- Avient Corporation recently reported its earnings for the second quarter and first half of 2025, with quarterly sales rising to US$866.5 million and net income increasing to US$52.6 million compared to the year prior.

- The company’s quarterly earnings per share from continuing operations saw significant year-over-year growth, indicating meaningful gains in profitability and operational momentum.

- We’ll examine how Avient’s improved quarterly net income shapes its investment narrative around premium product positioning and earnings growth potential.

Find companies with promising cash flow potential yet trading below their fair value.

Avient Investment Narrative Recap

Owning Avient shares often hinges on a belief in the company’s ability to capture premium pricing and long-term growth in specialty, sustainable materials, despite cyclical pressures in traditional markets. The latest quarterly results, with higher sales and much stronger net income, support the thesis of renewed earnings strength, but these gains do not fundamentally change the biggest near-term catalyst: Avient’s exposure to fast-growing healthcare and sustainability sectors. The principal risk remains margin pressure from volatile raw material costs, especially input inflation that may not be fully recoverable from customers.

Among recent announcements, Avient’s new US$500 million revolving credit agreement stands out as it supports operational flexibility in a period of earnings recovery. This move gives the company additional liquidity just as it seeks to manage potential swings in input costs and invest for growth, directly tying back to whether Avient can fully capitalize on emerging sector catalysts.

However, investors should also keep in mind that if raw material cost inflation accelerates and Avient is unable to pass these on to customers...

Read the full narrative on Avient (it's free!)

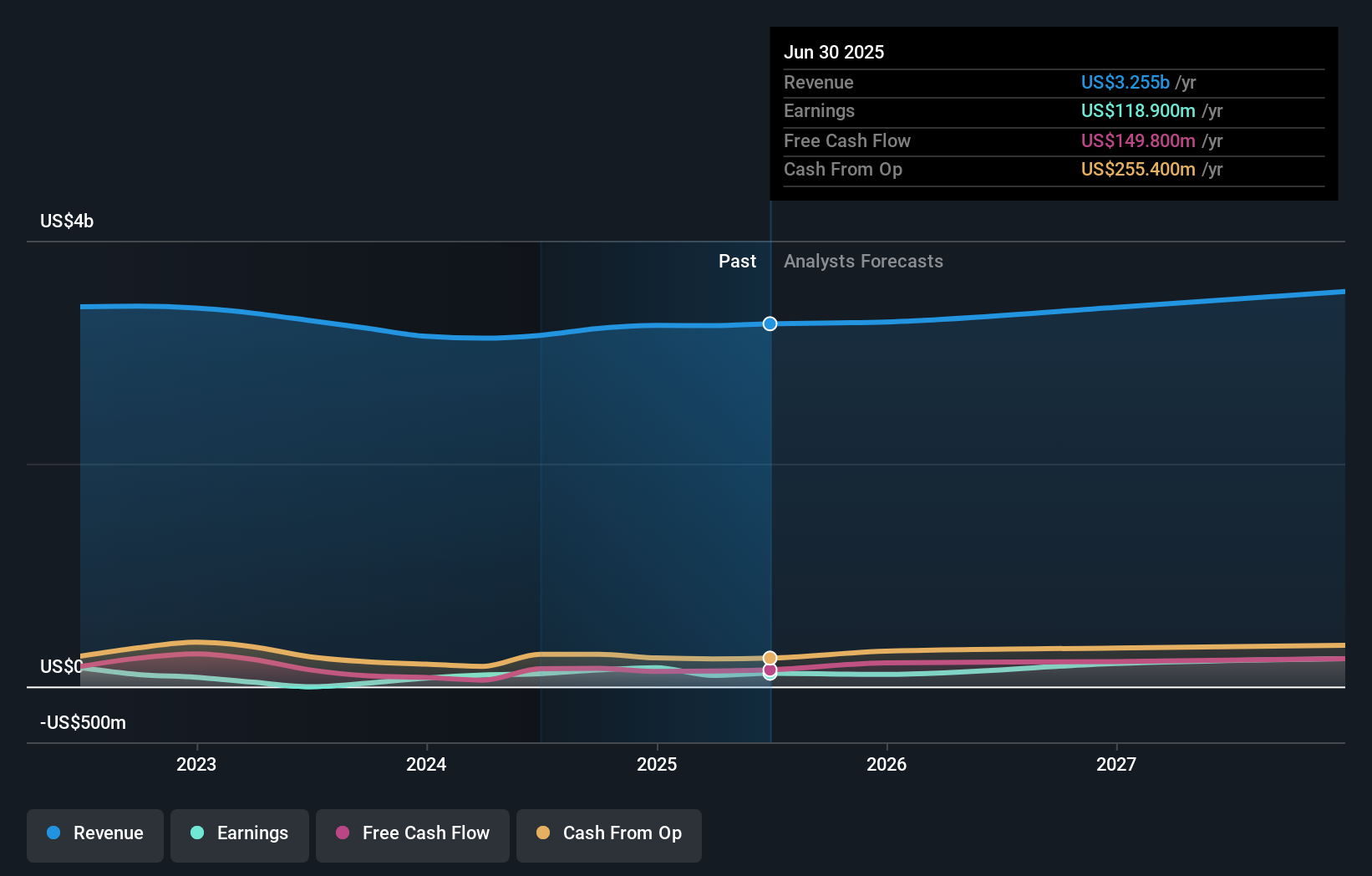

Avient's outlook anticipates $3.6 billion in revenue and $309.5 million in earnings by 2028. This projection is based on a 3.4% annual revenue growth rate and a $190.6 million increase in earnings from the current level of $118.9 million.

Uncover how Avient's forecasts yield a $41.71 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community valuations for Avient range from US$25.95 to US$54.01, with just 2 distinct forecasts included. While strong recent profit growth is a key catalyst for many, it remains to be seen how Avient's exposure to margin pressures could shape future outcomes, consider exploring how other investors view these variables.

Explore 2 other fair value estimates on Avient - why the stock might be worth 23% less than the current price!

Build Your Own Avient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avient research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avient's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com