- Group 1 Automotive recently declared a quarterly dividend of US$0.50 per share for September 2025 and announced the acquisition of Mercedes-Benz of Buckhead, a dealership expected to add US$210 million in annual revenues and strengthen its luxury presence in the Southeastern U.S.

- This combination of sustained shareholder returns and footprint expansion underscores the company’s ongoing commitment to both growth and capital allocation discipline.

- Given the company’s reaffirmed dividend, we’ll explore how this commitment to shareholder returns influences Group 1 Automotive’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Group 1 Automotive Investment Narrative Recap

To be a shareholder in Group 1 Automotive, you need to believe in its disciplined expansion strategy and the company's ability to balance growth via acquisitions with steady returns to shareholders. The recent dividend increase and dealership acquisition are positive signals, but do not materially impact the most important short-term catalyst, aftersales margin growth, or the continued risk of integration challenges and digital competition, which still weigh on the stock’s outlook.

Among the latest updates, the acquisition of Mercedes-Benz of Buckhead stands out as it highlights Group 1's ongoing focus on deepening its luxury portfolio and broadening its southeastern U.S. footprint. While this strengthens top-line scale, it underscores the company’s exposure to operational execution and integration risks, challenges often faced when assimilating new dealerships in competitive markets.

However, investors should be aware that even as Group 1 rewards shareholders, the risk from increasing online-only competition remains pressing if...

Read the full narrative on Group 1 Automotive (it's free!)

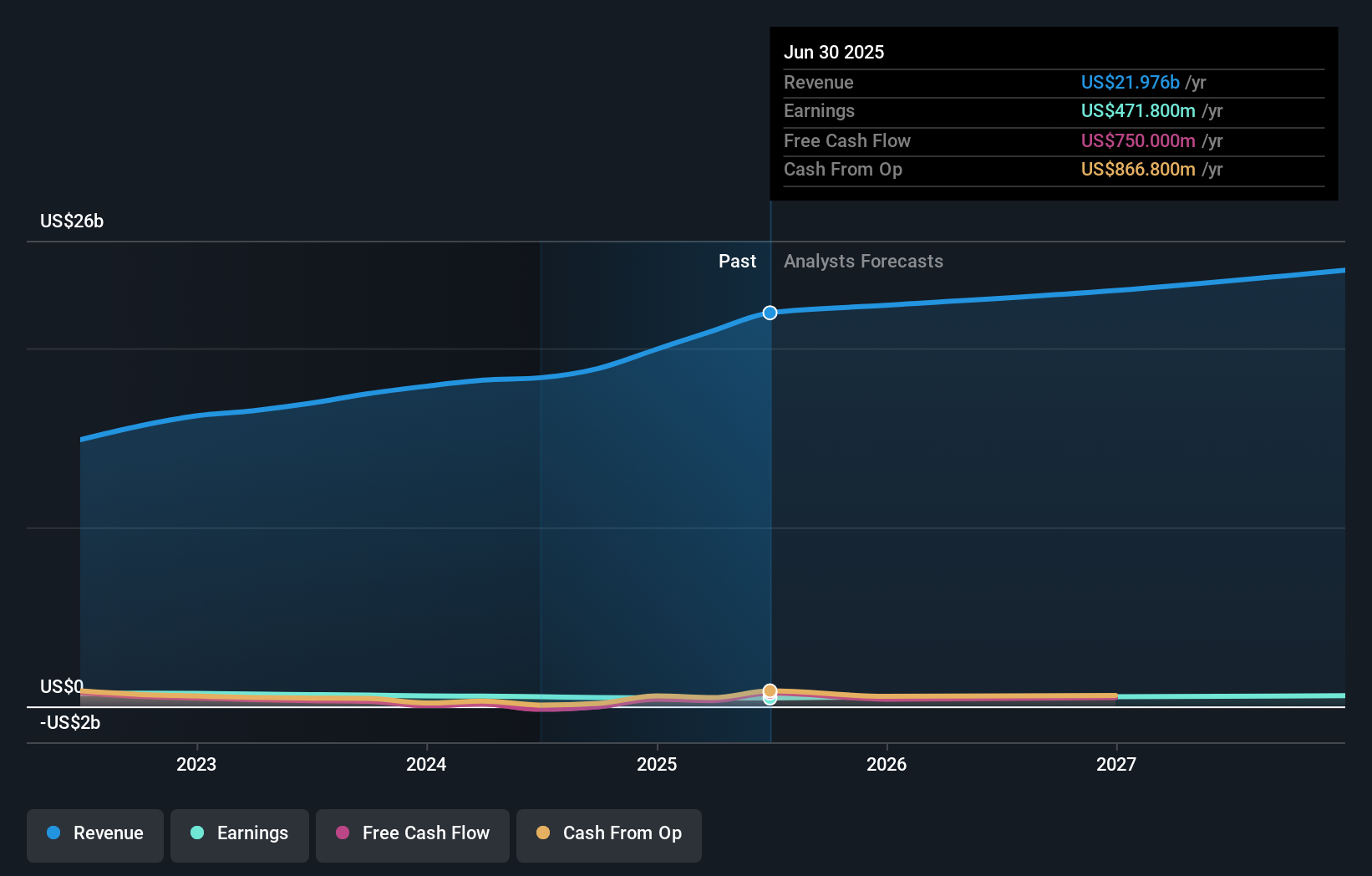

Group 1 Automotive's outlook projects $25.0 billion in revenue and $636.6 million in earnings by 2028. This forecast assumes a 4.3% annual revenue growth rate and a $164.8 million increase in earnings from $471.8 million today.

Uncover how Group 1 Automotive's forecasts yield a $475.12 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range between US$365.68 and US$490.66 per share. While investor opinions span nearly US$125, continued dealership expansion highlights the push for higher revenues, but the effectiveness of integration will shape future performance.

Explore 2 other fair value estimates on Group 1 Automotive - why the stock might be worth 18% less than the current price!

Build Your Own Group 1 Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Group 1 Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Group 1 Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Group 1 Automotive's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com