- Euronet Worldwide recently reported second quarter 2025 earnings, posting sales of US$1,074.3 million and net income of US$97.6 million, marking increases from the prior year, and completed its major buyback program with a repurchase of 2,300,000 shares for US$247 million during the last quarter.

- The completion of share repurchases totaling 24.21% of outstanding shares since early 2022 signals a substantial reduction in share count, amplifying the impact of the company’s improved quarterly profits.

- Given the substantial share reduction from the buyback, let's assess how this could influence Euronet Worldwide's future earnings per share growth narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Euronet Worldwide Investment Narrative Recap

To be a shareholder in Euronet Worldwide, you need to believe in its ability to drive growth from digital payments and global money transfer expansion, even as the world transitions away from cash. The recent buyback completion materially amplifies earnings per share in the short term, supporting the main catalyst of digitization-led profit growth, but does little to offset the major risk from shrinking legacy ATM revenues as cash use continues to decline.

Among recent announcements, the partnership with Visa to enable real-time transfers through Visa Direct stands out as highly relevant, given rising demand for seamless digital payments and cross-border transfers. This aligns closely with Euronet’s shift toward high-margin digital offerings, which could support earnings growth as the company mitigates pressure on its traditional cash-based segments.

By contrast, investors should be aware that accelerating moves toward cashless societies could rapidly erode Euronet’s legacy ATM business and...

Read the full narrative on Euronet Worldwide (it's free!)

Euronet Worldwide's outlook projects $5.2 billion in revenue and $477.0 million in earnings by 2028. This implies an annual revenue growth rate of 8.2% and a $144.3 million increase in earnings from the current $332.7 million level.

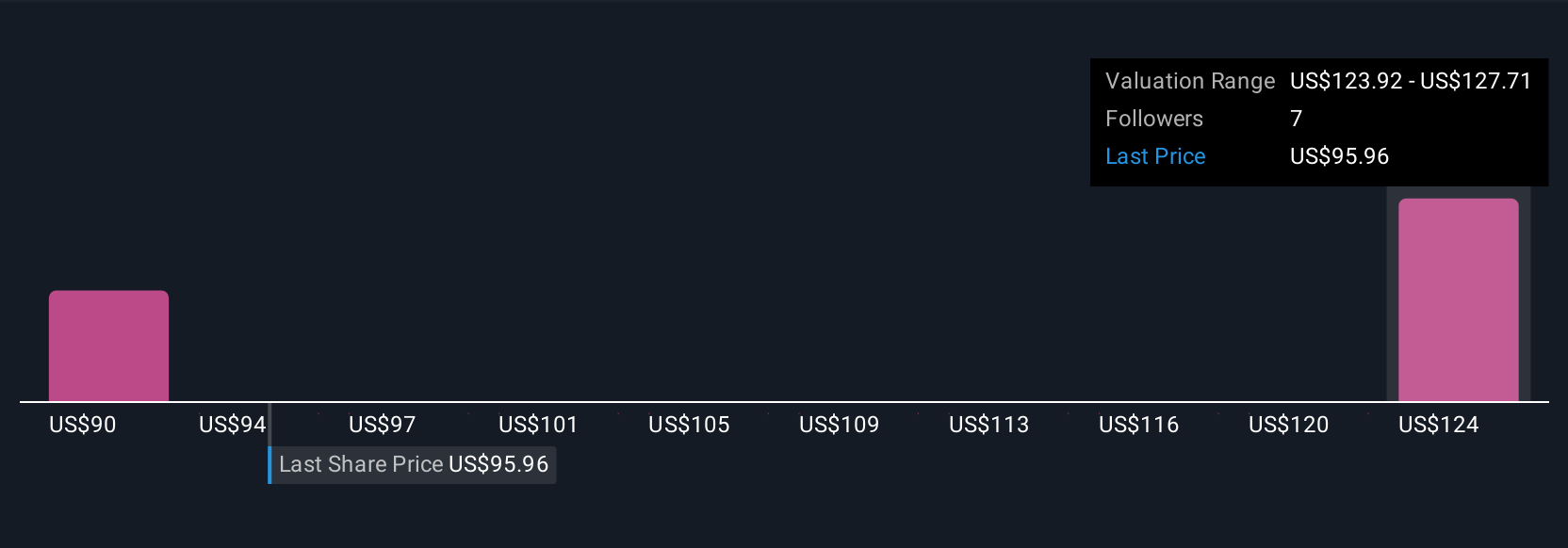

Uncover how Euronet Worldwide's forecasts yield a $127.71 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have placed Euronet’s fair value between US$89.08 and US$127.71 based on two estimates. While many are watching digital transaction adoption as a key growth driver, perspectives can differ sharply on how quickly legacy revenue streams might be affected, consider multiple views before forming your own outlook.

Explore 2 other fair value estimates on Euronet Worldwide - why the stock might be worth 6% less than the current price!

Build Your Own Euronet Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Euronet Worldwide research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Euronet Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Euronet Worldwide's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com