- Atkore Inc. recently reported third quarter results, revealing a decline in sales to US$735.05 million and net income to US$42.96 million, alongside an announcement that CEO and President William (Bill) Waltz will retire once a successor is named.

- The combination of a sharp decrease in earnings and an upcoming leadership change could prompt questions about Atkore's current business momentum and future direction.

- We'll examine how the significant earnings shortfall impacts Atkore's investment outlook and potential industry opportunities going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Atkore Investment Narrative Recap

To be a shareholder in Atkore today, you need to believe the company can eventually stabilize its margins and earnings amid ongoing price volatility for key products and commodities, all while leveraging tariff protection and infrastructure trends to regain momentum. However, the sharp earnings decline and news of CEO Bill Waltz's upcoming retirement have made the near-term path less clear, especially since leadership transitions can heighten short-term uncertainty when reliable forecasting is already a challenge.

Amid this backdrop, the announcement of Bill Waltz's retirement stands out as especially relevant. Succession uncertainty now coincides with margin compression and uneven demand visibility, both of which are magnified during periods of leadership transition and can increase execution risk for Atkore as it seeks to rebuild earnings growth.

In contrast, the combination of compressed margins and CEO transition is precisely the kind of uncertainty investors should be aware of because...

Read the full narrative on Atkore (it's free!)

Atkore's narrative projects $2.9 billion revenue and $220.9 million earnings by 2028. This requires a 0.5% annual revenue decline and a $109.5 million earnings increase from $111.4 million today.

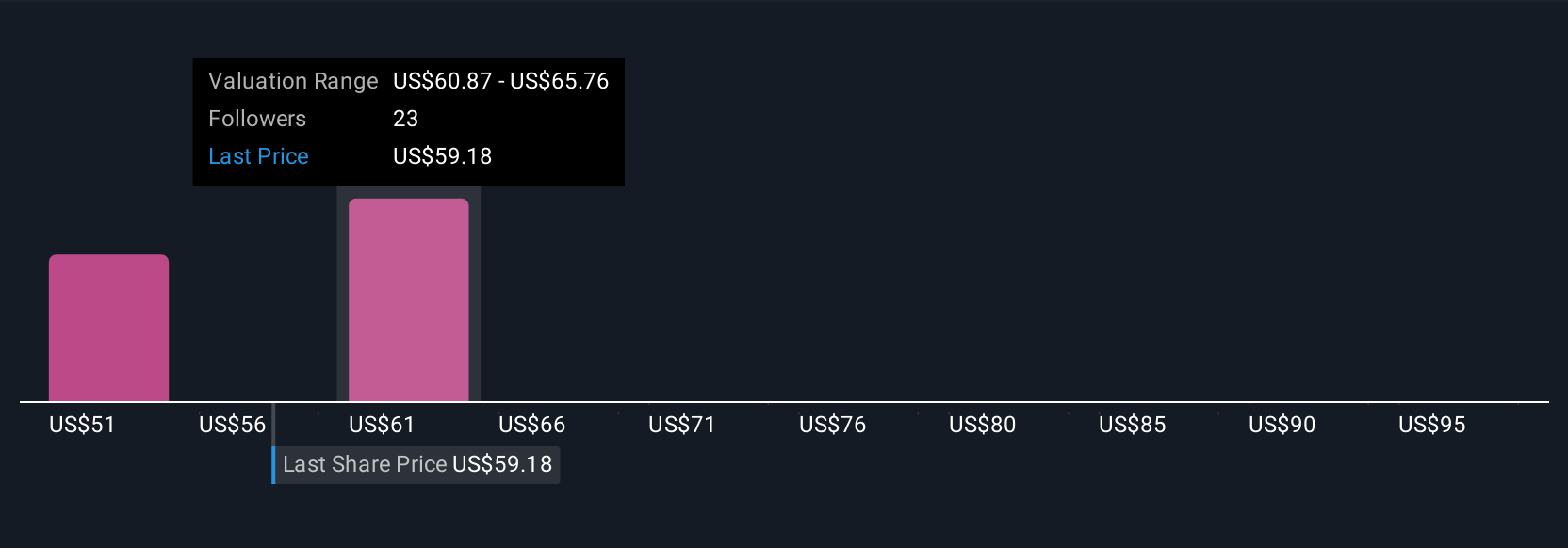

Uncover how Atkore's forecasts yield a $66.60 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range widely from US$50.62 to US$100. While opinions differ, current margin pressures and leadership change mean future outcomes could vary considerably, so consider several viewpoints before making your own call.

Explore 5 other fair value estimates on Atkore - why the stock might be worth as much as 76% more than the current price!

Build Your Own Atkore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atkore research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atkore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atkore's overall financial health at a glance.

No Opportunity In Atkore?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com