- On July 31, 2025, WESCO International announced it had repurchased 147,300 shares for US$25.01 million, completing its buyback program begun in June 2022, and also raised its full-year 2025 organic sales growth outlook following solid second-quarter sales of US$5.90 billion and continued positive momentum.

- Market observers highlighted WESCO's scale advantages and growing presence in the rapidly expanding data center sector as important factors supporting its reinforced outlook.

- We'll examine how the raised organic sales growth outlook and data center demand influence WESCO's long-term growth narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

WESCO International Investment Narrative Recap

For those considering WESCO International, owning shares is ultimately a belief in the company’s ability to convert its scale in electrical distribution and its growing role in the data center supply chain into long-term earnings growth. The recent completion of its US$562.37 million buyback and the upgraded 2025 sales growth outlook signal continued momentum, though heightened exposure to large project-based, thinner-margin contracts remains the key risk and is unlikely to be offset by buybacks in the near term.

Among recent announcements, the updated full-year organic sales growth guidance stands out. This matters for investors watching near-term catalysts, particularly as rapid data center sector growth has lifted revenue outlooks. That said, the underlying earnings pressure from margin compression in categories like wire and cable, especially tied to scale data center projects, is not directly addressed by the sales guidance alone.

Conversely, investors should be aware that while sales momentum is robust, the ongoing margin pressures in key segments could...

Read the full narrative on WESCO International (it's free!)

WESCO International's narrative projects $25.9 billion revenue and $909.7 million earnings by 2028. This requires 5.2% yearly revenue growth and a $275.5 million earnings increase from $634.2 million.

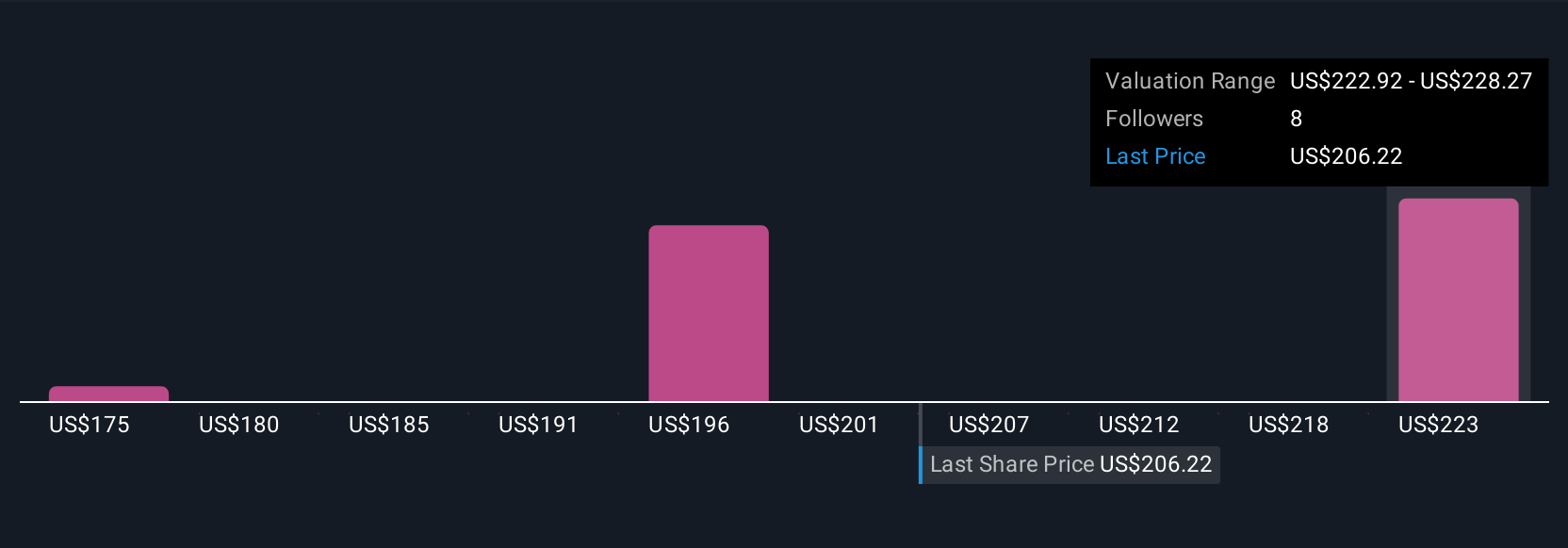

Uncover how WESCO International's forecasts yield a $228.27 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Three separate fair value estimates from the Simply Wall St Community range from US$174.72 to US$228.27 per share. While many see opportunity from accelerating data center demand, opinions differ on whether current margin pressures pose a risk to near-term earnings and valuation, explore these alternative views for a broader perspective.

Explore 3 other fair value estimates on WESCO International - why the stock might be worth 17% less than the current price!

Build Your Own WESCO International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WESCO International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WESCO International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WESCO International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com