- Penske Automotive Group reported its second quarter 2025 financial results, with net income rising to US$250 million and basic earnings per share increasing to US$3.78, despite relatively stable quarterly sales year-on-year.

- A key highlight is the company’s upcoming ex-dividend date, supported by a solid payout ratio and consistent earnings growth that may appeal to income-focused investors.

- We'll examine how Penske’s continued net income and earnings per share growth updates its long-term investment narrative and potential value drivers.

Find companies with promising cash flow potential yet trading below their fair value.

Penske Automotive Group Investment Narrative Recap

To be a Penske Automotive Group shareholder, you need to believe in the resilience of premium automotive retail, underpinned by recurring high-margin service revenue and disciplined capital returns. The recent earnings beat, net income up to US$250 million with stable sales, confirms EPS momentum but does not materially change the biggest short-term catalyst: further share buybacks and dividend growth. The principal risk remains cyclical exposure to luxury segments, where consumer weakness or higher rates could pressure future profitability, especially in key international markets.

The company's announcement of its 19th consecutive quarterly dividend increase, now at US$1.32 per share, highlights a continual commitment to returning capital. For investors, this stable dividend supports the narrative of earnings consistency as a key value driver, even as other headline risks remain present.

However, in contrast, something investors should still be alert to is how exposure to luxury vehicle sales could quickly...

Read the full narrative on Penske Automotive Group (it's free!)

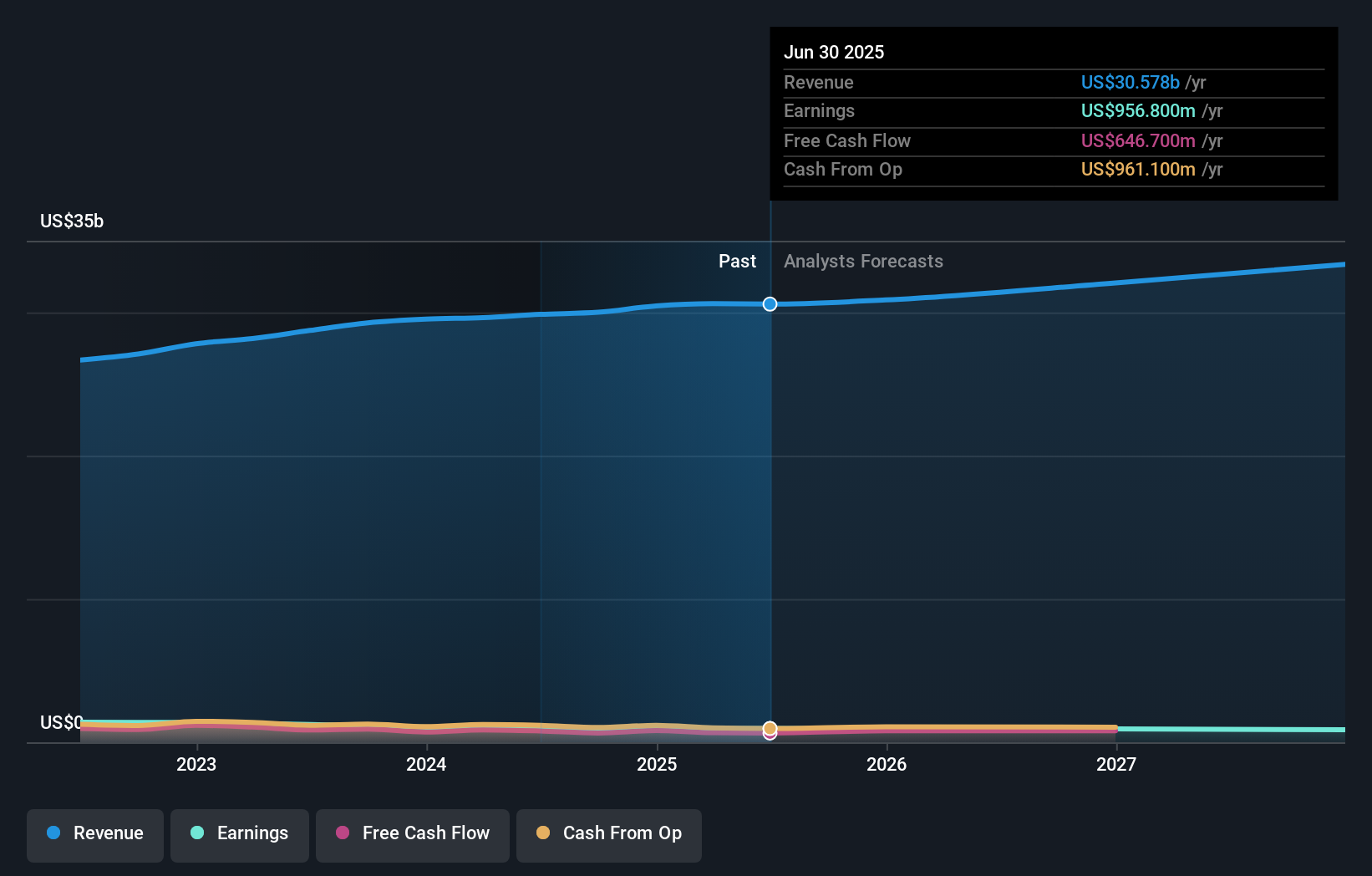

Penske Automotive Group's outlook anticipates $34.3 billion in revenue and $924.8 million in earnings by 2028. This implies a 3.9% annual revenue growth rate but a decrease in earnings of $32 million from current earnings of $956.8 million.

Uncover how Penske Automotive Group's forecasts yield a $176.14 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community stands at US$176.14. While consensus highlights stable dividend growth, differing opinions may arise as market participants weigh ongoing regulatory and profitability risks for international operations.

Explore another fair value estimate on Penske Automotive Group - why the stock might be worth as much as $176.14!

Build Your Own Penske Automotive Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penske Automotive Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Penske Automotive Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penske Automotive Group's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com