- Recently, PDD Holdings' earnings outlook was downgraded by analysts, with projections indicating a significant decline in earnings per share even as revenue is expected to rise, and the company received a Zacks Rank of #5 (Strong Sell).

- At the same time, PDD Holdings renewed its collaboration with SFHK for logistics services, resuming some self-pickup options and expanding its own locker network across districts.

- We’ll explore how the downward revision in earnings estimates may affect PDD Holdings’ investment narrative and long-term outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

PDD Holdings Investment Narrative Recap

To own shares in PDD Holdings, you have to believe that the company's significant investments in its logistics and merchant ecosystem can ultimately drive sustainable growth and profitability, even if short-term earnings are pressured. The recent downward revision to earnings forecasts, alongside ongoing revenue growth, intensifies focus on the company's ability to convert sales momentum into meaningful profit, a critical catalyst. However, this does not fundamentally change the immediate risk: margin pressure from higher ecosystem investment and fee reductions remains front and center.

Among recent company moves, the renewed logistics partnership with SFHK stands out, given its direct connection to operational efficiency and customer experience, two important drivers for supporting transaction volumes and merchant satisfaction. As PDD expands its locker network and resume self-pickup options, the company's focus on logistics resilience backs its commitment to ecosystem improvements, but the real test will be whether these investments translate into better profitability amid rising costs.

However, with profitability under scrutiny, investors should not overlook the ongoing challenge of shrinking net margins if revenue growth does not keep pace with...

Read the full narrative on PDD Holdings (it's free!)

PDD Holdings' outlook anticipates CN¥585.3 billion in revenue and CN¥135.1 billion in earnings by 2028. This reflects a projected 13.3% annual revenue growth and an earnings increase of CN¥35.9 billion from the current CN¥99.2 billion.

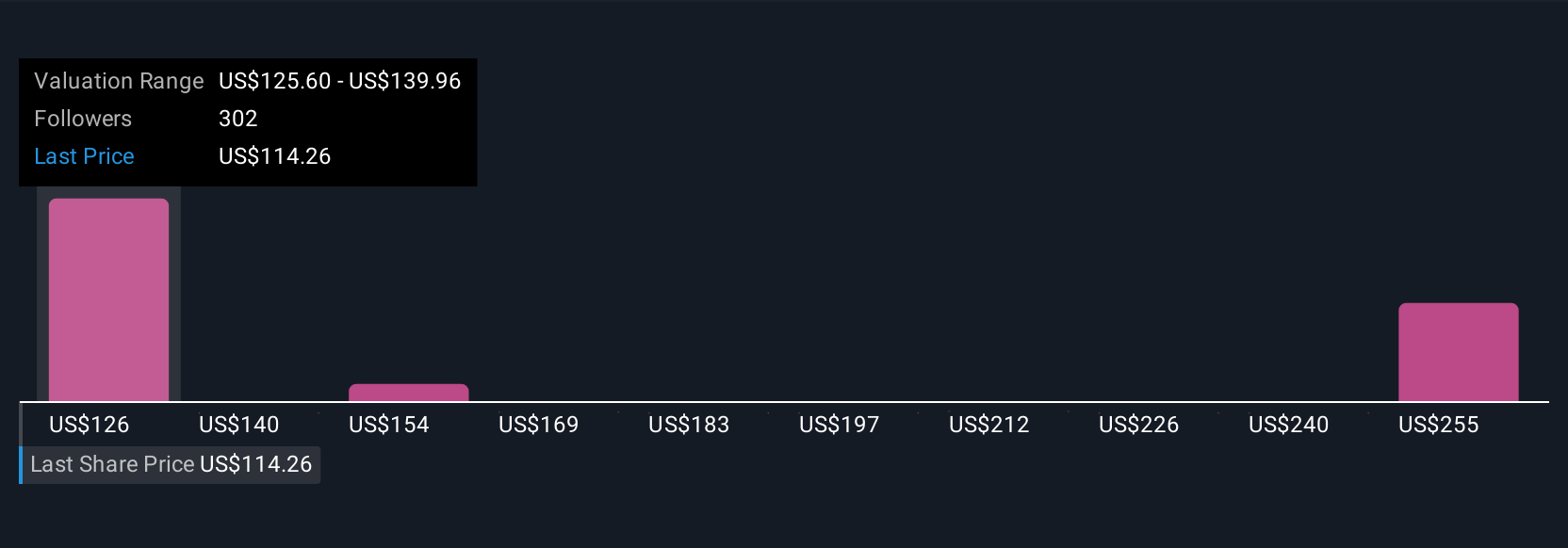

Uncover how PDD Holdings' forecasts yield a $125.60 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 19 Simply Wall St Community members range widely from US$125.60 to US$269.31, reflecting varied growth expectations. As earnings estimates are revised downward, you can explore how others are weighing margin risks and future potential here.

Explore 19 other fair value estimates on PDD Holdings - why the stock might be worth just $125.60!

Build Your Own PDD Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDD Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free PDD Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDD Holdings' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com