- Boise Cascade recently reported its second quarter 2025 results, recording sales of US$1,740.11 million and net income of US$61.99 million, both down from the prior year, alongside announcing the completion of a major share buyback and a 5% dividend increase.

- While the company continued capital returns to shareholders and faced a localized strike in Montana, the earnings report revealed continued pressure on revenue and profitability amid softer market conditions.

- We’ll examine how Boise Cascade’s year-over-year earnings decline and labor action at a key facility might impact its investment narrative.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Boise Cascade Investment Narrative Recap

Boise Cascade’s investment case centers on believing in the company’s ability to deliver steady capital returns, support for engineered wood demand, and successful expansion of its production and distribution network. The second quarter earnings decline and recent labor strike at Billings did not appear to materially affect the most immediate catalyst, ongoing shareholder returns, but they do spotlight the unpredictability of short-term operating results as the biggest near-term risk.

The continued execution and recent completion of a US$336.25 million share buyback stands out. This capital return is especially relevant given the earnings pressure and modest dividend increase, underscoring management’s commitment to deploying cash to offset current headwinds for shareholders.

Yet, while results reflect capital discipline, the current environment brings a different kind of risk investors need to keep in mind, particularly…

Read the full narrative on Boise Cascade (it's free!)

Boise Cascade's outlook forecasts $7.1 billion in revenue and $304.2 million in earnings by 2028. This is based on a 2.7% annual revenue growth rate and a $41.9 million increase in earnings from the current $262.3 million.

Uncover how Boise Cascade's forecasts yield a $106.33 fair value, a 26% upside to its current price.

Exploring Other Perspectives

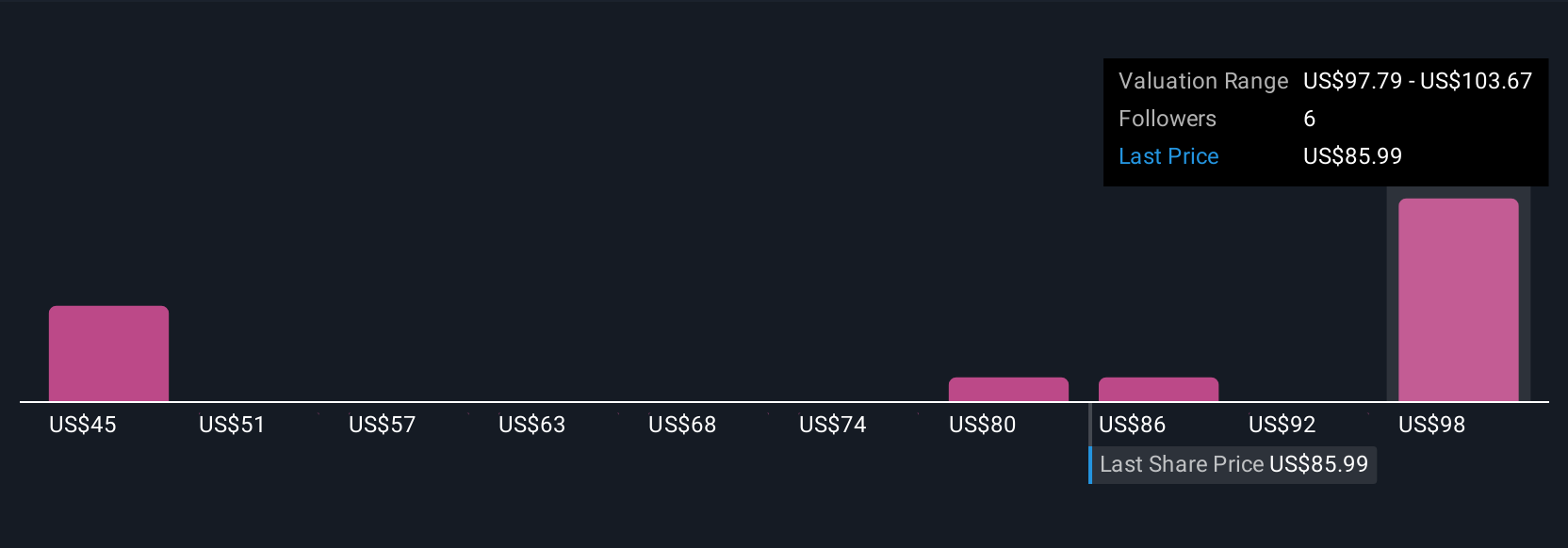

Simply Wall St Community members offered four fair value estimates for Boise Cascade, ranging from US$81 to US$106.33 a share. Opinions are mixed against a backdrop of shrinking profit margins and labor-related uncertainties, reminding you that viewpoints on future prospects can vary widely.

Explore 4 other fair value estimates on Boise Cascade - why the stock might be worth as much as 26% more than the current price!

Build Your Own Boise Cascade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boise Cascade research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Boise Cascade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boise Cascade's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com