- American Airlines recently expanded its services in Quebec City, including launching a new direct route to Dallas-Fort Worth and increasing flights to Charlotte, further connecting local travelers to major U.S. destinations through the 2025 fall season.

- This move not only enhances travel options for both leisure and business passengers, but is expected to help Quebec City capture a greater share of the growing market for U.S. cruise and tourism traffic.

- We will explore how American Airlines’ expanded route network from Quebec City could influence its broader investment outlook and sector recovery prospects.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

American Airlines Group Investment Narrative Recap

To be a shareholder in American Airlines Group, you need confidence in the rebound of both domestic and international air travel demand, as well as in the company’s ability to manage high costs and debt. The recent expansion of routes from Quebec City is promising for international diversification, but its immediate effect on the largest catalyst, domestic demand normalization, and the primary risk, persistently high labor and debt costs, is likely limited in the short term.

Among recent announcements, the board’s updated bylaws stand out for potentially improving shareholder engagement and transparency, even though they have little bearing on short-term financial catalysts. These governance changes could support longer-term investor confidence without shifting key earnings or revenue drivers near term.

However, investors should also be aware that while international routes may add new revenue streams, American’s exposure to high labor costs...

Read the full narrative on American Airlines Group (it's free!)

American Airlines Group's outlook anticipates $61.7 billion in revenue and $1.8 billion in earnings by 2028. This projection is based on a 4.4% annual revenue growth rate and an increase in earnings of $1.2 billion from the current $567.0 million.

Uncover how American Airlines Group's forecasts yield a $13.31 fair value, a 3% upside to its current price.

Exploring Other Perspectives

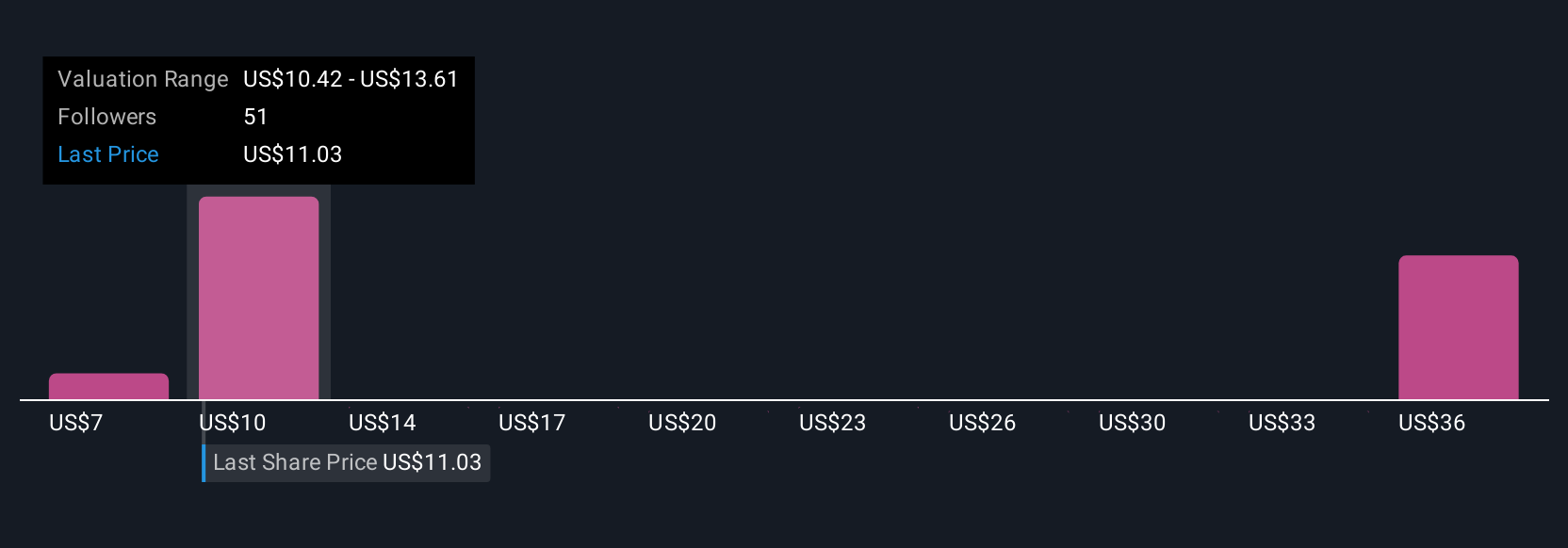

Simply Wall St Community fair value estimates for American Airlines range from US$7.23 to US$35.36, with 12 different viewpoints represented. While broader market participants see risk in cost pressures, these opinions reflect how expectations for profitability and recovery can differ dramatically among investors.

Explore 12 other fair value estimates on American Airlines Group - why the stock might be worth 44% less than the current price!

Build Your Own American Airlines Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Airlines Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Airlines Group's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com