- Applied Digital Corporation reported its fourth quarter and full year results for the period ending May 31, 2025, with quarterly revenue rising to US$38.01 million from US$26.9 million year-over-year and a net loss that narrowed to US$52.54 million for the quarter, but widened to US$233.68 million for the full year.

- Despite increased annual revenue, the company's full-year losses deepened, reflecting both higher scale and notable cost or investment pressures as it pursues growth in digital infrastructure.

- We'll explore how rising revenue alongside ongoing losses may influence Applied Digital's investment narrative moving forward.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Applied Digital Investment Narrative Recap

To be a shareholder in Applied Digital, you need to believe in the company's ability to capture long-term growth through AI and digital infrastructure, even as near-term losses persist. The latest financial results, showing rising revenue but widening annual losses, do not materially impact the most important short-term catalyst, which remains the execution of long-term lease agreements with hyperscaler clients, nor do they significantly alter the most pressing risk of heavy capital requirements and financial leverage. However, continued bottom-line pressure keeps a spotlight on Applied Digital’s ability to achieve scale while managing expanding costs and debt.

Among recent announcements, the two 15-year lease agreements with CoreWeave, which represent approximately US$7 billion in contracted revenue, are especially relevant. This development directly underpins the company’s strategy to build recurring, multi-year revenue streams and address customer concentration, providing increased visibility into growth at a time when financial performance is under close scrutiny.

By contrast, investors should be aware of the impact that substantial capital expenditure and rising debt might have if future customer growth slows or large contracts are lost...

Read the full narrative on Applied Digital (it's free!)

Applied Digital's narrative projects $755.7 million revenue and $102.2 million earnings by 2028. This requires 73.7% yearly revenue growth and a $263.2 million increase in earnings from -$161.0 million.

Uncover how Applied Digital's forecasts yield a $17.22 fair value, a 15% upside to its current price.

Exploring Other Perspectives

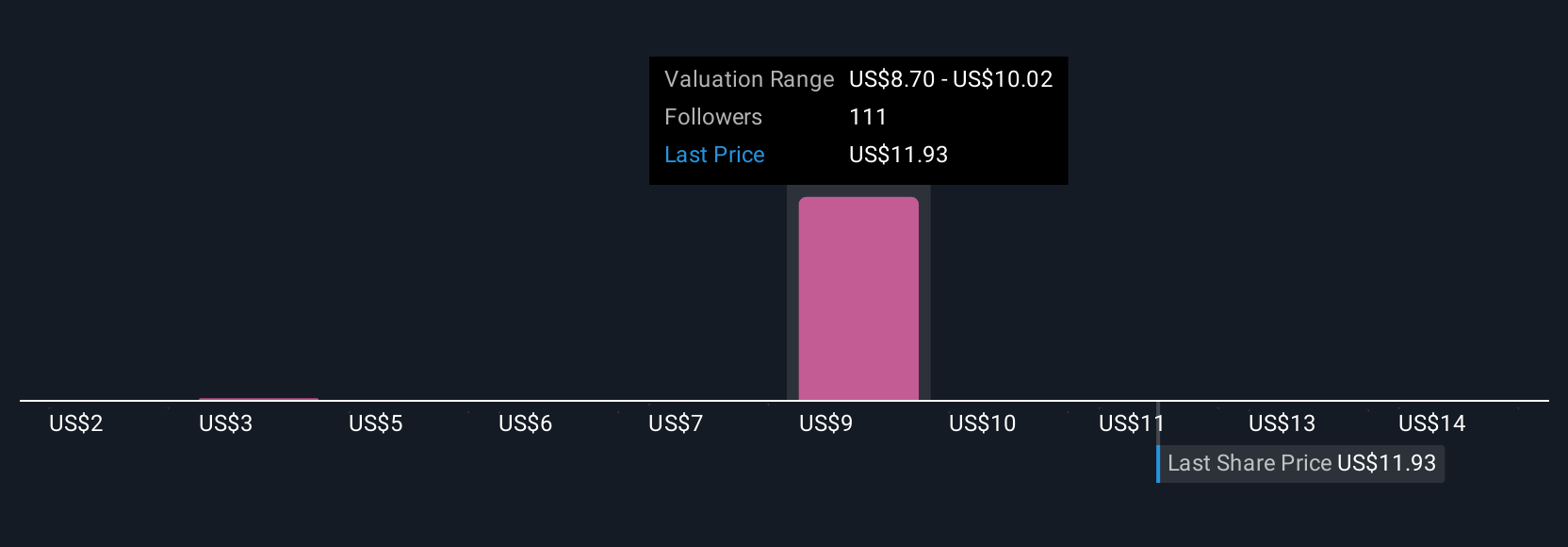

Twenty-seven members of the Simply Wall St Community estimate fair value in a wide range from US$2.06 to US$20 per share. While many see substantial growth potential from recent hyperscaler partnerships, views differ sharply on the effect of ongoing operating losses and high balance sheet leverage.

Explore 27 other fair value estimates on Applied Digital - why the stock might be worth as much as 34% more than the current price!

Build Your Own Applied Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Digital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Applied Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Digital's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com