- ONEOK, Inc. recently completed a US$747.71 million fixed-income offering of 4.950% senior subordinated unsecured notes due in 2032, with several leading financial institutions, RBC Capital Markets, Scotia Capital, SMBC Nikko, MUFG Securities, CIBC World Markets, and Wells Fargo Securities, added as co-lead underwriters.

- This substantial debt financing and the broadened underwriter syndicate signal a highly coordinated capital-raising effort that may influence the company's funding flexibility and future strategic initiatives.

- We'll explore how the addition of multiple co-lead underwriters for ONEOK's bond offering could affect its forward-looking investment thesis.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

ONEOK Investment Narrative Recap

ONEOK shareholders typically believe in persistent global demand for U.S. NGL and natural gas volumes, with the company's growth underpinned by infrastructure expansion and asset integration. The recent US$747.71 million bond offering, coordinated with multiple new co-lead underwriters, does not materially change the near-term investment thesis, as the biggest catalyst remains volume growth in key U.S. basins while the largest current risk continues to be earnings sensitivity to commodity price cycles and spreads.

Among recent announcements, ONEOK’s Q2 2025 earnings showed revenue and net income growth versus the prior year, which is relevant in assessing the company’s ability to capitalize on infrastructure expansion and export market catalysts, especially as new debt raises increase financial flexibility for executing on capital projects and supporting shareholder returns.

In contrast, investors should be aware of increasing financial leverage and how a downturn in commodity prices...

Read the full narrative on ONEOK (it's free!)

ONEOK's narrative projects $28.1 billion revenue and $4.5 billion earnings by 2028. This requires a -0.1% yearly revenue decline and a $1.4 billion earnings increase from $3.1 billion today.

Uncover how ONEOK's forecasts yield a $101.33 fair value, a 37% upside to its current price.

Exploring Other Perspectives

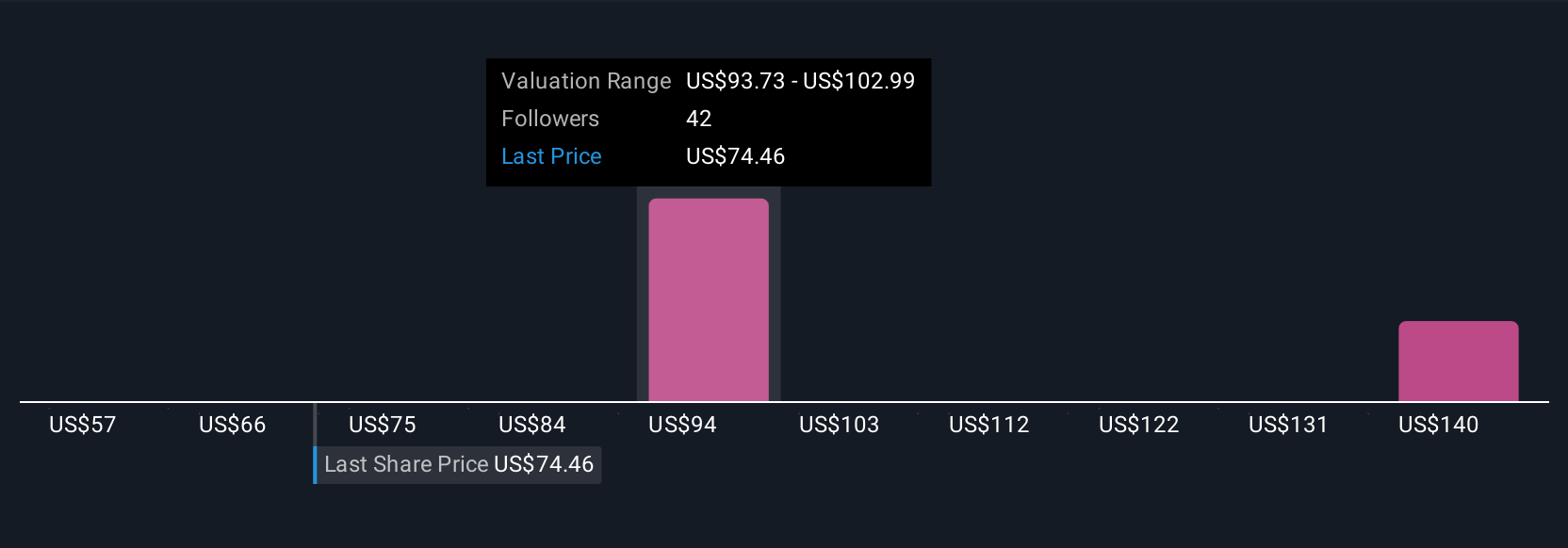

Simply Wall St Community members provided five fair value estimates for ONEOK, ranging widely from US$56.66 up to US$149.23. While opinions vary, many remain focused on the company's exposure to commodity price cycles, a key earnings risk that shapes how future performance could surprise in either direction.

Explore 5 other fair value estimates on ONEOK - why the stock might be worth over 2x more than the current price!

Build Your Own ONEOK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ONEOK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ONEOK's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com