- Recent options market activity in Amkor Technology saw very high implied volatility for the October 17, 2025 $34.59 Put contract, signaling investor anticipation of a significant stock movement.

- This surge in options trading implies that market participants expect major volatility ahead, even though no new company-specific announcements have surfaced.

- With heightened options activity pointing to possible swings in Amkor's stock, we'll explore the potential impact on its investment outlook now.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Amkor Technology Investment Narrative Recap

Belief in Amkor Technology as an investment often centers on its potential to benefit from surging demand for advanced semiconductor packaging, particularly as AI proliferation drives the need for more complex chip solutions. The recent surge in options-implied volatility raises short-term uncertainty, but unless it is accompanied by a company-specific event or change in demand indicators, it does not shift the core catalyst of AI-led growth or the primary risks around capacity underutilization and margin pressures for investors today.

Among recent developments, Amkor’s amended credit agreement creating a new US$500 million term loan is significant, reflecting ongoing investment in capacity and operational flexibility. While this bolsters resources for expansion, it also points to persistent financial risk if demand falls short, an issue that remains central to assessing near-term catalysts and longer-term risks for shareholders considering possible shifts in profitability and capital allocation.

Yet, even with apparent momentum, investors should remain mindful of how underutilized manufacturing assets and associated margin pressures could...

Read the full narrative on Amkor Technology (it's free!)

Amkor Technology's narrative projects $7.7 billion in revenue and $540.2 million in earnings by 2028. This requires 6.9% yearly revenue growth and a $236.4 million earnings increase from $303.8 million today.

Uncover how Amkor Technology's forecasts yield a $24.38 fair value, in line with its current price.

Exploring Other Perspectives

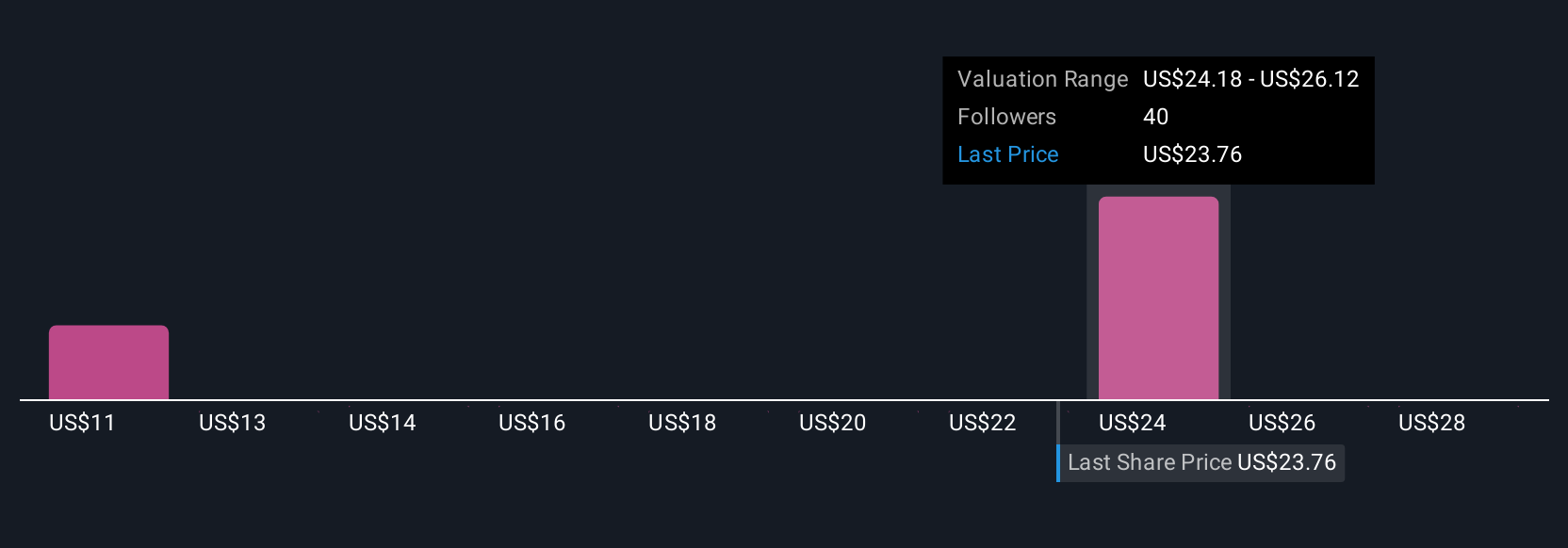

Five fair value estimates from the Simply Wall St Community fall between US$10.46 and US$27.43 per share, reflecting diverse investor outlooks. With increasing capital expenditure tied to expansion, the potential for overcapacity and the risk of margin compression are issues that could affect future investor confidence and financial outcomes, check out how others interpret the data for different insights.

Explore 5 other fair value estimates on Amkor Technology - why the stock might be worth as much as 13% more than the current price!

Build Your Own Amkor Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amkor Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amkor Technology's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com