- In August 2025, Goldman Sachs Group announced a significant dividend increase to $4.00 per share and completed multiple fixed-income offerings, including new bonds totaling US$80 million and €80 million, while speculation resurfaced regarding its possible involvement in a EUR 15 billion continuation fund for Froneri Limited.

- While these actions highlight the firm's ability to return capital to shareholders and pursue large-scale investment opportunities, analysts also caution that the minimal free cash flow coverage for the dividend could affect its long-term sustainability.

- We'll examine how Goldman Sachs' elevated capital return program, marked by its higher dividend and substantial repurchase authorization, shapes its updated investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Goldman Sachs Group Investment Narrative Recap

To be a shareholder in Goldman Sachs today, you need to believe in the firm's ability to sustain strong capital returns while successfully expanding in asset and wealth management for steadier earnings. The recent news of a higher dividend and active involvement in major capital markets transactions does not materially alter the biggest catalyst, ongoing M&A activity and rising institutional client engagement, or the main short-term risk, which remains regulatory uncertainty about capital requirements and dividend cover.

Of the recent announcements, the 33% dividend increase to US$4.00 per share directly reflects Goldman's current focus on returning more cash to shareholders. However, this follows analyst cautions about low free cash flow coverage, a factor that could become more important if regulatory policies or capital buffers become less predictable.

However, while higher dividends can be positive, investors should be aware that...

Read the full narrative on Goldman Sachs Group (it's free!)

Goldman Sachs Group's outlook forecasts $61.4 billion in revenue and $16.9 billion in earnings by 2028. This is based on expected annual revenue growth of 3.9% and an earnings increase of $2.2 billion from current earnings of $14.7 billion.

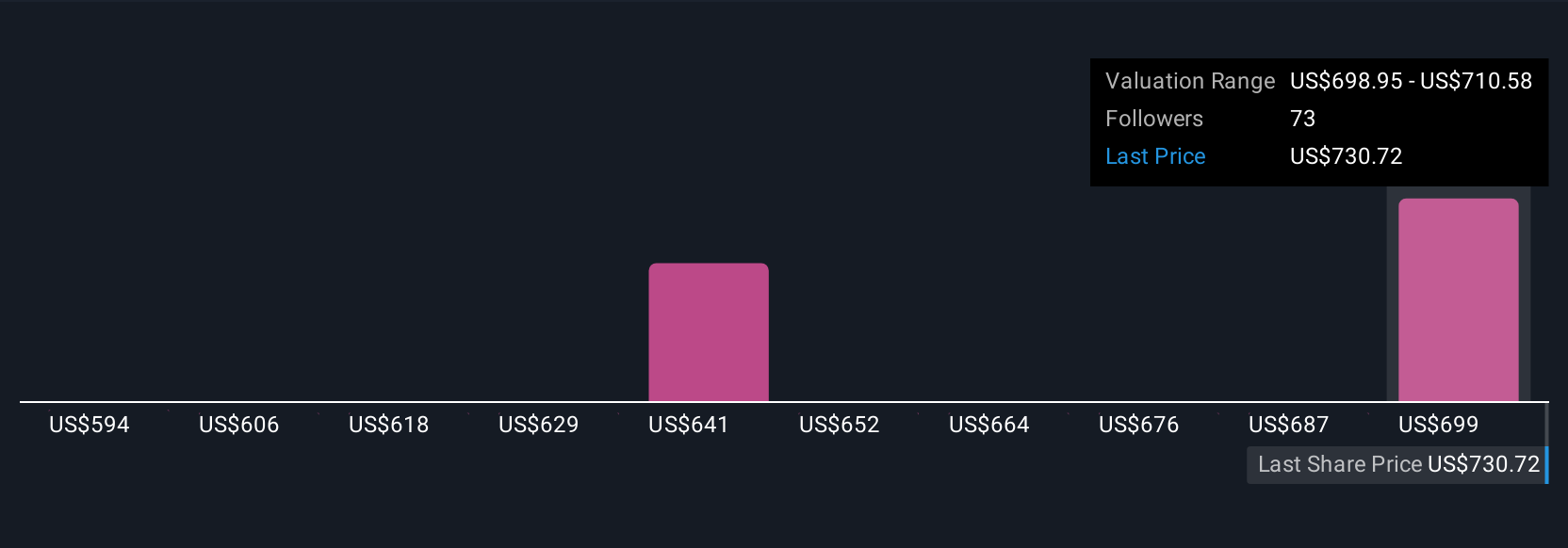

Uncover how Goldman Sachs Group's forecasts yield a $708.05 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members' fair value estimates for Goldman Sachs range from US$594.31 to US$708.05, based on three separate forecasts. As institutional deal activity continues to act as a key driver for performance, you can see how individual perspectives can widely differ and why exploring more than one view is important.

Explore 3 other fair value estimates on Goldman Sachs Group - why the stock might be worth 20% less than the current price!

Build Your Own Goldman Sachs Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goldman Sachs Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goldman Sachs Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goldman Sachs Group's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com