- In the past quarter, ATI Inc. reported increased sales and earnings, completed a US$430.13 million share repurchase, and Boeing announced the extension and expansion of their long-term titanium supply agreement with ATI, covering Boeing’s full range of commercial airplane programs and subsidiaries.

- This combination of strong financial performance and the deepening of a major aerospace partnership highlights ATI’s growing influence and resilience within the high-performance materials sector.

- We'll examine how the expanded Boeing agreement supports ATI's revenue diversification and future growth prospects within its investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ATI Investment Narrative Recap

ATI shareholders look for durable growth powered by aerospace demand and sustained high-margin contracts with giants like Boeing and Airbus. While the expanded Boeing agreement further secures ATI’s aerospace revenues, it does not materially reduce the company’s concentration risk around a handful of large OEM customers, still the most important short-term driver and challenge for the stock.

The most relevant recent announcement is the expanded supply deal with Boeing, which enhances ATI’s locked-in sales in aerospace, supporting one of the main catalysts: stable, higher-margin revenue streams through long-term agreements with major aircraft manufacturers. Yet this raises important questions about what happens as ATI’s exposure to non-aerospace segments continues to fluctuate...

Read the full narrative on ATI (it's free!)

ATI's outlook projects $5.5 billion in revenue and $635.8 million in earnings by 2028. This is based on a forecasted 6.9% annual revenue growth rate and a $218.3 million increase in earnings from the current $417.5 million.

Uncover how ATI's forecasts yield a $98.67 fair value, a 31% upside to its current price.

Exploring Other Perspectives

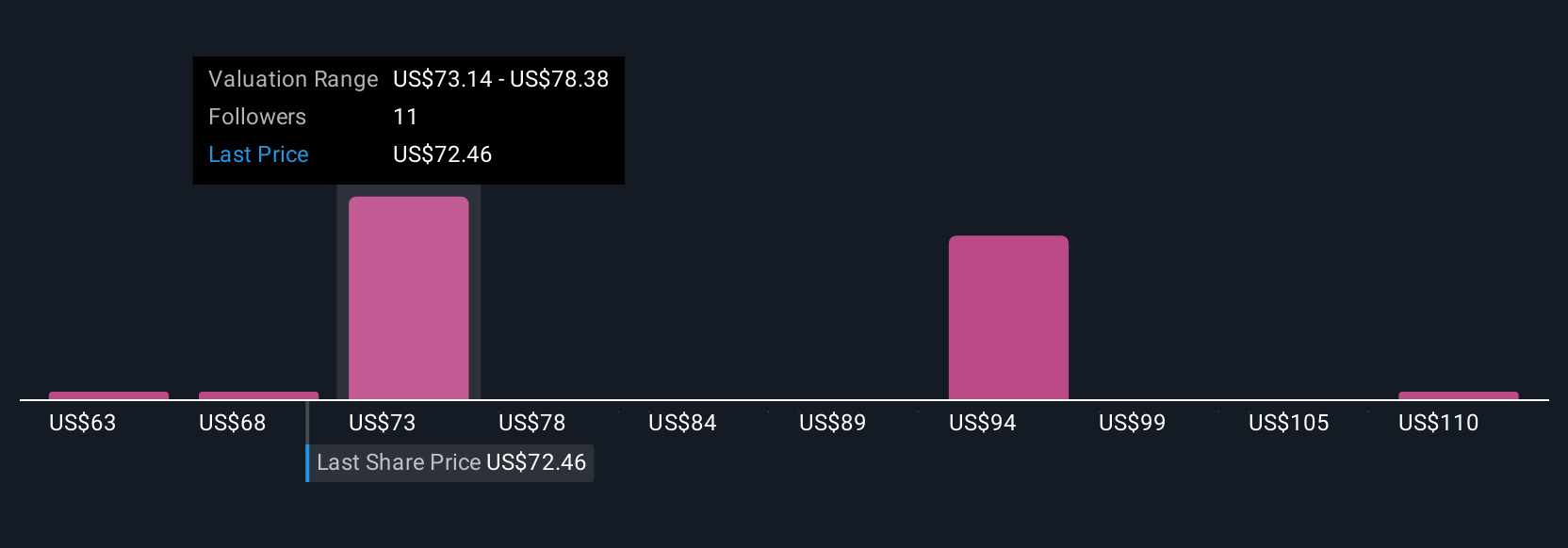

Simply Wall St Community members peg ATI’s fair value estimates between US$62.68 and US$115 across five analyses. With so many views and earnings now increasingly tied to just a few top customers, it is critical to consider how much concentration risk might matter to you as well.

Explore 5 other fair value estimates on ATI - why the stock might be worth as much as 52% more than the current price!

Build Your Own ATI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATI research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ATI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATI's overall financial health at a glance.

No Opportunity In ATI?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com