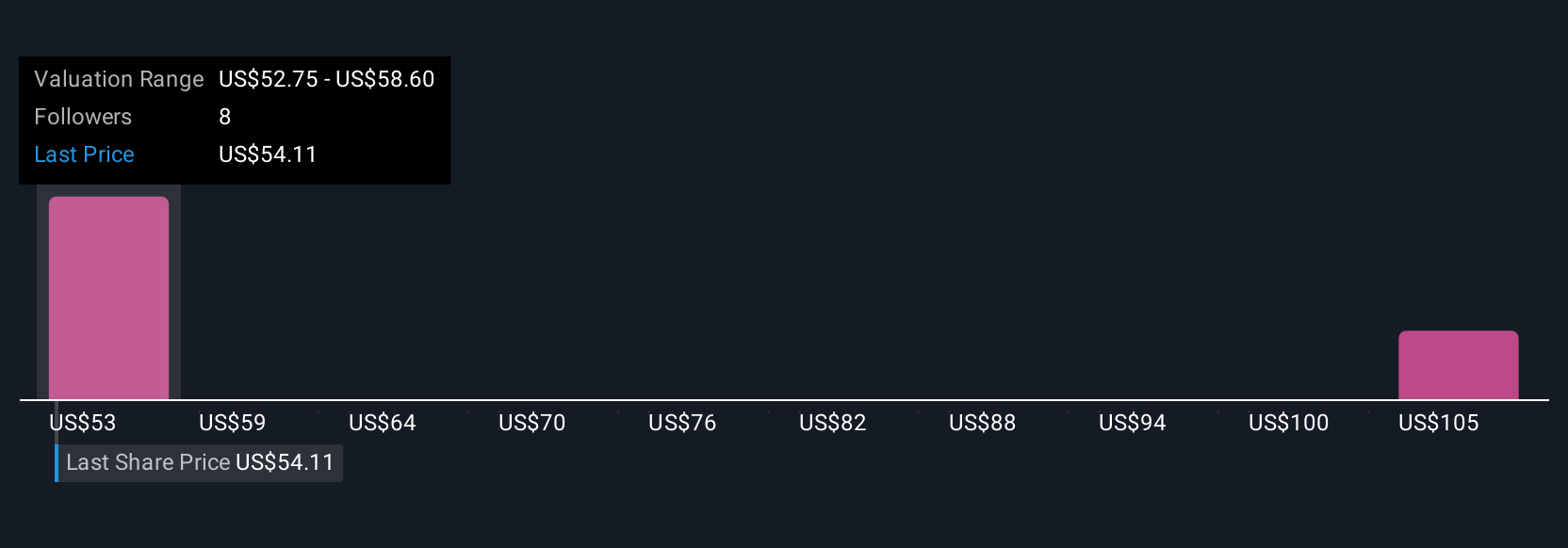

Community members on Simply Wall St estimate Avnet’s fair value between US$51.25 and US$109.81, across three distinct views. While many see upside, ongoing EMEA demand challenges may shape the range of outcomes for Avnet’s future performance.

Explore 3 other fair value estimates on Avnet - why the stock might be worth over 2x more than the current price!

Build Your Own Avnet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avnet research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Avnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avnet's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com