- On August 7, 2025, Brightstar Lottery PLC announced it was awarded a seven-year contract to deploy its Aurora™ retail central system and cloud-based software for Sachsische Lotto-GmbH in Saxony, Germany, following a competitive procurement process.

- This agreement expands Brightstar's European footprint, offering cloud-enabled technology that may strengthen long-term revenue opportunities and international relationships.

- We'll explore how this long-term contract in Germany could influence Brightstar Lottery’s investment narrative and its long-term growth profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Brightstar Lottery Investment Narrative Recap

To be a shareholder in Brightstar Lottery, you need to believe in the global shift to digital and omnichannel lottery solutions, where long-term contracts underpin recurring revenue and international reach. The recent German win extends Brightstar’s visibility and supports its reputation as a go-to provider, but with near-term profitability and regulatory clarity in Italy still the primary catalysts and risks, the overall short-term impact appears accretive but not yet pivotal to earnings momentum.

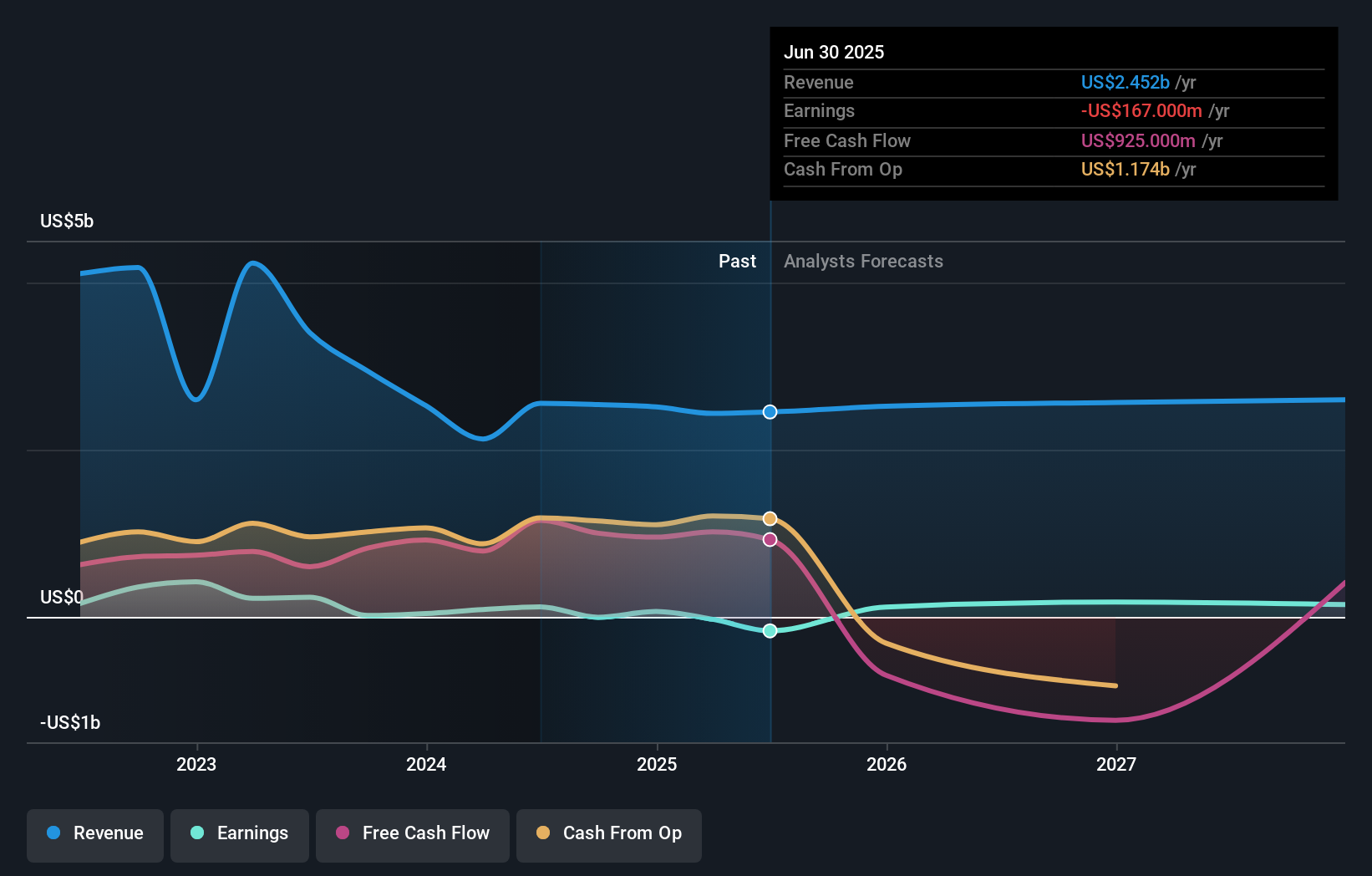

Among the latest company updates, the full-year 2025 revenue guidance of US$2.50 billion is especially relevant, as it sets expectations for the top line amid expanding contracts like Saxony. This context helps frame whether new international wins buffer pressure in core European markets, or whether regional regulatory concerns and recent earnings volatility remain in focus for investors tracking stability and fulfillment of financial targets.

In contrast, investors should be aware that heavy reliance on Italy as a profit driver continues to present...

Read the full narrative on Brightstar Lottery (it's free!)

Brightstar Lottery's narrative projects $2.6 billion in revenue and $1.0 billion in earnings by 2028. This requires 2.5% yearly revenue growth and a $1.17 billion increase in earnings from the current level of -$167.0 million.

Uncover how Brightstar Lottery's forecasts yield a $18.52 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer two contrasting fair value estimates for Brightstar Lottery, ranging from US$6.73 to US$18.52 per share. While investor views vary widely, ongoing regulatory risks in Italy could have an outsized effect on these outlooks and the company's direction, so explore alternative opinions carefully.

Explore 2 other fair value estimates on Brightstar Lottery - why the stock might be worth less than half the current price!

Build Your Own Brightstar Lottery Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Brightstar Lottery research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brightstar Lottery's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com