- Earlier this month, JetBlue announced the launch of TrueBlue Travel, its rebranded consumer booking platform that expands loyalty point redemption beyond flights to include hotels, car rentals, and travel experiences, replacing the Paisly by JetBlue website.

- This move not only enhances the value proposition for TrueBlue loyalty members but also supports JetBlue's JetForward strategy by deepening customer engagement and diversifying revenue sources within the broader travel ecosystem.

- We'll explore how the expanded point redemption options through TrueBlue Travel could impact JetBlue's long-term customer retention and business model.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

JetBlue Airways Investment Narrative Recap

Investors in JetBlue often share a belief in a recovery fueled by resilient leisure travel demand, premium product expansion, and the company’s ability to extract more value from its loyalty ecosystem. The launch of TrueBlue Travel may reinforce long-term customer retention and diversify revenue, though it does not materially alter JetBlue’s immediate exposure to soft unit revenues and margin pressures from volatile travel demand and heightened competition, a central risk currently facing the airline. The most relevant recent announcement is JetBlue’s Blue Sky collaboration with United Airlines, which enables loyalty integration and gives customers broader earning and redemption options, further supporting retention and ecosystem ambitions in light of these shifting catalysts. Yet, despite its progress, investors should be aware that rising labor costs and demand unpredictability remain key sources of volatility, particularly when...

Read the full narrative on JetBlue Airways (it's free!)

JetBlue Airways' narrative projects $10.6 billion in revenue and $728.0 million in earnings by 2028. This requires 5.1% yearly revenue growth and a $1.114 billion increase in earnings from the current -$386.0 million.

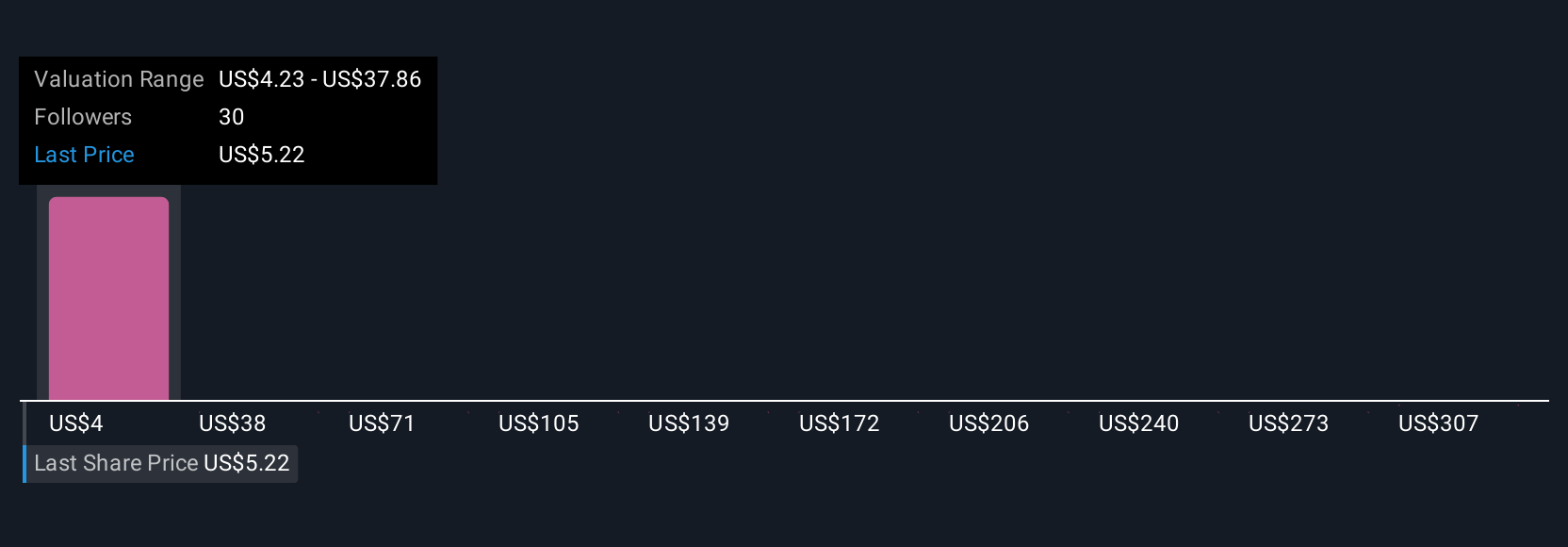

Uncover how JetBlue Airways' forecasts yield a $4.23 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates for JetBlue range from US$4.23 to US$340.49, revealing immense variation in outlooks. Some see promise in loyalty and network expansion, while persistent margin pressure and recent losses prompt caution for others, explore the full spectrum of independent views now.

Explore 6 other fair value estimates on JetBlue Airways - why the stock might be worth 12% less than the current price!

Build Your Own JetBlue Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JetBlue Airways research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JetBlue Airways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JetBlue Airways' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com