- PENN Entertainment reported second quarter results showing year-over-year revenue and net loss improvements, completed a US$115.6 million share repurchase program, and filed a shelf registration for 8.2 million shares related to its ESOP plan.

- The company also announced enhancements to its ESPN BET Sportsbook with the launch of FanCenter, and appointed former Louisiana Gaming Control Board Chair Ronnie Jones as an independent member of its Compliance Committee.

- We'll examine how the combination of improved earnings and capital returns could influence PENN's earnings outlook and digital growth expectations.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

PENN Entertainment Investment Narrative Recap

For PENN Entertainment, the investment case hinges on confidence in its transition toward integrated digital and land-based gaming, with shareholder value tied to driving digital profitability and efficiently allocating capital. The latest earnings improvement and share buyback completion support the short-term catalyst of reaching profitability in the Interactive segment, though persistent market saturation and digital competition remain the most pressing risks; these updates do not fundamentally change that balance for now. Among recent developments, the expansion of ESPN BET's FanCenter stands out, as it targets digital engagement and could directly impact the company's ability to meet its online growth milestones, a key focus for investors tracking catalyst progress. However, investors should keep in mind that, in contrast, ongoing digital market saturation and intense competition still present a material risk that...

Read the full narrative on PENN Entertainment (it's free!)

PENN Entertainment's narrative projects $7.8 billion in revenue and $442.9 million in earnings by 2028. This requires 5.6% yearly revenue growth and a $527.9 million earnings increase from the current -$85.0 million.

Uncover how PENN Entertainment's forecasts yield a $21.89 fair value, a 28% upside to its current price.

Exploring Other Perspectives

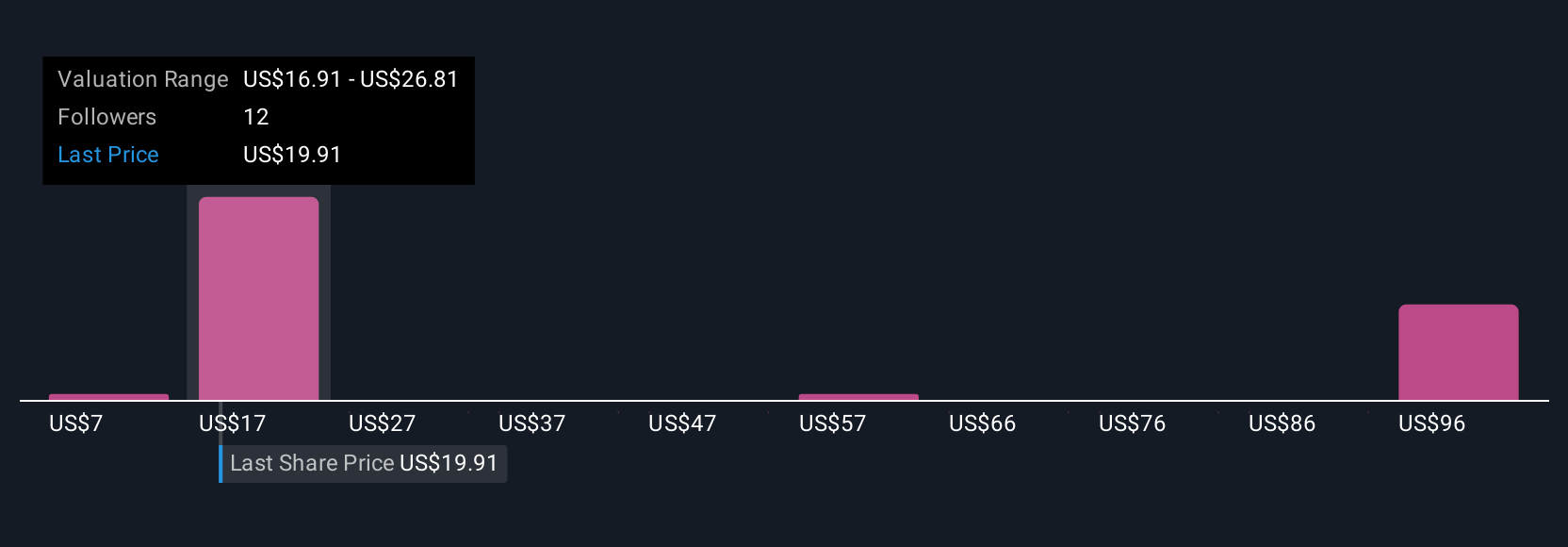

The Simply Wall St Community submitted four fair value estimates for PENN, ranging from US$7 to US$90.19 per share. While consensus highlights digital expansion as a major growth driver, persistent online competition could complicate PENN’s performance outlook, see what a broad mix of investors are watching next.

Explore 4 other fair value estimates on PENN Entertainment - why the stock might be worth over 5x more than the current price!

Build Your Own PENN Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PENN Entertainment research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PENN Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PENN Entertainment's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com