- Axcelis Technologies reported second quarter 2025 earnings with revenue of US$194.54 million and net income of US$31.38 million, both declining compared to the prior year, and announced completion of a US$232.94 million share repurchase program covering 8.93% of shares.

- Despite lower recent earnings, analyst optimism about future earnings prospects has increased, reflected in a strong buy rating based on upward revisions in earnings estimates.

- Next, we'll consider how analysts' increased confidence, marked by their estimate upgrades, could shape Axcelis Technologies’ long-term investment narrative.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

Axcelis Technologies Investment Narrative Recap

To be a shareholder in Axcelis Technologies, you need to believe in the company’s ability to grow alongside the global adoption of silicon carbide power devices in electric vehicles and industrial sectors. The recent earnings decline and completion of the large share repurchase program do not materially alter the most important short term catalyst, global SiC demand acceleration in advanced markets, nor do they reduce the biggest risk, which is Axcelis’s heavy exposure to China and related geopolitical pressures.

Among recent announcements, the management’s third quarter revenue and earnings guidance of about US$200 million and US$0.87 per share is the most relevant. This outlook underscores ongoing muted demand conditions, while reinforcing that the near-term trajectory still hinges predominantly on sector-wide demand catalysts such as advanced SiC adoption and broader customer investment cycles.

Yet, investors should be aware that in contrast to near-term optimism, Axcelis’s concentrated sales exposure to China also brings ...

Read the full narrative on Axcelis Technologies (it's free!)

Axcelis Technologies' outlook projects $836.1 million in revenue and $66.7 million in earnings by 2028. This reflects a -2.3% annual revenue decline and a decrease of $91.8 million in earnings from the current $158.5 million level.

Uncover how Axcelis Technologies' forecasts yield a $85.50 fair value, a 5% upside to its current price.

Exploring Other Perspectives

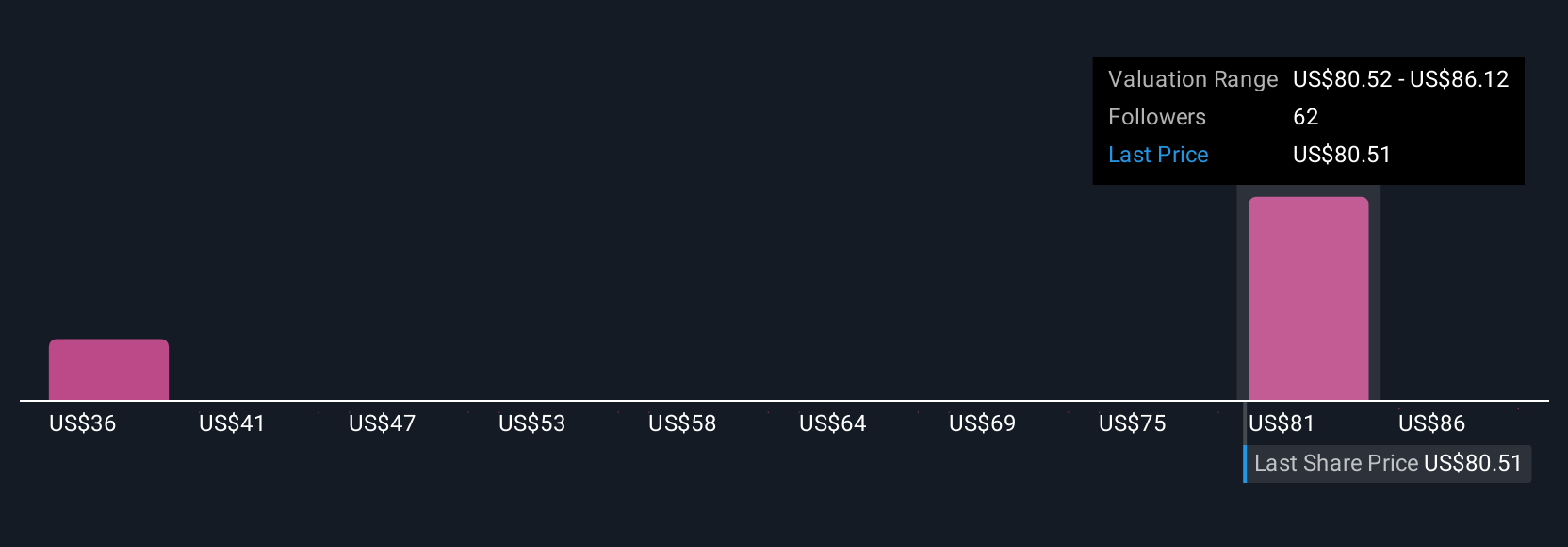

Fair value estimates from the Simply Wall St Community range from US$35.61 to US$91.71 based on three different analyses. While bulls focus on the SiC device growth opportunity, potential revenue stagnation could weigh heavily on future performance, so comparing these perspectives can be valuable.

Explore 3 other fair value estimates on Axcelis Technologies - why the stock might be worth as much as 13% more than the current price!

Build Your Own Axcelis Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axcelis Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Axcelis Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axcelis Technologies' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com