- International Seaways reported its second-quarter 2025 results, revealing that revenue fell to US$195.64 million and net income dropped to US$61.65 million compared to the previous year; the company also announced both a US$0.65 supplemental dividend and a US$0.12 regular quarterly dividend, both to be paid in September 2025.

- Despite the weaker earnings, the Board's decision to declare a supplemental dividend stands out as a signal of confidence in the company's ongoing capital return strategy.

- Given the supplemental dividend announcement during a period of year-over-year earnings decline, we'll now explore how these developments impact International Seaways' investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

International Seaways Investment Narrative Recap

To own International Seaways, an investor has to believe in the long-term strength of demand for tanker shipping, the benefits of a modernized fleet, and the company’s commitment to returning capital to shareholders. The recent drop in second-quarter revenue and net income does put pressure on the short-term outlook, but this news does not appear to substantially change the most important near-term catalyst: ongoing fleet renewal and tanker demand. The largest risk remains exposure to oil market volatility and geopolitical disruptions, which have not been directly addressed by the latest results.

The supplemental dividend of US$0.65 per share, declared alongside the regular US$0.12 dividend, is the most relevant announcement for investors to consider. This payout underscores management’s ongoing capital return focus despite the earnings drop, and is especially pertinent given that dividend sustainability and payout policy have been frequent focal points amid current earnings volatility. The combination of robust dividends and earnings pressure means investors should pay close attention to...

Read the full narrative on International Seaways (it's free!)

International Seaways' narrative projects $748.6 million in revenue and $143.4 million in earnings by 2028. This requires a -4.5% annual revenue decline and a decrease of $178.3 million in earnings from the current $321.7 million.

Uncover how International Seaways' forecasts yield a $53.80 fair value, a 27% upside to its current price.

Exploring Other Perspectives

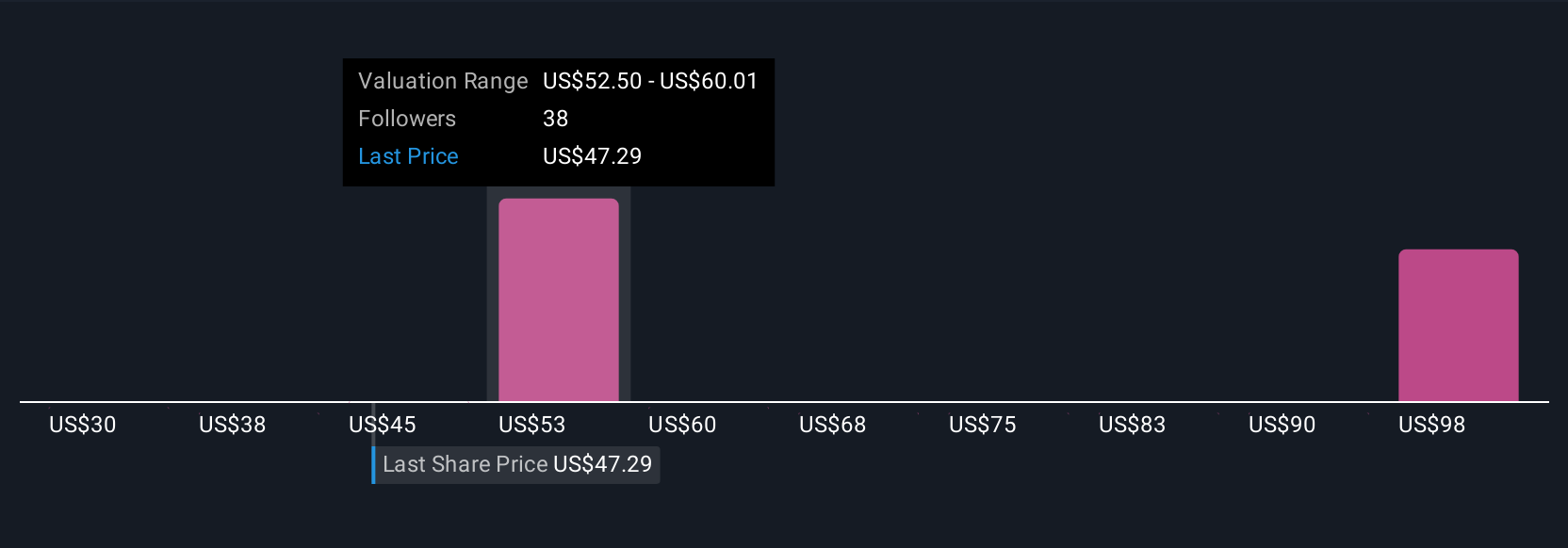

Six distinct fair value estimates from the Simply Wall St Community range between US$30 and US$106.63 per share. While many see opportunity, continuing volatility in tanker rates may weigh on the company and shape future expectations.

Explore 6 other fair value estimates on International Seaways - why the stock might be worth over 2x more than the current price!

Build Your Own International Seaways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Seaways research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free International Seaways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Seaways' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com