- In July 2025, CRA International, Inc. reported improved second-quarter and six-month earnings, raised its full-year revenue guidance, affirmed its quarterly dividend, and provided an update on its ongoing share repurchase program.

- CRA International's latest results reveal a marked acceleration in net income growth alongside the company's enhanced outlook for the remainder of the fiscal year.

- We'll now explore how CRA International's raised revenue guidance could reshape the company's investment narrative and future expectations.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CRA International Investment Narrative Recap

To be a shareholder in CRA International, I’d need to believe that the company can continue capturing demand from global M&A, regulatory, and advisory work, particularly as regulatory complexity grows. The most recent quarterly results and raised revenue guidance support the main short-term catalyst, sustained momentum in high-value advisory assignments, while the main risk remains a potential downturn in dealmaking or regulatory enforcement activity; so far, this risk does not appear materially affected by the new earnings report.

CRA International’s updated full-year revenue guidance, now projected between US$730 million and US$745 million, is a direct reflection of the continued strength in demand for its services. For investors focused on near-term growth, the guidance upgrade reinforces the company’s positioning to benefit from the current surge in global deal activity.

Yet, with increased capital commitments to buybacks and a significant net debt position, the question remains: what happens if earnings volatility unexpectedly resurfaces and...

Read the full narrative on CRA International (it's free!)

CRA International's narrative projects $822.0 million revenue and $60.0 million earnings by 2028. This requires 4.9% yearly revenue growth and a $3.6 million earnings increase from $56.4 million today.

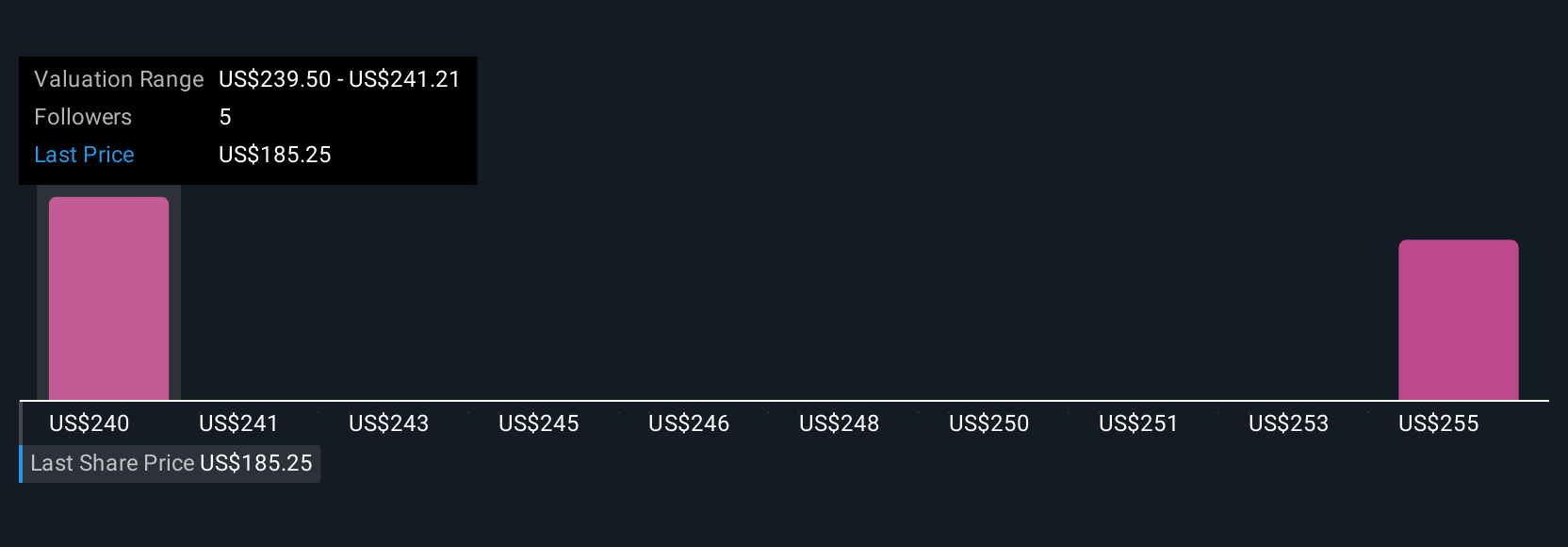

Uncover how CRA International's forecasts yield a $239.50 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place CRA International's fair value between US$239.50 and US$257.15, based on just two distinct forecasts. Despite these high estimates, flat consultant headcount points to talent scaling challenges that could influence long-term growth and investor confidence.

Explore 2 other fair value estimates on CRA International - why the stock might be worth as much as 35% more than the current price!

Build Your Own CRA International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CRA International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CRA International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CRA International's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com