- On August 4, 2025, Robert Half Inc. affirmed its quarterly dividend of US$0.5900 per share, payable September 15, 2025, with an ex-date and record date of August 25, 2025.

- This routine dividend announcement followed an uptick in sector optimism, spurred by a key inflation report that reinforced hopes for a Federal Reserve interest rate cut.

- We’ll explore how renewed expectations for lower interest rates may influence Robert Half’s investment outlook and sector positioning.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Robert Half Investment Narrative Recap

To be a Robert Half shareholder today, you’d need to believe demand for skilled professionals and specialized staffing will recover, benefiting from digitization trends and improved business confidence. The recent dividend affirmation is a routine move and doesn’t materially change the company’s short-term outlook: the most important catalyst now is a potential rebound in hiring demand if interest rates fall, while the biggest risk remains persistent revenue weakness and margin pressure.

Among recent developments, Robert Half’s July earnings announcement stands out: quarterly profits dropped and guidance pointed to ongoing revenue declines. This context matters, as it highlights that even if broader sector optimism improves with a rate cut, management continues to flag challenges regaining growth, making the upcoming quarters critical for tracking any meaningful turnaround.

Yet, in contrast to hopes of recovery, investors should also be mindful of ongoing cost pressures and margin compression, particularly as...

Read the full narrative on Robert Half (it's free!)

Robert Half's outlook calls for $5.9 billion in revenue and $317.1 million in earnings by 2028. This is based on analysts' assumptions of 2.1% annual revenue growth and a $139 million increase in earnings from the current $178.1 million.

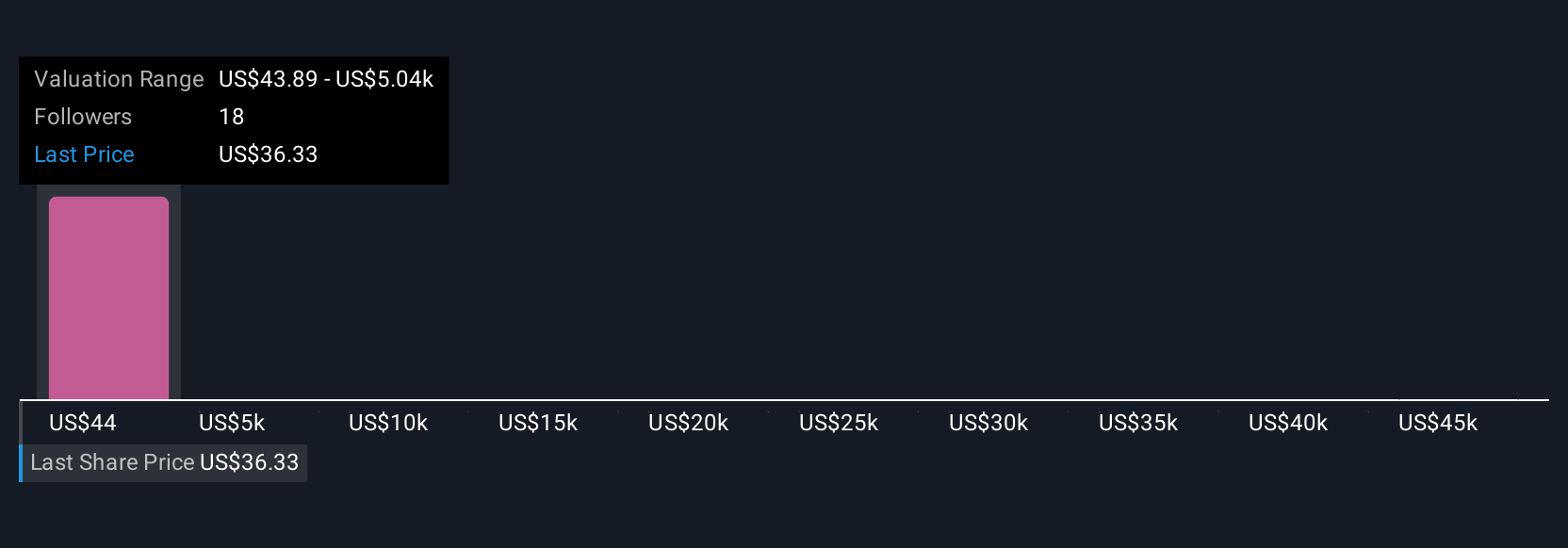

Uncover how Robert Half's forecasts yield a $43.89 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Four distinct fair value estimates from the Simply Wall St Community range from US$43.89 to an outlier of US$49,991.88. While views vary widely, many see the catalyst of tech-driven hiring and flexible workforce trends as key factors that could influence Robert Half’s future performance, explore multiple perspectives to better understand the range of possibilities.

Explore 4 other fair value estimates on Robert Half - why the stock might be a potential multi-bagger!

Build Your Own Robert Half Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Robert Half research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Robert Half research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Robert Half's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com