- Arcosa, Inc. recently reported its second quarter 2025 results, highlighting US$736.9 million in sales, up from US$664.7 million a year earlier, and a significant increase in net income driven by the full integration of the Stavola acquisition.

- Management tightened its 2025 revenue guidance and announced a focus on deleveraging, supported by above-average demand and operational improvements across aggregates and wind tower segments.

- We’ll now assess how Arcosa’s record-high adjusted EBITDA margin and raised guidance feed into its evolving investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Arcosa Investment Narrative Recap

To be a shareholder in Arcosa, you have to believe in the company’s ability to successfully integrate acquisitions, drive margin expansion, and capture ongoing demand in construction and renewables. The record-high adjusted EBITDA margin and raised 2025 guidance underscore management’s focus on operational gains, helping solidify the main catalyst: the rapid payoff of the Stavola deal and margin uplift. However, despite this momentum, ongoing risks related to free cash flow and reliance on US infrastructure demand remain; so far, the recent results do not materially change the risk profile.

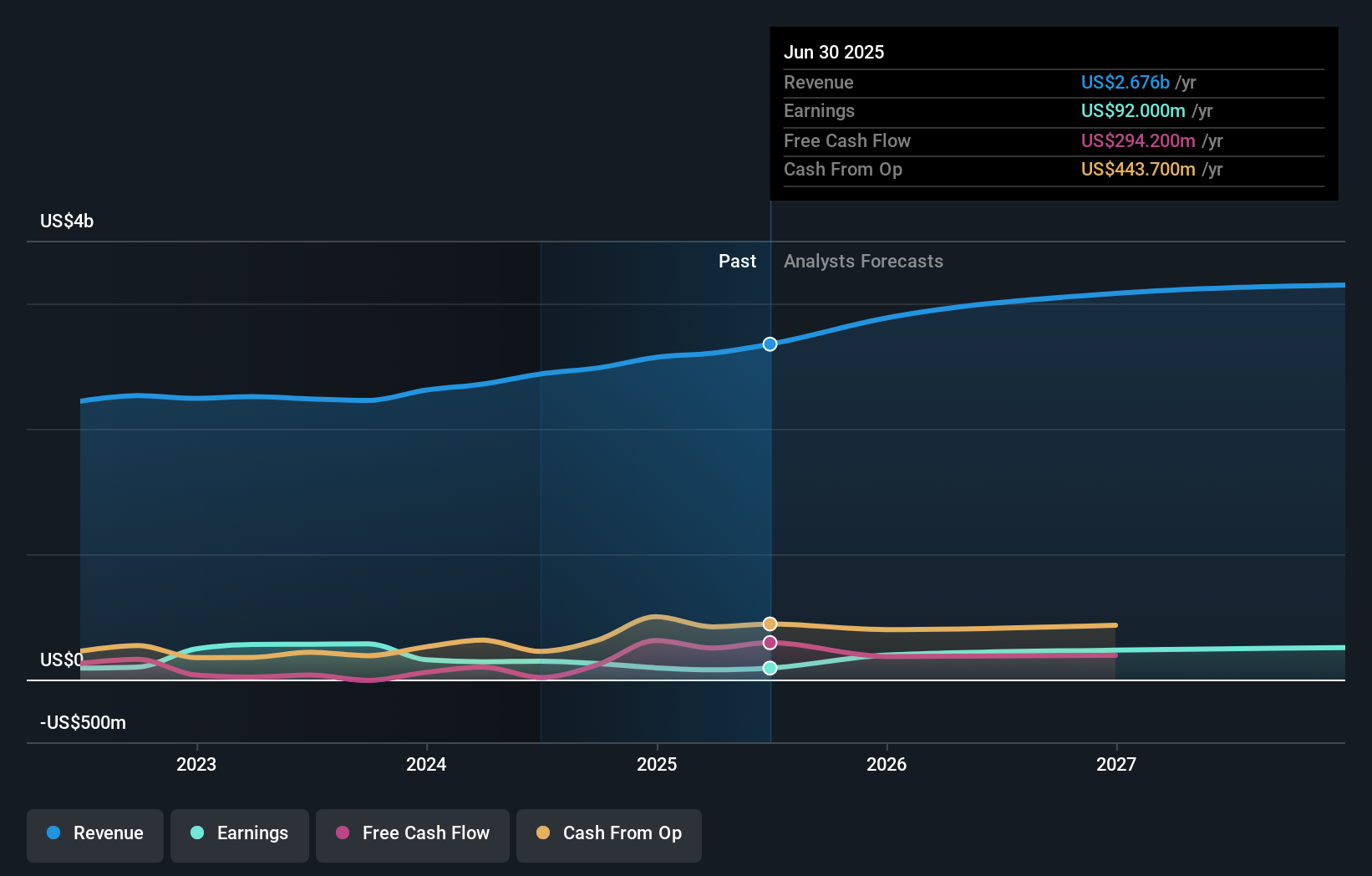

Of all the recent announcements, Arcosa’s move to tighten its full-year 2025 revenue guidance stands out. This adjustment, which now centers the revenue range at US$2.85 billion to US$2.95 billion, suggests management is closely monitoring external factors and internal execution as it pushes for margin and cash flow improvement, both critical to offsetting earlier acquisition-related headwinds.

In contrast, investors should also be aware that free cash flow remains under pressure, and while the margin improvement is promising...

Read the full narrative on Arcosa (it's free!)

Arcosa's outlook anticipates $3.5 billion in revenue and $453.3 million in earnings by 2028. This reflects a 10.0% annual revenue growth rate and a $375.5 million increase in earnings from the current $77.8 million level.

Uncover how Arcosa's forecasts yield a $111.83 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Two separate fair value assessments from the Simply Wall St Community span a wide range, from US$48.33 up to US$111.83. This diversity stands alongside Arcosa’s improved EBITDA margin and guidance raise, reflecting how beliefs about acquisition integration can shape broader expectations for performance.

Explore 2 other fair value estimates on Arcosa - why the stock might be worth less than half the current price!

Build Your Own Arcosa Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcosa research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Arcosa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcosa's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com