- Brookfield Infrastructure Partners reported its second quarter 2025 results, posting sales of US$5.43 billion and reducing its net loss to US$6 million compared to the previous year, while also announcing a 6% increase in its quarterly distribution to US$0.43 per unit, with affirmations for several preferred dividends.

- This combination of stable operating results and a higher distribution marks a continued focus on shareholder returns despite only modest changes in net profitability.

- We'll look at how the recent distribution increase and earnings results may influence Brookfield Infrastructure Partners' investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

Brookfield Infrastructure Partners Investment Narrative Recap

To own Brookfield Infrastructure Partners, you need to believe in the long-term growth of global infrastructure essentials, data, energy, and utilities, underpinned by contracted and inflation-linked revenues. The latest results, with stable operating performance and a higher distribution, do little to alter the near-term focus on growth through acquisitions, though increased deal activity remains the clearest immediate catalyst, and elevated leverage remains the most significant risk. The news does not materially influence either the catalyst or the risk profile at this time.

The most relevant announcement to consider is the 6% increase in the quarterly distribution to US$0.43 per unit. This uptick reinforces Brookfield’s longstanding commitment to growing unitholder distributions, which is particularly notable against a backdrop of large-scale acquisition activity and ongoing capital deployment. In the context of recent earnings, the higher distribution underscores the company’s aim to balance shareholder returns with organic and inorganic expansion.

In contrast, while distributions rise, investors should be aware that sustained acquisition activity could elevate leverage and refinancing risk if borrowing costs stay higher for longer...

Read the full narrative on Brookfield Infrastructure Partners (it's free!)

Brookfield Infrastructure Partners is forecast to reach $25.3 billion in revenue and $1.1 billion in earnings by 2028. This outlook relies on annual revenue growth of 5.5% and an earnings increase of $1.06 billion from current earnings of $36.0 million.

Uncover how Brookfield Infrastructure Partners' forecasts yield a $40.18 fair value, a 32% upside to its current price.

Exploring Other Perspectives

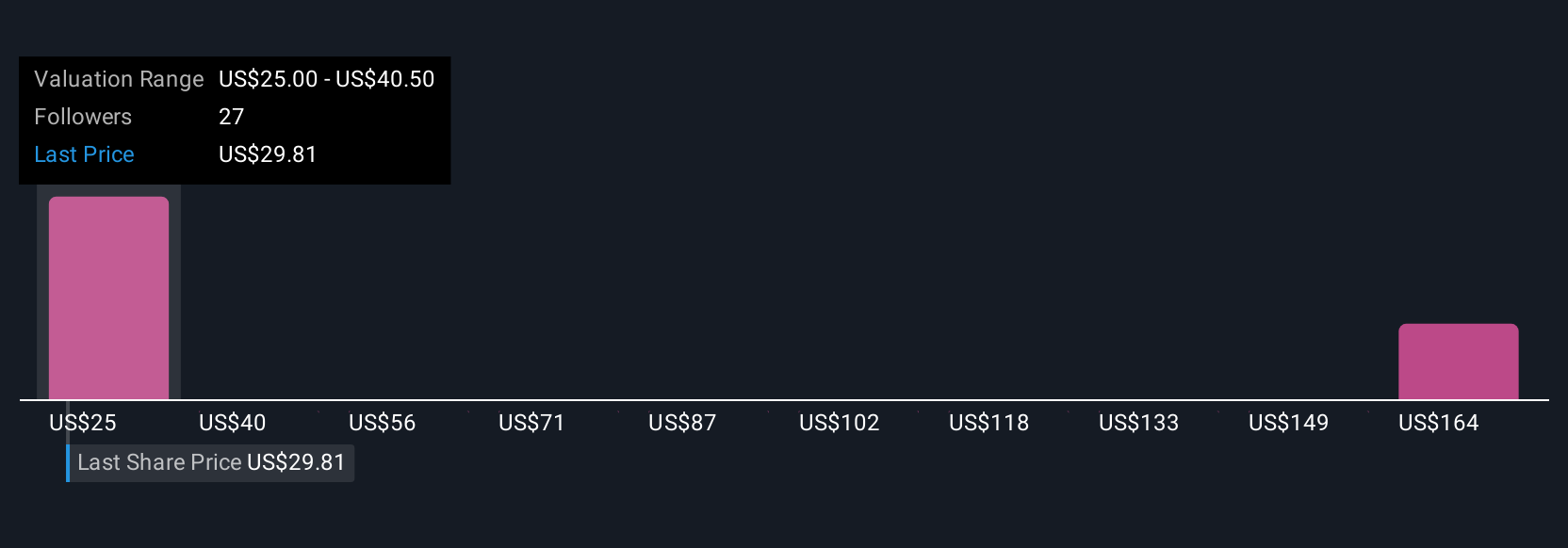

Five private investors in the Simply Wall St Community estimated Brookfield’s fair value from US$25.00 to US$181.17 per unit. Against this range, the sustained increase in acquisition activity remains a point of focus, with broad implications for capital deployment and future earnings volatility. Explore these varied viewpoints to see how expectations differ.

Explore 5 other fair value estimates on Brookfield Infrastructure Partners - why the stock might be worth over 5x more than the current price!

Build Your Own Brookfield Infrastructure Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Infrastructure Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Infrastructure Partners' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com